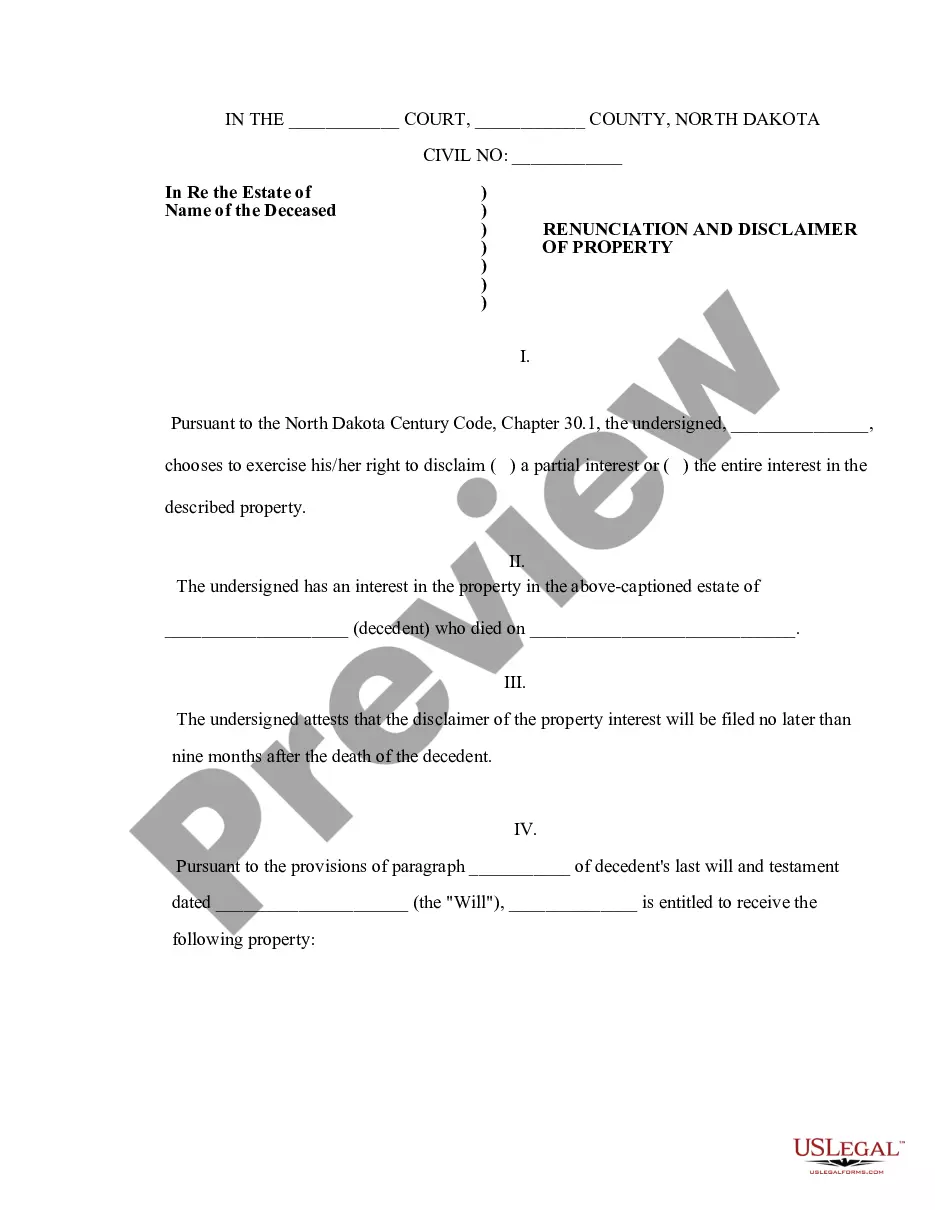

North Dakota Renunciation And Disclaimer of Property from Will by Testate

What is this form?

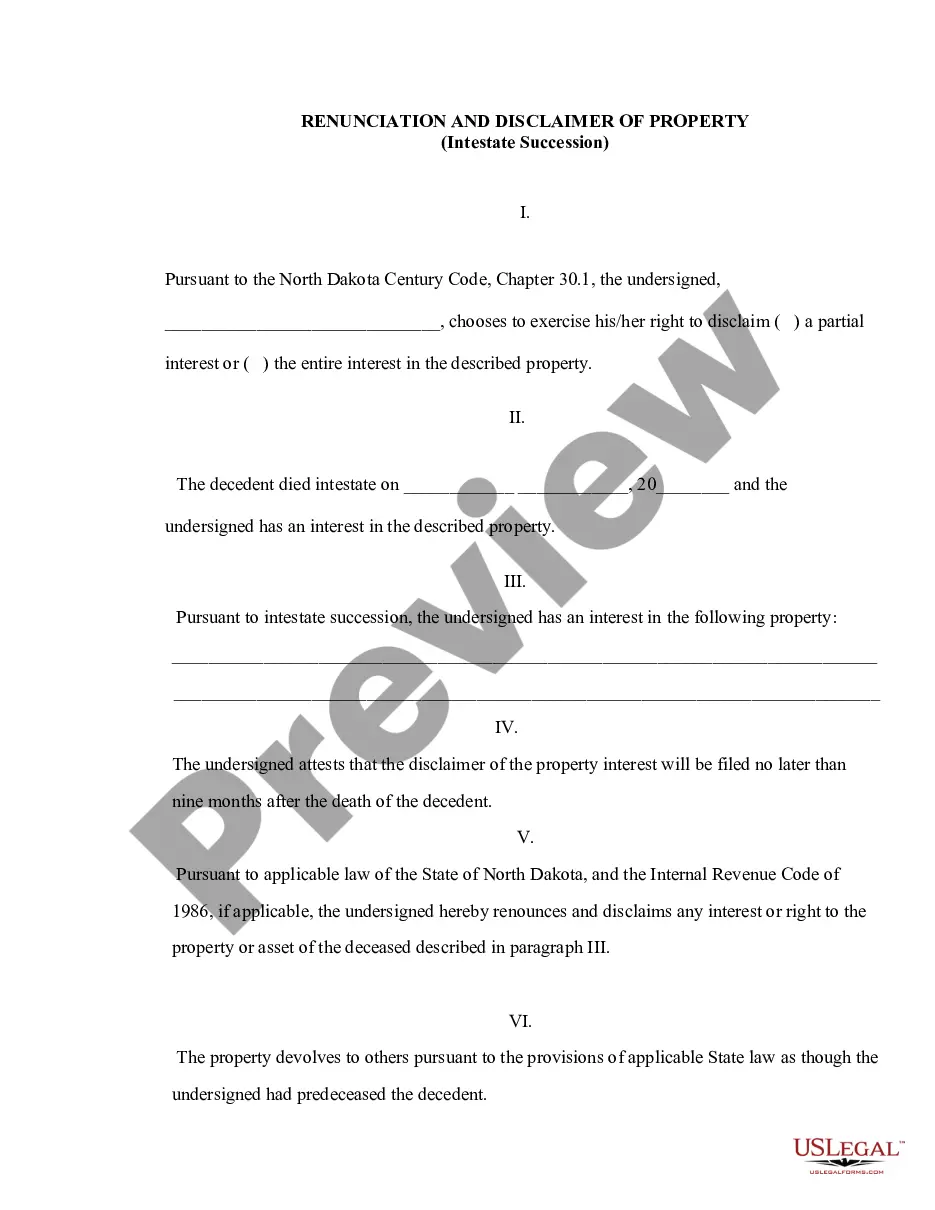

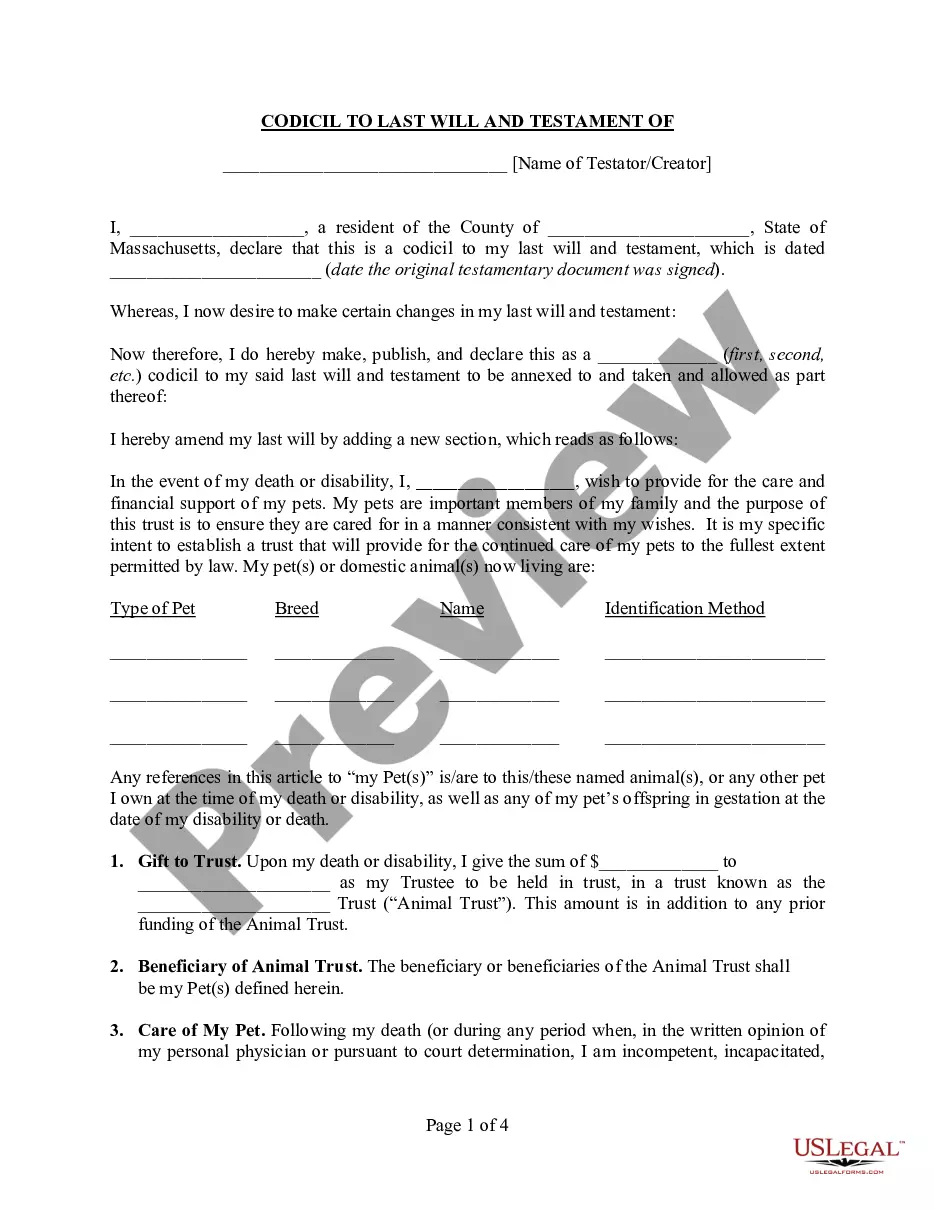

The Renunciation and Disclaimer of Property from Will by Testate is a legal document that allows a beneficiary to refuse an inheritance as specified in a decedent's will. This form is crucial for situations when a beneficiary does not wish to accept their share of the estate, either partially or entirely. By submitting this disclaimer, the beneficiary can ensure that their property interest will be treated as if they predeceased the decedent, which may have implications for tax or inheritance distribution. It is important to understand the specific legal stipulations under North Dakota law when using this form.

Form components explained

- Identification of the beneficiary and the decedent.

- Choice to disclaim either a partial or entire interest in the property.

- A statement regarding the timely filing of the disclaimer.

- Description of the property being disclaimed.

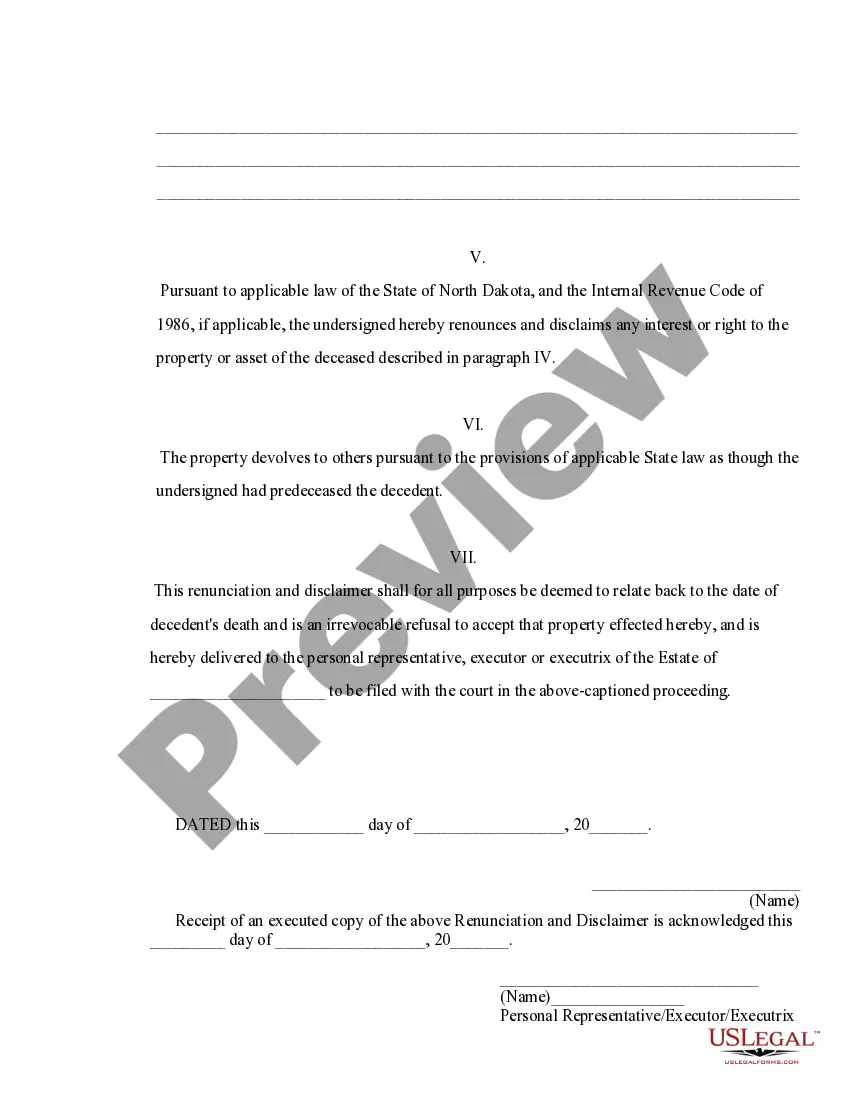

- Legal acknowledgment of the renunciation's implications under North Dakota law.

- Notary section for verification of the beneficiary's signature.

Common use cases

This form is used when a beneficiary of a will wishes to formally disclaim their right to receive property from the estate. Reasons for using this form may include personal financial situations where acceptance of the assets could lead to tax implications, family dynamics, or disputes over the inheritance, or simply if the beneficiary has no interest in the property being inherited.

Who this form is for

This form is intended for:

- Beneficiaries named in a will who wish to decline their inheritance.

- Individuals seeking to protect themselves from potential liabilities associated with the inherited property.

- Those wishing to redirect their inheritance to other beneficiaries, such as siblings or children.

How to prepare this document

- Identify the beneficiary and provide their contact information.

- Clearly state whether the disclaimer is for a partial interest or the entire interest in the property.

- Provide the name of the decedent and the date of their death.

- List the property or assets being disclaimed as described in the decedent's will.

- Sign the form in the presence of a notary public for verification purposes.

- Ensure that the completed form is filed within nine months of the decedent's death.

Notarization requirements for this form

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to file the disclaimer within the nine-month period.

- Not properly identifying the property being disclaimed.

- Not including required signatures or notary acknowledgment.

- Confusing a partial disclaimer with a full disclaimer.

What to keep in mind

- The Renunciation and Disclaimer of Property is a vital document for beneficiaries who wish to reject an inheritance.

- It is essential to comply with state-specific laws, particularly in North Dakota.

- Notarization is a requirement for this form to ensure validity.

- Completing the disclaimer in a timely manner is critical to its enforceability.

Form popularity

FAQ

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

A disclaimer is essentially a refusal of a gift or bequest.Disclaimers typically arise in the context of postmortem estate planning where a beneficiary may desire to make a qualified disclaimer under Sec. 2518 to achieve certain tax results such as qualifying for a marital deduction.

The disclaimer deed is a legal document that has legal consequences. Further, the disclaimer deed will clearly state that the spouse signing it is waiving (disclaiming) any interest in the house being purchased.

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.

Some banks and building societies will release quite large amounts without the need for probate or letters of administration.If the organisation refuses to release money without probate or letters of administration, you must apply for probate or letters of administration even if it is not otherwise needed.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.