North Carolina Call Asset Transfer Agreement

Description

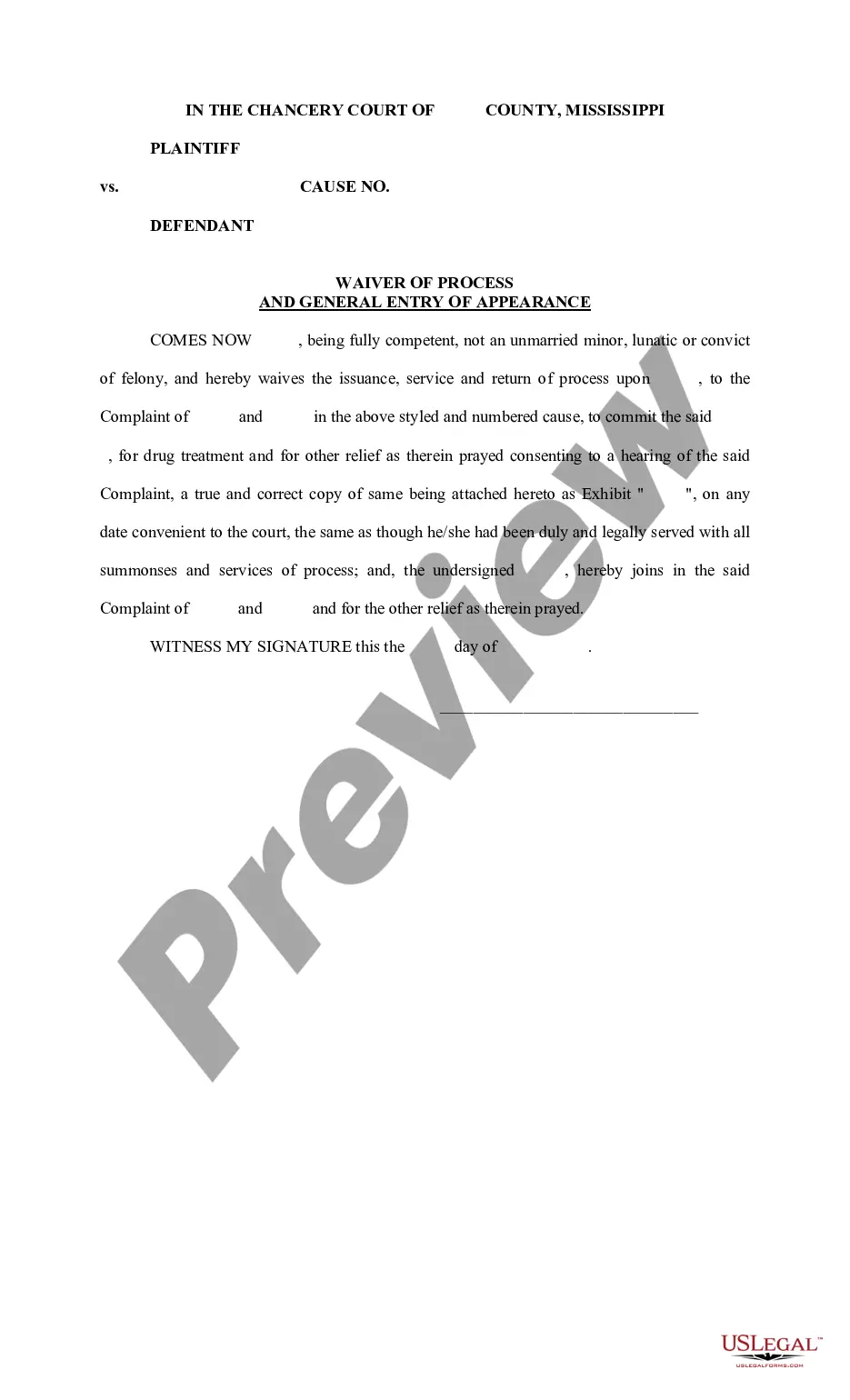

How to fill out Call Asset Transfer Agreement?

It is possible to invest hrs on the web trying to find the authorized file template that meets the federal and state specifications you want. US Legal Forms provides 1000s of authorized kinds which can be reviewed by experts. It is simple to obtain or printing the North Carolina Call Asset Transfer Agreement from our assistance.

If you have a US Legal Forms account, you may log in and click on the Download button. Following that, you may complete, modify, printing, or sign the North Carolina Call Asset Transfer Agreement. Each and every authorized file template you acquire is your own forever. To obtain one more backup associated with a purchased develop, check out the My Forms tab and click on the related button.

Should you use the US Legal Forms site for the first time, stick to the simple directions listed below:

- Initial, make sure that you have chosen the proper file template for the area/area that you pick. Read the develop information to make sure you have selected the right develop. If offered, take advantage of the Review button to appear with the file template as well.

- If you would like discover one more variation of your develop, take advantage of the Look for discipline to discover the template that meets your requirements and specifications.

- Once you have discovered the template you would like, simply click Buy now to continue.

- Choose the pricing prepare you would like, enter your qualifications, and register for a free account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal account to fund the authorized develop.

- Choose the file format of your file and obtain it for your gadget.

- Make changes for your file if required. It is possible to complete, modify and sign and printing North Carolina Call Asset Transfer Agreement.

Download and printing 1000s of file templates while using US Legal Forms website, that offers the greatest assortment of authorized kinds. Use expert and state-specific templates to tackle your organization or person requires.

Form popularity

FAQ

A transfer of assets (TOA) is when you transfer all or part of an account from one financial firm to another without selling your holdings.

There are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser. Asset Purchase vs. Share Purchase when Buying a Business | Unified LLP unifiedllp.com ? business-law-asset-purchase-vs-s... unifiedllp.com ? business-law-asset-purchase-vs-s...

What Is an Asset Transfer? Asset transfer is a process by which ownership or control of an asset is transferred from one person or entity to another. The asset in question could be a tangible asset such as real estate or inventory, or an intangible asset such as a patent or a contractual right.

An asset transfer agreement is a contract between two parties whereby one party agrees to transfer ownership of an asset to the other party. The agreement sets out the terms and conditions of the transfer, including the price, date of transfer, and any other relevant details. What Is An Asset Transfer Agreement? - oboloo oboloo.com ? blog ? what-is-an-asset-transfer-agr... oboloo.com ? blog ? what-is-an-asset-transfer-agr...

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

A transfer agreement is a legally binding document that conveys ownership from one person or entity to another. Transfer agreements are used to sell real estate, businesses, and other tangible assets as well as intellectual property such as computer code, song lyrics, and industrial processes.

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any. What to Include in an Asset Purchase Agreement - Coppaken Law Firm coppakenlaw.com ? blog ? what-to-include-... coppakenlaw.com ? blog ? what-to-include-...

Asset Purchases The resulting transfer of assets will include those desired contracts to which the company is a party to. Such transfer of contracts will be done by way of an assignment, thereby triggering any assignment provision and the corresponding need to obtain consent of the other party(ies) to such contract(s). Acquiring Contracts in an M&A Transaction - Clark Wilson LLP cwilson.com ? acquiring-contracts-in-the-pu... cwilson.com ? acquiring-contracts-in-the-pu...