North Carolina Self-Employed Roofing Services Agreement

Description

How to fill out Self-Employed Roofing Services Agreement?

Are you in the location where you will require documents for potentially business or personal purposes nearly every workday.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the North Carolina Self-Employed Roofing Services Agreement, which can be tailored to meet federal and state requirements.

Select the pricing plan you want, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download another copy of the North Carolina Self-Employed Roofing Services Agreement at any time, if needed. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Self-Employed Roofing Services Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/county.

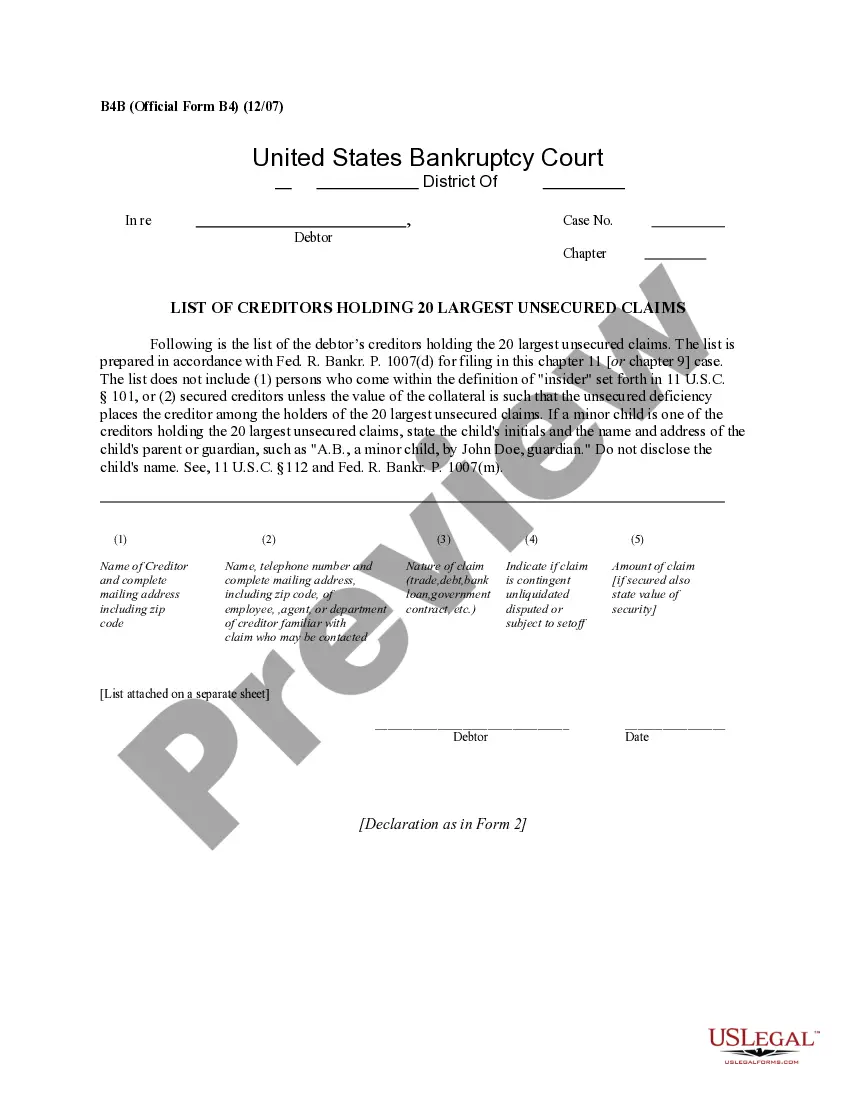

- Use the Preview button to review the form.

- Check the description to make sure you have chosen the correct form.

- If the form is not what you’re looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the right form, click Buy now.

Form popularity

FAQ

Yes, roofers must be licensed and insured in North Carolina to operate legally. Licensing ensures that the roofer meets state standards for quality and safety, while insurance protects both the contractor and the homeowner from potential liabilities. When drafting your North Carolina Self-Employed Roofing Services Agreement, make sure to include a clause that confirms the roofer's licensing and insurance coverage to safeguard your interests.

To write up a roofing contract, start by clearly defining the scope of work. Include details such as the materials to be used, payment terms, and project timelines. It's essential to outline any warranties and the responsibilities of both parties. Using a comprehensive North Carolina Self-Employed Roofing Services Agreement helps ensure that all critical aspects are covered, protecting both you and your client.

To create a roofing contract, you should start by defining the project scope, including materials, labor, and timeline. Next, include payment terms, warranties, and any specific legal requirements for North Carolina. Utilizing a North Carolina Self-Employed Roofing Services Agreement template from US Legal Forms can streamline this process, ensuring that all necessary elements are included. This approach helps protect your interests and fosters a professional relationship with your clients.

A standard roofing contract outlines the terms and conditions for roofing work, including scope, payment, and timeline. This agreement is crucial for establishing clear expectations between the contractor and the client. In North Carolina, a well-crafted North Carolina Self-Employed Roofing Services Agreement can include essential details such as warranties and liability clauses. Using a reputable service like US Legal Forms can help you create a comprehensive contract that meets industry standards.

Yes, you can write your own legally binding contract. However, it is essential to ensure that your agreement meets all legal requirements specific to North Carolina. A well-structured North Carolina Self-Employed Roofing Services Agreement will protect both you and your client. You may also consider using platforms like US Legal Forms to access templates and guidance for creating effective contracts.

In North Carolina, an operating agreement is not legally required for an LLC, but having one is highly recommended. This document outlines the management structure and operating procedures of your LLC, providing clarity for all members. If you are setting up a North Carolina Self-Employed Roofing Services Agreement as part of your LLC, an operating agreement can help define business practices and protect your interests. Using uslegalforms can help you draft an effective agreement tailored to your needs.

To write a contract for a roofing job, start by outlining the project scope, including all tasks and materials involved. Clearly state the payment terms, project timeline, and any warranties or guarantees. When creating a North Carolina Self-Employed Roofing Services Agreement, use simple language, ensuring both parties understand their responsibilities. Consider using platforms like uslegalforms to access templates that can simplify this process.

In North Carolina, you can perform work on projects that total $30,000 or less without a contractor's license. However, it is essential to understand that this limit includes all labor and materials for the project. For those considering a North Carolina Self-Employed Roofing Services Agreement, staying within this threshold allows you to operate legally without a license. Always check local regulations to ensure compliance.

Yes, roofing contractors must be licensed in North Carolina to operate legally. This requirement ensures that contractors meet specific standards and provide quality services to their clients. If you are a self-employed roofing contractor, you should consider using a North Carolina Self-Employed Roofing Services Agreement to outline the terms of your work. By having a formal agreement, you can protect yourself and your clients, ensuring clarity and professionalism in your roofing projects.