North Carolina Correspondent Agreement - Self-Employed Independent Contractor

Description

How to fill out Correspondent Agreement - Self-Employed Independent Contractor?

Have you been in the situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones you can trust isn't easy.

US Legal Forms offers thousands of template forms, including the North Carolina Correspondent Agreement - Self-Employed Independent Contractor, that are designed to comply with state and federal regulations.

When you find the appropriate form, simply click Purchase now.

Choose the pricing plan you prefer, fill in the required details to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents list. You can acquire an additional copy of the North Carolina Correspondent Agreement - Self-Employed Independent Contractor anytime, if needed. Just click the necessary form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the North Carolina Correspondent Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

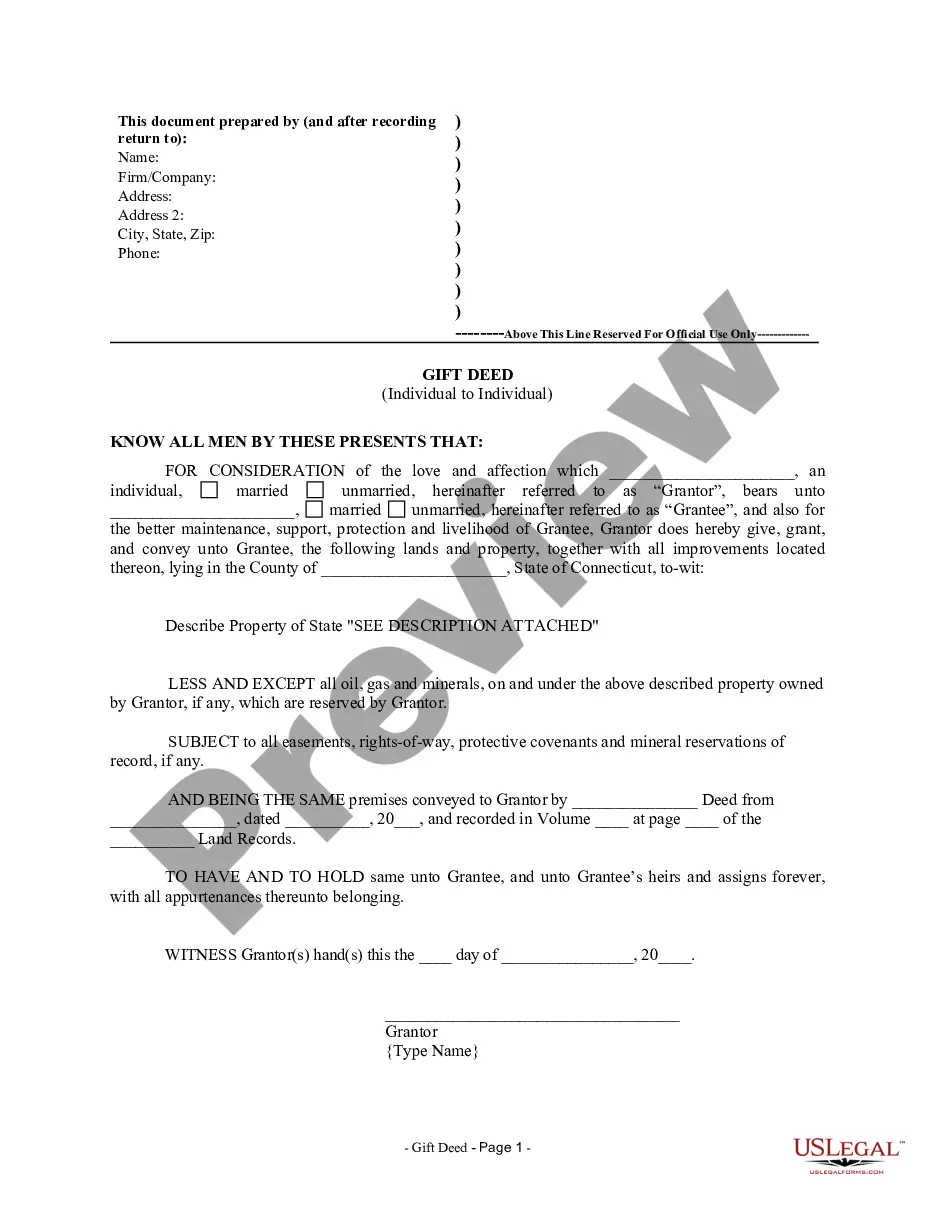

- Utilize the Review option to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Certain individuals are exempt from workers' compensation requirements in North Carolina, including sole proprietors and independent contractors. Additionally, businesses with fewer than three employees do not need to carry coverage. If you're navigating the North Carolina Correspondent Agreement - Self-Employed Independent Contractor landscape, consulting with a legal expert can provide clarity on your obligations and protections.

In North Carolina, 1099 workers, commonly referred to as independent contractors, generally do not require workers' compensation insurance. This is because they are not classified as employees and face different regulations. If you are working under a North Carolina Correspondent Agreement - Self-Employed Independent Contractor model, understanding your insurance needs is vital to ensure you are adequately protected.

Independent contractors often do not qualify for workers' compensation benefits because they are not classified as employees. Since they work for themselves, they usually must obtain their coverage. If you're engaged in a North Carolina Correspondent Agreement - Self-Employed Independent Contractor arrangement, it's wise to consider whether securing your workers' comp feels right for your situation.

Yes, an independent contractor is typically considered self-employed. This classification means they operate their own business and have more control over their work compared to traditional employees. If you’re exploring the North Carolina Correspondent Agreement - Self-Employed Independent Contractor model, it’s crucial to understand how this impacts your legal and tax obligations as a self-employed individual.

In North Carolina, any business with three or more employees is generally required to carry workers' compensation insurance. This legislation helps ensure that employees receive necessary medical care and benefits if they are injured on the job. However, for those utilizing the North Carolina Correspondent Agreement - Self-Employed Independent Contractor model, it's essential to understand your classification, as independent contractors may face different requirements.

In North Carolina, independent contractors typically do not need workers' compensation unless they have a specific contract requirement. However, it is wise to secure coverage as a precaution against potential work-related injuries. As a self-employed independent contractor, having insurance can offer peace of mind and protect your business. The North Carolina Correspondent Agreement - Self-Employed Independent Contractor may also specify these insurance requirements for your benefit.

Creating an independent contractor agreement is a straightforward process. First, outline the scope of work, payment terms, and deadlines. Next, include important details like confidentiality clauses and termination conditions. Utilizing platforms like US Legal Forms can simplify this task, providing templates specifically designed for a North Carolina Correspondent Agreement - Self-Employed Independent Contractor.