North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

If you desire to summarize, retrieve, or print authentic document templates, utilize US Legal Forms, the premier assortment of legal forms that are accessible online.

Take advantage of the website's straightforward and convenient search feature to locate the documents you need.

A selection of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After finding the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee. Every legal document template you acquire is yours permanently. You have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again. Be proactive and download, and print the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to locate the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/region.

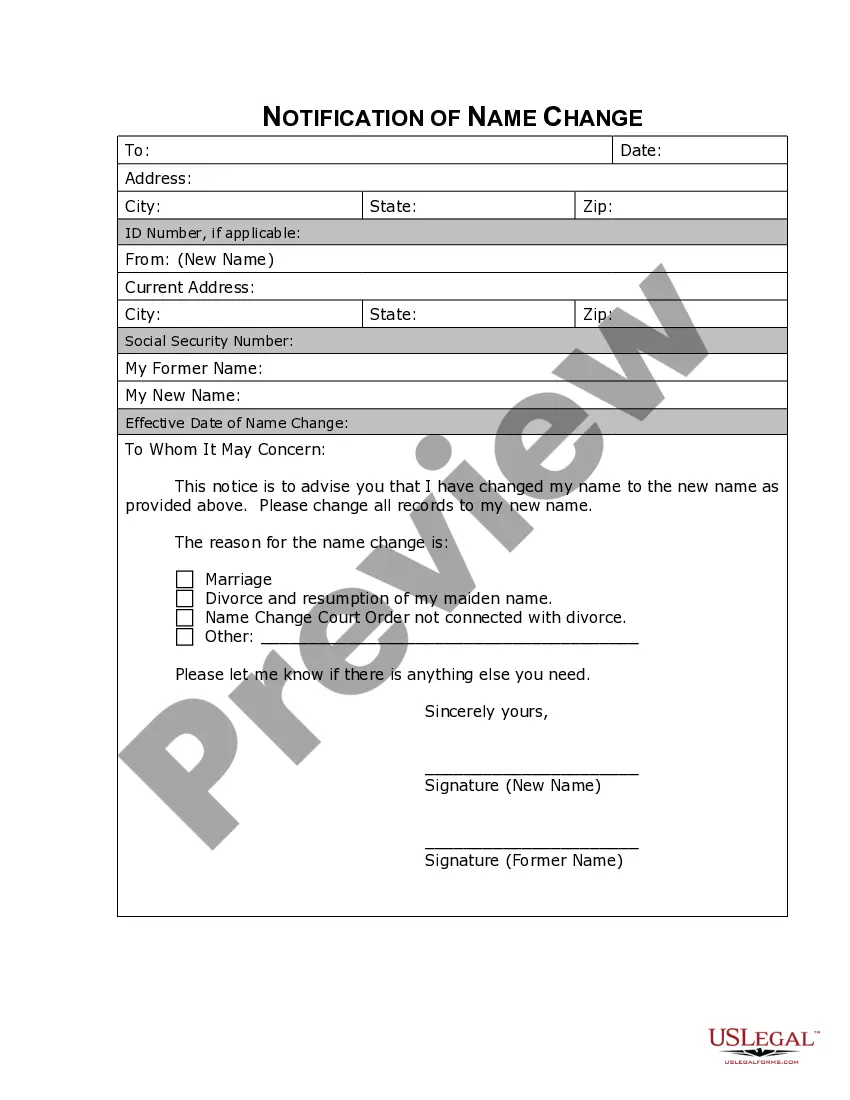

- Step 2. Use the Review option to examine the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The form for payroll deduction permission is typically a written document that employees must complete to authorize deductions from their paychecks. This form outlines the specific amounts and purposes for the deductions. The North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee is an excellent resource to obtain this permission, ensuring that all parties understand the terms.

Form 2159 is specifically designed for authorizing voluntary payroll deductions and is often used in various employee benefit programs. Employees can utilize this form to designate which benefits they want deductions to support, ensuring proper management of these deductions. Consider using the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee as a comprehensive alternative.

Yes, payroll deductions must typically be approved by the employee in writing to ensure transparency and consent. This requirement protects both the employee and the employer from potential disputes regarding deductions. The North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee fulfills this written consent requirement, helping maintain clear communication.

A payroll request form is used to formally initiate changes to payroll processes, such as deductions or changes in payment methods. It helps employers document changes and keeps consistent records of employee requests. Utilizing the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee can facilitate these requests efficiently.

A payroll deduction agreement is a formal document that allows an employer to take specified amounts from an employee's paycheck. This deduction can be for various purposes, such as health insurance or retirement contributions. The North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee serves as a crucial tool for establishing these agreements, ensuring clarity and compliance.

Payroll deduction authorization means that an employee has given permission for their employer to withhold a designated amount from their salary for specified purposes. This authorization is crucial for ensuring that deductions align with the employee's preferences and legal requirements. The North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee serves as a vital tool in this process, ensuring that all parties are informed and agree on the deductions being made.

In North Carolina, employers must comply with federal and state payroll requirements to ensure accurate employee compensation. These include timely payment of wages, proper tax withholdings, and adherence to overtime regulations. Additionally, using tools like the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee helps streamline the deduction process, ensuring all requirements are met efficiently.

Payroll deduction refers to the process where a portion of an employee's wages is withheld by the employer for various purposes. This can include taxes, benefits, or payment for optional programs. Understanding payroll deduction is essential for managing finances and ensuring that the right amounts are allocated. The North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee facilitates this process, allowing employees to authorize specific deductions.

An optional deduction is a payroll deduction chosen by the employee rather than required by law or employer policy. These deductions can include contributions to retirement plans, insurance, and charity donations. By opting into these deductions, you can enhance your financial strategy while providing services or savings that meet your needs. The North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee makes it easy to codify this choice.

A payroll deduction authorization form is a document that allows employees to direct how specific amounts are deducted from their paychecks. This form can cover various deductions including taxes, health benefits, and savings plans. By using this form, you maintain control over your contributions. When dealing with optional deductions, the North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee is essential.