North Dakota Warranty Deed from Six Individuals (multiple jurisdictions) to One Individual

Understanding this form

This Warranty Deed is a legal document used to transfer ownership of real property from six individuals (the Grantors) to one individual (the Grantee). Unlike other deeds, this form includes warranties that protect the Grantee against any claims on the property that may arise after the transfer. The Warranty Deed complies with all relevant state statutory laws across multiple jurisdictions.

Main sections of this form

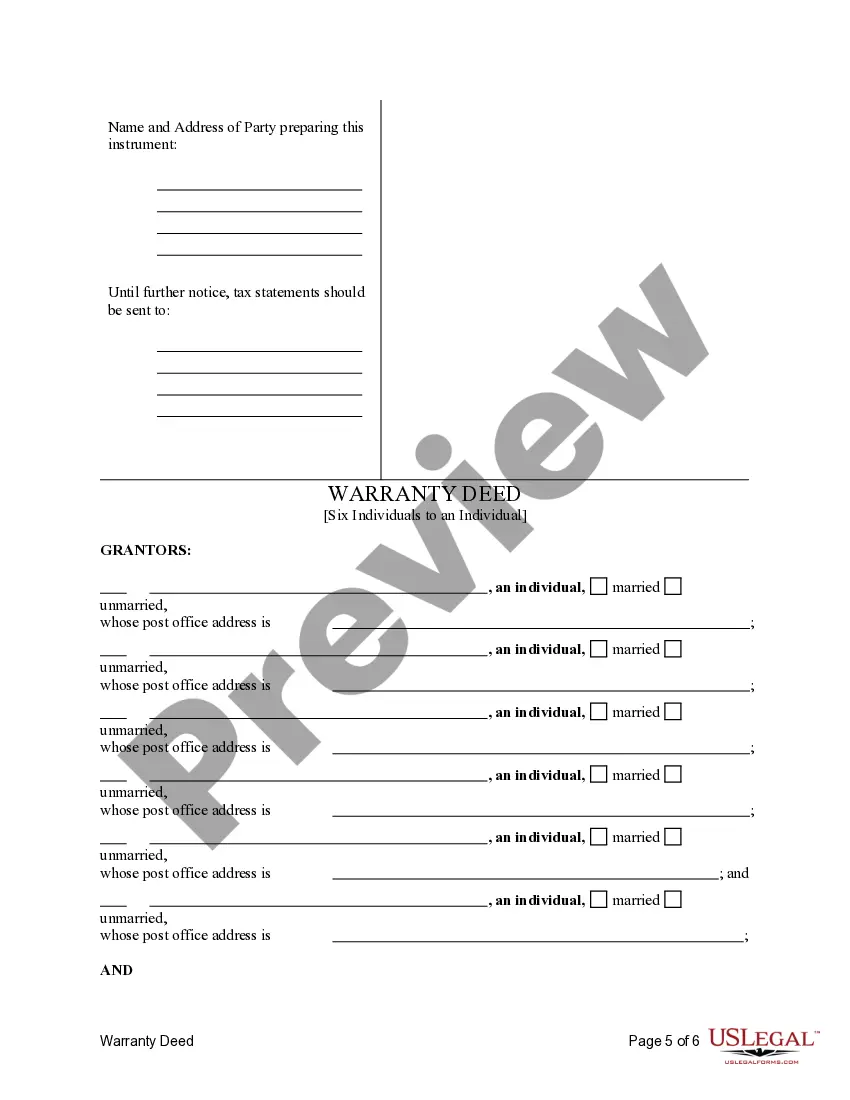

- Names and details of the Grantors (the six individuals transferring the property).

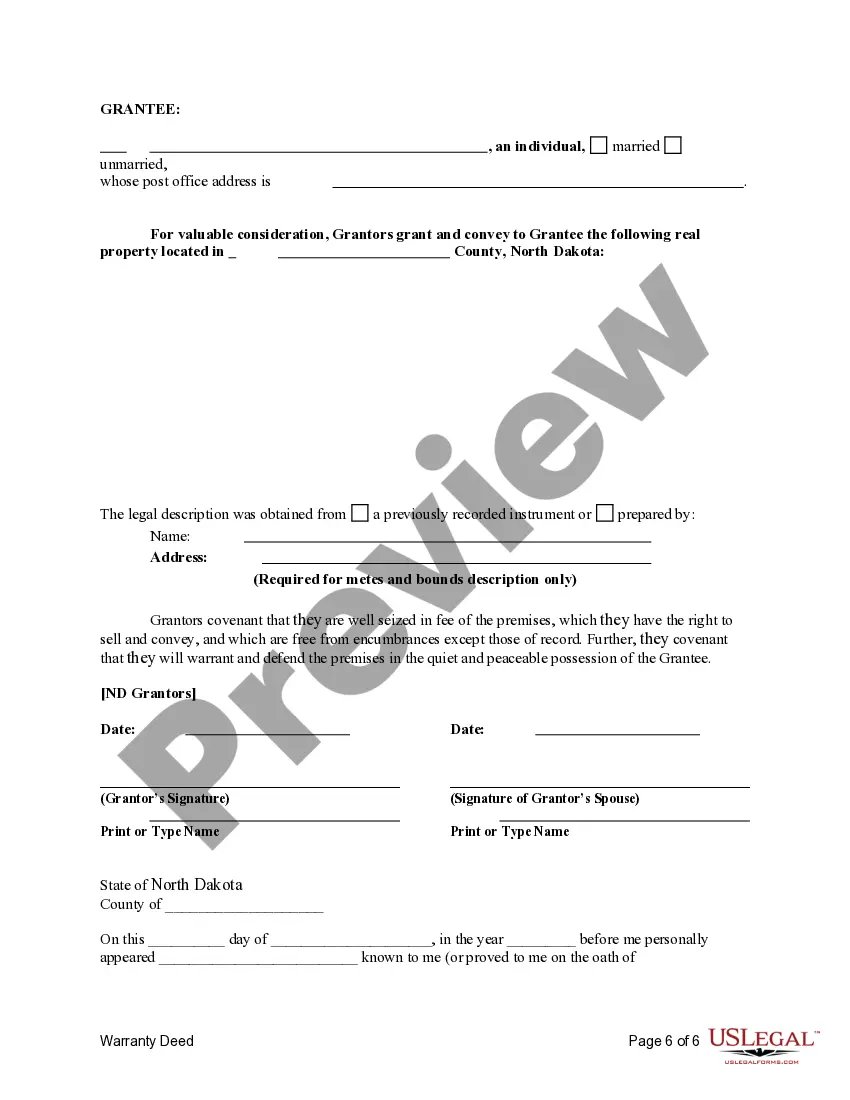

- Name and details of the Grantee (the single individual receiving the property).

- Description of the property being transferred, including legal boundaries.

- Warranties provided by the Grantors regarding the title of the property.

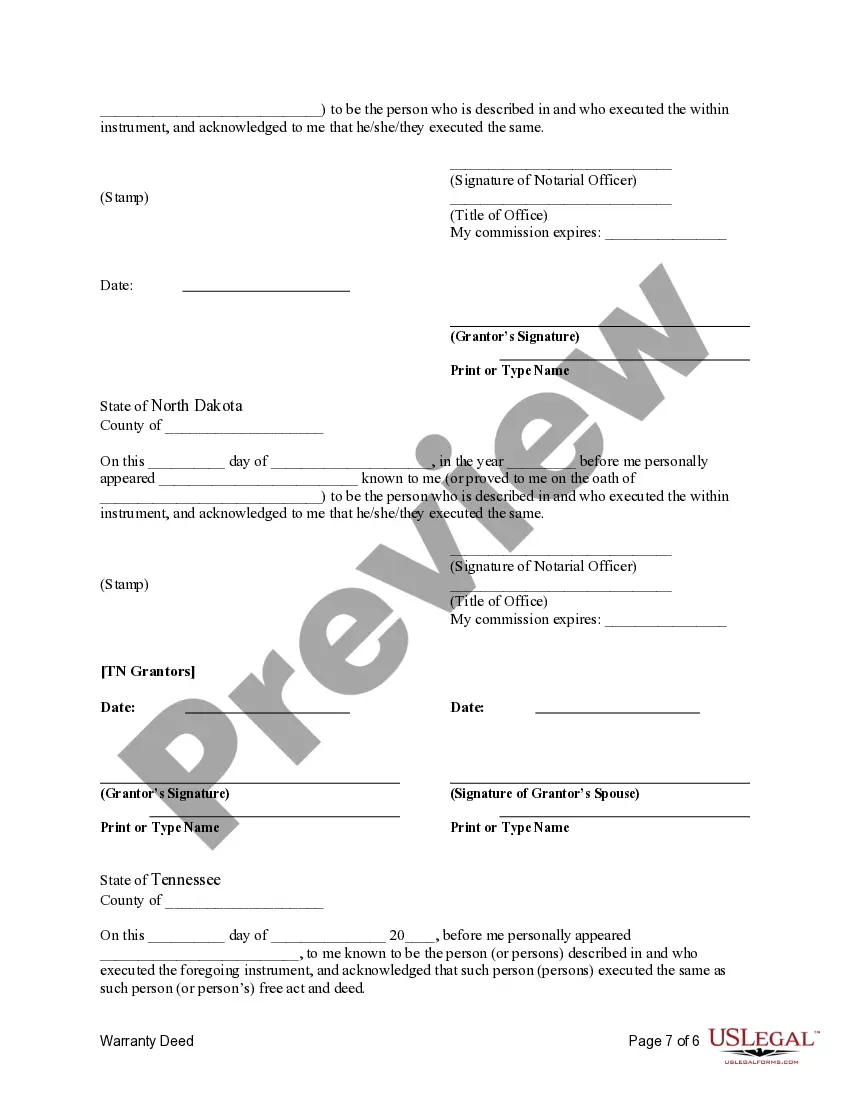

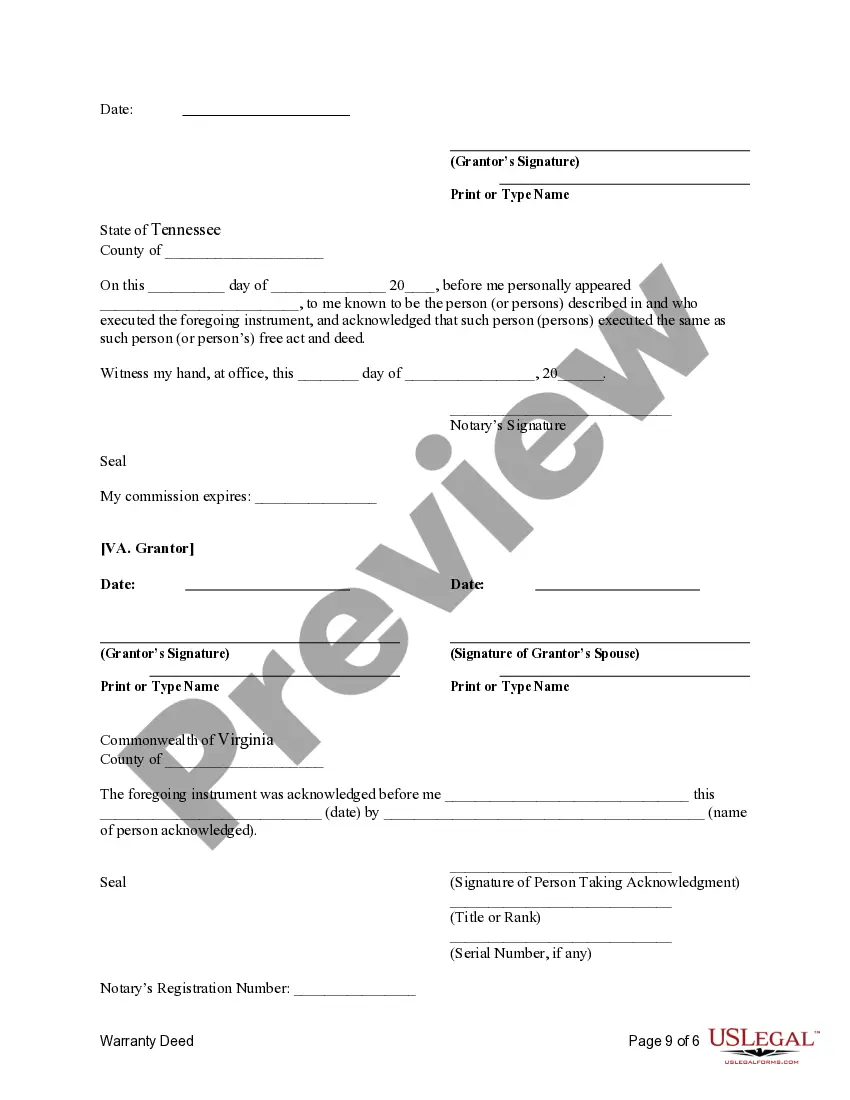

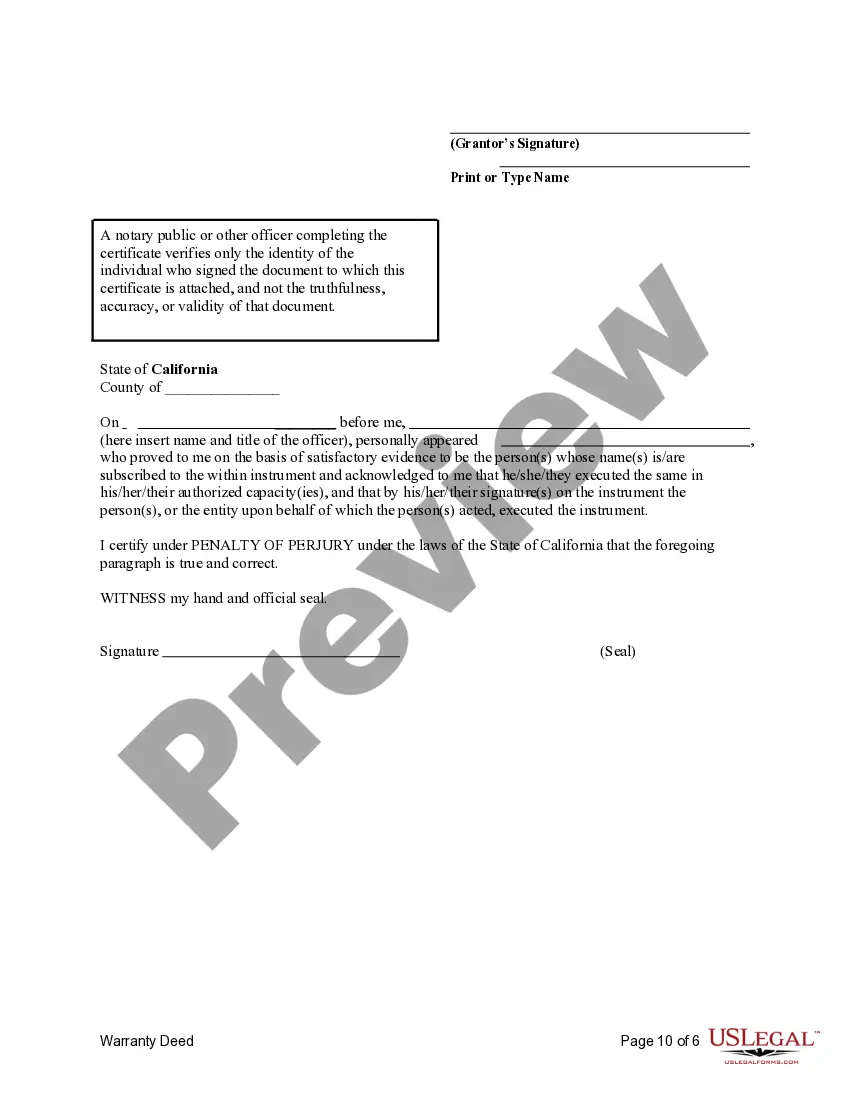

- Signature lines for all Grantors and any required witnesses.

- Date of execution to record when the deed is signed.

Legal requirements by state

This Warranty Deed adheres to the statutory laws required in various states. Ensure to check local regulations regarding property transfers in your specific jurisdiction. It is important to understand that requirements may vary, such as exemptions related to consideration statements as specified in North Dakota law.

When this form is needed

This form is ideal to use when multiple individuals want to convey ownership of property to a single person. It can be applicable in scenarios such as family property transfers, inheritance situations involving multiple heirs, or in circumstances where a group of co-owners decides to consolidate their property rights. Using a Warranty Deed ensures that the Grantee receives clear title free from previous claims, making it a secure choice for property transfer.

Who should use this form

- Individuals or groups who jointly own property and wish to transfer it to one individual.

- Heirs or beneficiaries involved in the distribution of an estate that includes real property.

- Real estate professionals or attorneys facilitating property transactions on behalf of clients.

- Anyone requiring a legally binding document to ensure ownership and protection against future claims.

Completing this form step by step

- Identify and list the full names and addresses of the six Grantors and the one Grantee.

- Provide a detailed legal description of the property being conveyed, including parcel numbers if applicable.

- Specify any warranties or representations made by the Grantors regarding the title of the property.

- Ensure all Grantors sign the deed in the designated signature lines.

- Include the execution date at the bottom of the deed.

- If required, have the document notarized to validate the signatures.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes

- Failing to include all necessary Grantor signatures, which can invalidate the deed.

- Not providing a complete and accurate legal description of the property.

- Neglecting to have the deed notarized when required by local laws.

- Leaving out the date of execution on the deed.

- Assuming verbal agreements are sufficient; all terms should be documented in writing.

Why use this form online

- Convenience of accessing and completing the form from home, avoiding trips to legal offices.

- Editability allows users to ensure accuracy before finalizing the document.

- Reliable templates drafted by licensed attorneys help ensure compliance with state laws.

- Streamlined process reduces the time it takes to go through traditional legal document preparation.

Legal use & context

- This Warranty Deed is enforceable as a formal legal instrument for property transfer.

- It protects the Grantee by providing guarantees against claims to the property.

- Failure to comply with local recording requirements may result in the deed not being recognized by courts.

Key takeaways

- A Warranty Deed provides stronger protection for the Grantee compared to other deed types.

- The form must be executed properly to ensure legal validity.

- Understanding local laws is crucial for effective document use.

Form popularity

FAQ

Resolving Small Ambiguities: The Scrivener Affidavit. Sometimes an omission attracts attention just after recording. The Correction Deed: Stronger Than a Scrivener's Affidavit. Obtain your correction deed form. Execute the correction deed. Record the correction deed.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances. Free and clear means that no one else has rights to the title above the owner.

The basic requirements of a valid deed are (1) written instrument, (2) competent grantor, (3) identity of the grantee, (4) words of conveyance, (5) adequate description of the land, (6) consideration, (7) signature of grantor, (8) witnesses, and (9) delivery of the completed deed to the grantee.

DEEDS IN GENERAL It must be in writing; 2. The parties must be properly described; 3. The parties must be competent to convey and capable of receiving the grant of the property; 4. The property conveyed must be described so as to distinguish it from other parcels of real property.; 5.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.