North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

Are you currently in a position in which you need to have papers for possibly business or person functions nearly every day? There are tons of legal papers templates available online, but discovering versions you can rely is not easy. US Legal Forms offers a large number of develop templates, much like the North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes, which are published to fulfill federal and state requirements.

In case you are already knowledgeable about US Legal Forms website and have an account, simply log in. Following that, you may obtain the North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes template.

Unless you provide an accounts and need to begin to use US Legal Forms, adopt these measures:

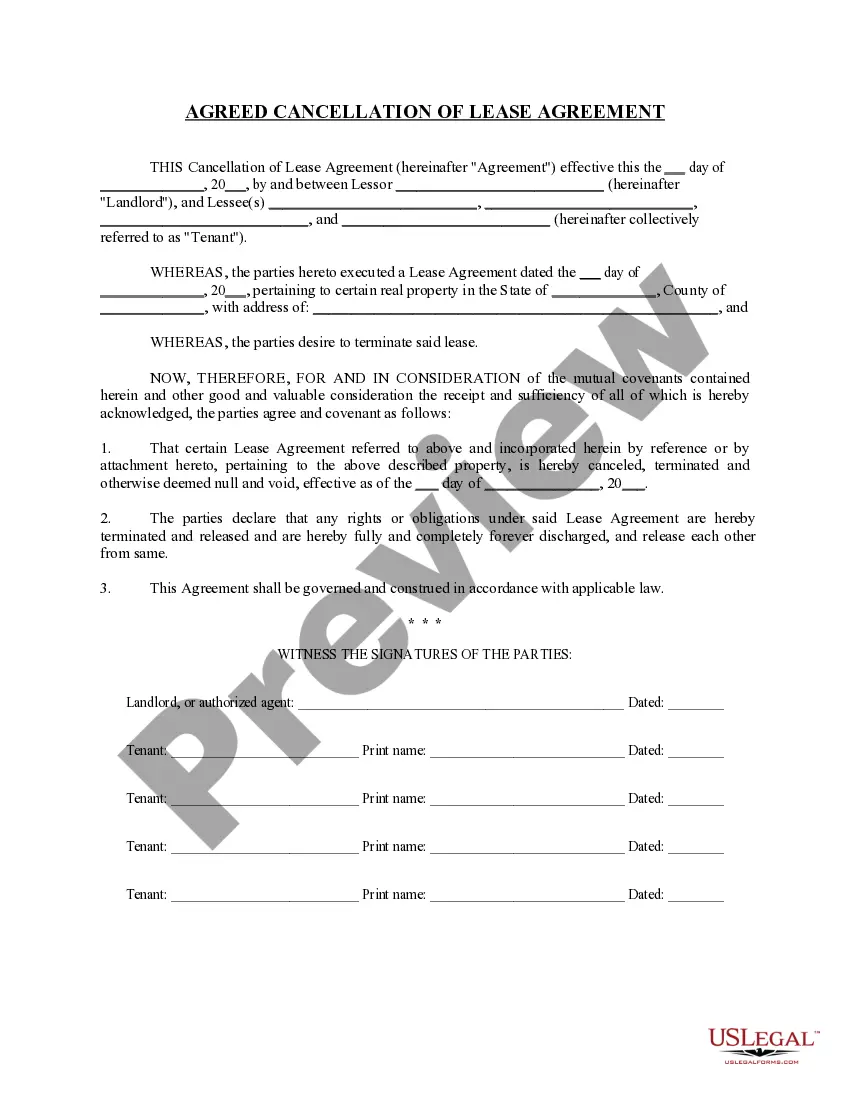

- Discover the develop you require and make sure it is to the correct metropolis/region.

- Make use of the Preview switch to examine the shape.

- Browse the information to ensure that you have selected the right develop.

- In the event the develop is not what you`re searching for, take advantage of the Look for area to get the develop that fits your needs and requirements.

- If you discover the correct develop, click on Buy now.

- Opt for the rates prepare you want, submit the desired info to make your money, and purchase the order making use of your PayPal or credit card.

- Decide on a hassle-free paper file format and obtain your version.

Locate all of the papers templates you might have bought in the My Forms food selection. You may get a extra version of North Carolina Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes at any time, if necessary. Just click on the needed develop to obtain or print the papers template.

Use US Legal Forms, probably the most extensive variety of legal kinds, to conserve time as well as stay away from blunders. The service offers expertly manufactured legal papers templates that can be used for a range of functions. Make an account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

What is The Affidavit for Collection of Personal Property? ing to the North Carolina statute § 28A-25-1, a heir can settle a deceased person's estate without going through probate by applying for the Affidavit for Collection of Personal Property of the Decedent (form AOC-E-203B).

Typically, fees ? such as fiduciary, attorney, executor, and estate taxes ? are paid first, followed by burial and funeral costs. If the deceased member's family was dependent on him or her for living expenses, they will receive a ?family allowance? to cover expenses. The next priority is federal taxes.

This is when courts transfer the ownership of assets to beneficiaries or heirs. The final distribution only occurs when the estate is settled, meaning all creditors and taxes have been paid, all disputes have been resolved, and the judge gives final approval.

If the estate is small and has a reasonable amount of debt, six to eight months is a fair expectation. With a larger estate, it will likely be more than a year before everything settles. This is especially true if there's a lot of debt or real estate in multiple states.

Some assets will need to go through a legal probate process to determine who will inherit them, while a non-probate asset with a named beneficiary can be transferred directly to its new owner. The executor (or administrator) of your loved one's estate is responsible for the distribution of probate assets.

If a year has passed since the Executor was qualified, the Executor must either submit a Final Account [Form AOC-E-506] to close out the estate, or an Annual Account [also Form AOC-E-506] if the estate is not ready to be closed.

Three common strategies for dividing an inheritance include: Per stirpes. One of the simplest strategies for asset distribution among heirs, this method requires that the estate be divided equally among each branch of the family. ... Per capita. ... Per capita by generation.