North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

How to fill out Journalist - Reporter Agreement - Self-Employed Independent Contractor?

If you need to finish, download, or print sanctioned documents templates, utilize US Legal Forms, the premier collection of legal forms, available online.

Take advantage of the site’s user-friendly and convenient search to find the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor in just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor. Every legal document template you obtain is yours forever. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Compete and download, and print the North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your personal business or individual needs.

- If you are currently a US Legal Forms user, sign in to your account and click on the Download button to retrieve the North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

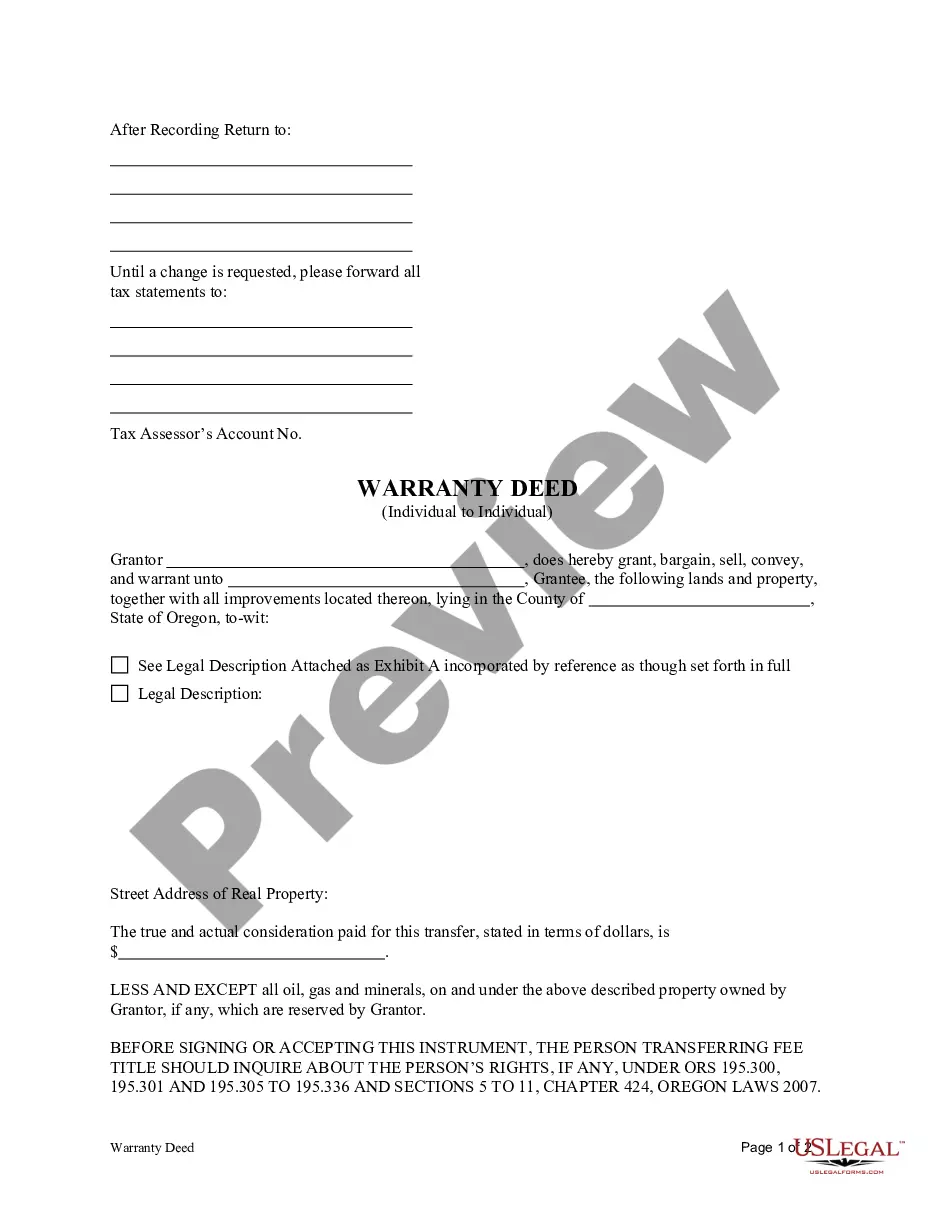

- Step 2. Utilize the Preview feature to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Select the payment plan you prefer and input your details to register for the account.

Form popularity

FAQ

Writing an independent contractor agreement involves clearly defining the terms of your working relationship. Start by outlining the scope of work, payment terms, and deadlines. Include clauses that address confidentiality and termination, ensuring both parties understand their rights. Using US Legal Forms can simplify this process, providing templates tailored for a North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor.

While being a North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor offers many benefits, there are downsides to consider. You may face income instability since contracts can vary in length and payment. Furthermore, you are responsible for your own benefits, such as health insurance and retirement savings. It's vital to weigh these factors when deciding if independent contracting is right for you.

In North Carolina, an independent contractor is a self-employed individual who provides services to clients without being an employee. This means you have more flexibility and control over your work, including how you complete tasks and manage your schedule. However, you also take on responsibilities such as securing your clients and managing your own taxes. A North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor can clarify your rights and duties.

The basic independent contractor agreement outlines the terms between a client and a self-employed individual, such as a North Carolina journalist or reporter. This document specifies the scope of work, payment terms, and the responsibilities of both parties. It serves to protect your rights and clarify expectations, ensuring a smooth working relationship. For those seeking a North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor, using a platform like uslegalforms can simplify the process and provide peace of mind.

An independent contractor can show proof of employment by presenting a variety of documents, including signed contracts with clients, invoices for services rendered, and bank statements reflecting payments received. These materials confirm your engagement in professional activities. Furthermore, maintaining a portfolio showcasing your work can enhance your credibility. A North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor can also support your claim of employment.

To provide proof of employment as an independent contractor, you can share client contracts, invoices, and payment receipts. These documents demonstrate the work you have completed and the compensation you have received. Additionally, maintaining a portfolio of your work can substantiate your claim. A well-structured North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor can also serve as proof of your professional engagements.

When employing an independent contractor, you typically need to complete a contract that outlines the terms of the agreement, including payment and project specifics. Additionally, you may require a W-9 form for tax purposes, as this helps document the contractor's taxpayer identification number. It's also wise to keep records of all correspondence and invoices. Utilizing a North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor template can streamline this process.

In North Carolina, an operating agreement is not legally required for an LLC, but it is highly recommended. This document outlines the management structure and operating procedures of the LLC, ensuring clarity among members. Having an operating agreement can help prevent disputes and provide guidelines for the business's operation. If you are hiring a North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor, consider also having an operating agreement in place for added protection.

When self-employed, you can prove your employment by presenting contracts with clients, invoices for services rendered, and bank statements showing deposits. These documents establish a clear link between your work and the income you receive. It is also helpful to maintain a professional portfolio that highlights your projects. The North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor you create can reinforce your professional status.

To prove you are self-employed, you can provide documentation such as tax returns showing income from freelance work, business licenses, and client contracts. Additionally, invoices sent to clients can serve as proof of your self-employment status. Keeping good records is crucial, as they substantiate your independent contractor status. Your North Carolina Journalist - Reporter Agreement - Self-Employed Independent Contractor can also serve as evidence of your self-employed role.