Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

North Carolina Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt

Description

How to fill out Letter Denying That Alleged Debtor Owes Any Part Of Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes Such A Debt?

Have you found yourself in a scenario where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms provides thousands of form templates, including the North Carolina Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes such Debt, which are designed to comply with federal and state regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of North Carolina Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes such Debt at any time, if needed. Just select the desired form to download or print the template. Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the North Carolina Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Confirm that Alleged Debtor Owes such Debt template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Acquire the form you need and ensure it is for the correct city/state.

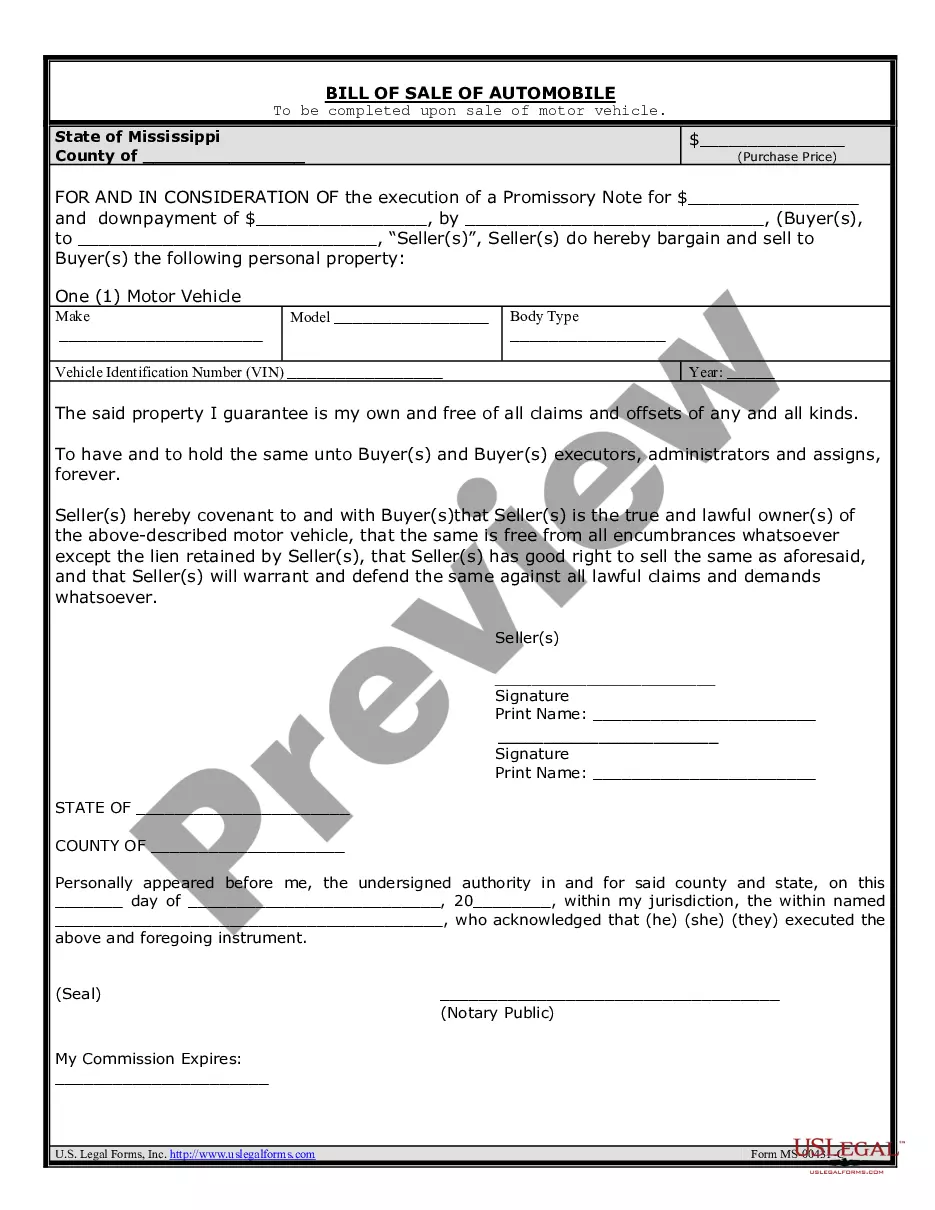

- Utilize the Review feature to inspect the form.

- Check the description to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Lookup section to find the form that meets your needs and requirements.

- Once you find the right form, click Purchase now.

Form popularity

FAQ

The best sample for a debt validation letter includes a clear statement of the subject, such as ‘Request for Debt Validation.’ It should include your personal details, account number, and a statement denying the debt. Refer to the North Carolina Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt for a comprehensive framework that ensures all necessary points are covered.

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureau's website.

A debt validation letter is a letter a consumer sends to a debt collector requesting the debt collector validate a debt they are trying to collect. It is your first chance to assert your rights before debt collectors.

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

The Federal Trade Commission advises that you be as specific as possible in the letter about the reason why you think you do not owe this debt (or owe all of it, if you're disputing the amount), but you should give as little personal information as possible in the letter.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.