North Carolina Executor's Deed of Distribution

Description

How to fill out Executor's Deed Of Distribution?

If you have to comprehensive, down load, or print out legal document web templates, use US Legal Forms, the biggest assortment of legal types, that can be found online. Utilize the site`s easy and hassle-free search to discover the documents you will need. A variety of web templates for business and individual purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to discover the North Carolina Executor's Deed of Distribution in a handful of mouse clicks.

In case you are already a US Legal Forms customer, log in for your account and click on the Download key to find the North Carolina Executor's Deed of Distribution. You may also accessibility types you previously acquired within the My Forms tab of the account.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the right area/country.

- Step 2. Utilize the Review choice to look through the form`s content material. Do not forget about to learn the outline.

- Step 3. In case you are not satisfied together with the type, utilize the Search field towards the top of the screen to locate other variations from the legal type template.

- Step 4. When you have discovered the shape you will need, select the Purchase now key. Select the prices program you like and put your qualifications to sign up for an account.

- Step 5. Procedure the deal. You may use your Мisa or Ьastercard or PayPal account to perform the deal.

- Step 6. Select the formatting from the legal type and down load it in your gadget.

- Step 7. Comprehensive, edit and print out or indicator the North Carolina Executor's Deed of Distribution.

Each legal document template you buy is your own permanently. You possess acces to each type you acquired within your acccount. Click the My Forms portion and pick a type to print out or down load yet again.

Be competitive and down load, and print out the North Carolina Executor's Deed of Distribution with US Legal Forms. There are millions of specialist and express-distinct types you can use for your personal business or individual requirements.

Form popularity

FAQ

North Carolina charges an excise tax for transfers of North Carolina real estate. The excise tax?which is like transfer taxes in other states?is assessed on deeds and other instruments that transfer interests in real estate. The excise tax rate is $1.00 for each $500.00 of the consideration for the transfer.

For small estates, North Carolina has a simplified process which allows you to wrap up the estate without formal probate. This process applies to estates with personal property valued at $20,000, or $30,000 if the surviving spouse inherits everything under state law.

Unlike South Carolina and many other states, real property in North Carolina does not typically pass through probate. When a decedent dies intestate (without a Will), title to the decedent's non-survivorship real property is vested in his or heir heirs as of the time of death [G.S. 28A-15-2(b)].

The deed to the property automatically transfers to you after your loved one passes away. From that point, all you would need to prove that you are the rightful owner of the property is: A copy of your loved one's death certificate. A copy of your loved one's will awarding you the property.

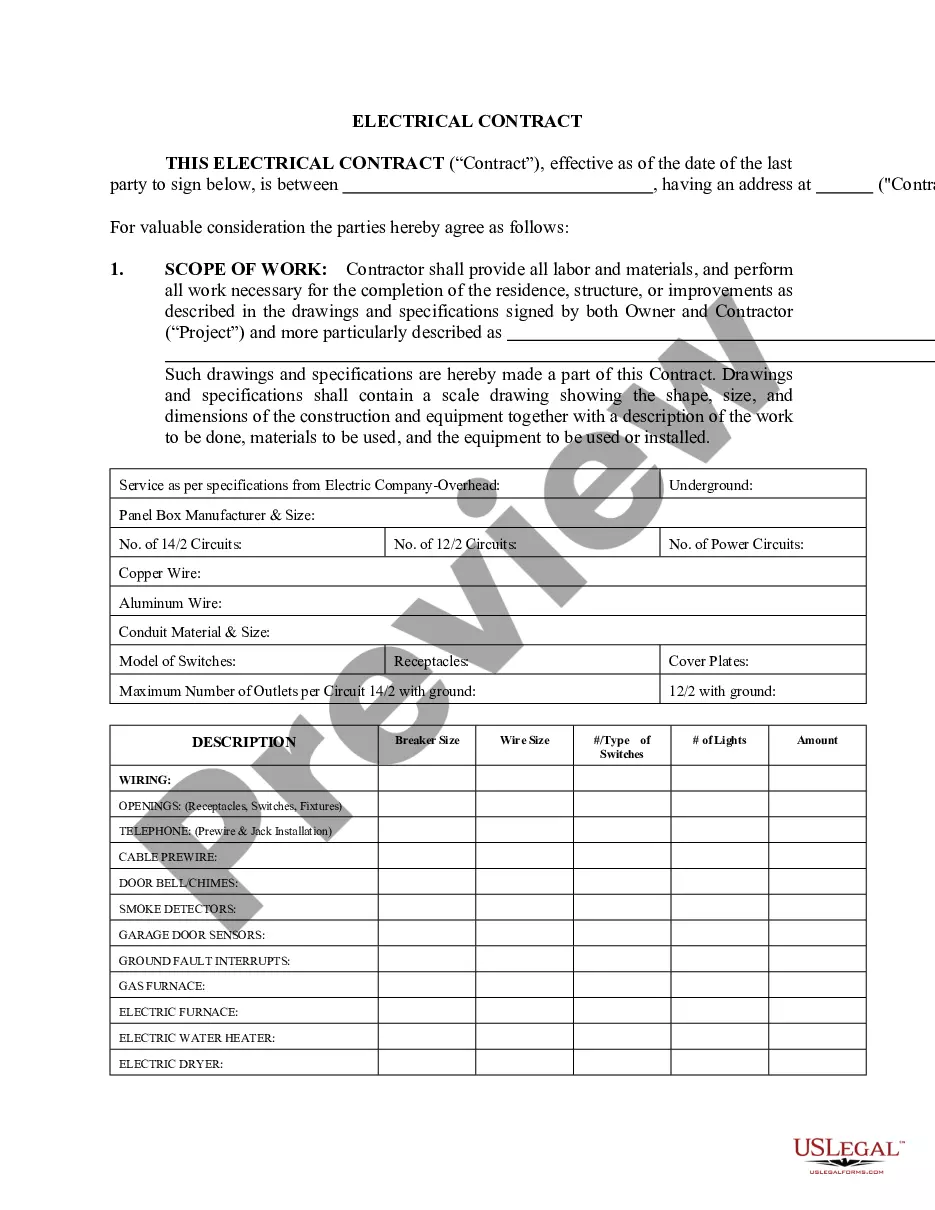

The distribution, sale, or transfer must be approved by a probate court or processed as required by North Carolina statutory requirements for an estate to sell. An executor's deed is an important legal instrument that can help smooth the transfer of real property to the new owners upon the passing of a loved one.

Laws Related to Land Inheritance in North Carolina When one owner passes, ownership switches to the surviving owner, regardless of any information in the deceased's will. If you have sole ownership of a piece of property and pass away in North Carolina, the ownership goes to your heirs immediately.

If one of these individuals is interested in being an executor, they must apply to the Clerk of Superior Court through a form from the court's office. This form includes a preliminary inventory of the decedent's assets.

The Personal Representative must file a final account, report and petition for final distribution, have the petition set for hearing, give notice of the hearing to interested persons, and obtain a court order approving the final distribution.