North Carolina Special Improvement Project and Assessment

Description

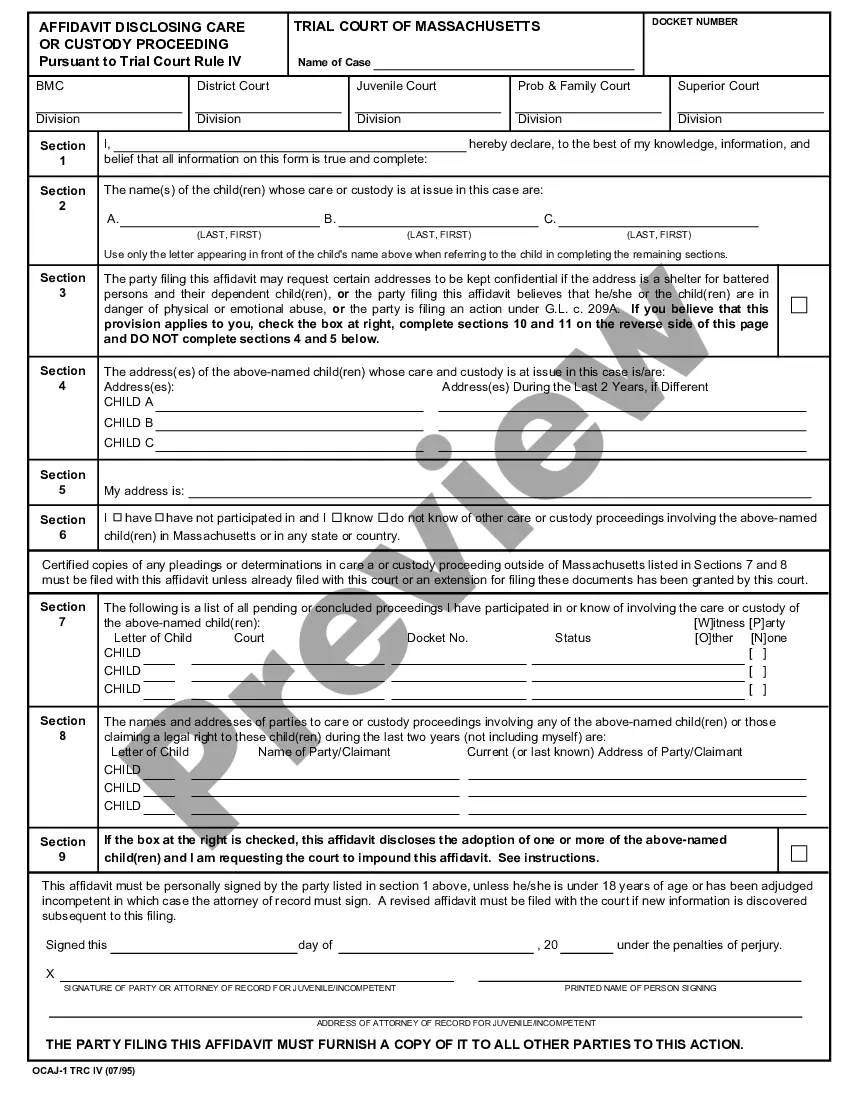

How to fill out Special Improvement Project And Assessment?

US Legal Forms - among the most significant libraries of legitimate varieties in the States - delivers a wide array of legitimate file web templates you are able to down load or print. Utilizing the website, you may get a huge number of varieties for company and specific purposes, categorized by classes, suggests, or search phrases.You will discover the latest versions of varieties much like the North Carolina Special Improvement Project and Assessment within minutes.

If you currently have a subscription, log in and down load North Carolina Special Improvement Project and Assessment from the US Legal Forms library. The Down load key can look on each develop you look at. You have accessibility to all earlier delivered electronically varieties inside the My Forms tab of your account.

In order to use US Legal Forms the first time, listed below are basic recommendations to help you get started:

- Ensure you have selected the correct develop for your city/area. Select the Preview key to check the form`s information. Read the develop outline to ensure that you have chosen the appropriate develop.

- If the develop doesn`t satisfy your requirements, use the Lookup industry on top of the display to find the one that does.

- In case you are pleased with the form, validate your decision by simply clicking the Get now key. Then, choose the prices program you want and give your credentials to register on an account.

- Approach the deal. Use your credit card or PayPal account to complete the deal.

- Select the file format and down load the form on your own device.

- Make modifications. Load, edit and print and indicator the delivered electronically North Carolina Special Improvement Project and Assessment.

Each and every format you included with your money lacks an expiry day and is your own property for a long time. So, if you would like down load or print yet another version, just visit the My Forms portion and then click about the develop you want.

Get access to the North Carolina Special Improvement Project and Assessment with US Legal Forms, by far the most comprehensive library of legitimate file web templates. Use a huge number of expert and state-certain web templates that meet your small business or specific requires and requirements.

Form popularity

FAQ

Special assessment refers to the payment made by citizens of a particular locality in exchange for certain special facilities provided to them by the public authorities. Special levy is charged on commodities whose consumption is harmful to the health and well-being of citizens.

Ing to paragraph 8(k) of Form 2-T, the seller is obligated to pay ?in full at Settlement, all Special Assessments that are approved prior to Settlement, whether payable in a lump sum or future installments, provided that the amount thereof can be reasonably determined or estimated.? Since the assessment in ...

The assessment base for the special assessment is a bank's estimated uninsured deposits, reported for the quarter that ended December 31, 2022, adjusted to exclude the first $5 billion in estimated uninsured deposits from the bank (or for banks that are part of a holding company with one or more subsidiary banks, at ...

A special assessment tax is a surtax levied on property owners to pay for specific local infrastructure projects such as the construction or maintenance of roads or sewer lines. The tax is charged only to the owners of property in the neighborhood that will benefit from the project.

Special assessment. noun. : a specific tax levied on private property to meet the cost of public improvements that provide a special benefit enhancing the value of the property.

Customers or clients may file a complaint using the NC DSS Civil Rights Complaint Form. Please fill out the form and provide a copy to the local county DSS Title VI Compliance Officer. To protect your rights you must file a complaint within 180 days of the date you believe you or someone else was treated unfairly.