North Carolina Employee Stock Option Plan of Emulex Corp.

Description

How to fill out Employee Stock Option Plan Of Emulex Corp.?

Discovering the right legitimate record template can be a struggle. Obviously, there are plenty of web templates available on the Internet, but how can you get the legitimate type you will need? Make use of the US Legal Forms internet site. The assistance delivers 1000s of web templates, such as the North Carolina Employee Stock Option Plan of Emulex Corp., which you can use for enterprise and private needs. All the types are checked by experts and satisfy federal and state demands.

If you are already signed up, log in to your account and click on the Download switch to obtain the North Carolina Employee Stock Option Plan of Emulex Corp.. Make use of your account to appear throughout the legitimate types you might have acquired earlier. Visit the My Forms tab of your own account and obtain an additional copy of your record you will need.

If you are a whole new customer of US Legal Forms, listed here are easy instructions so that you can follow:

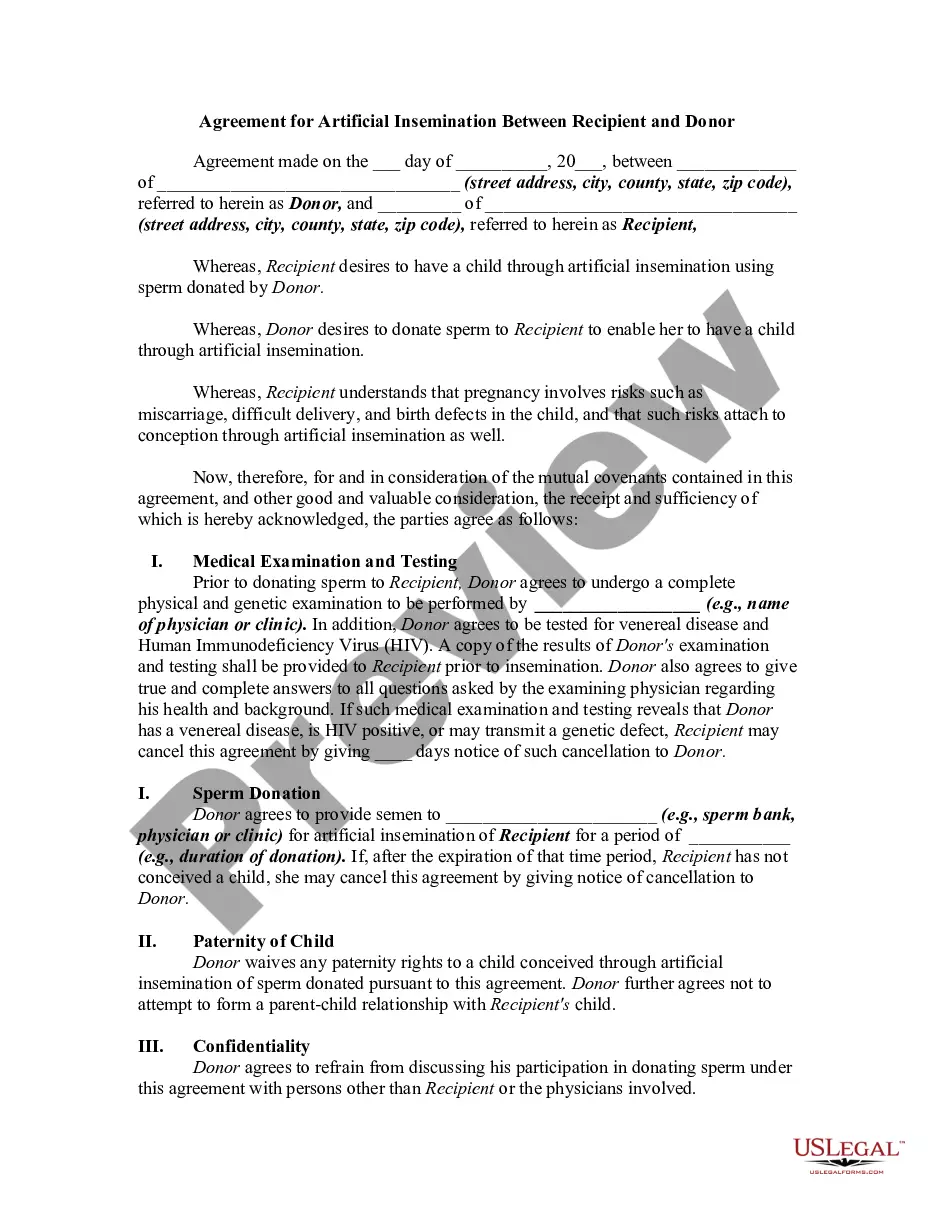

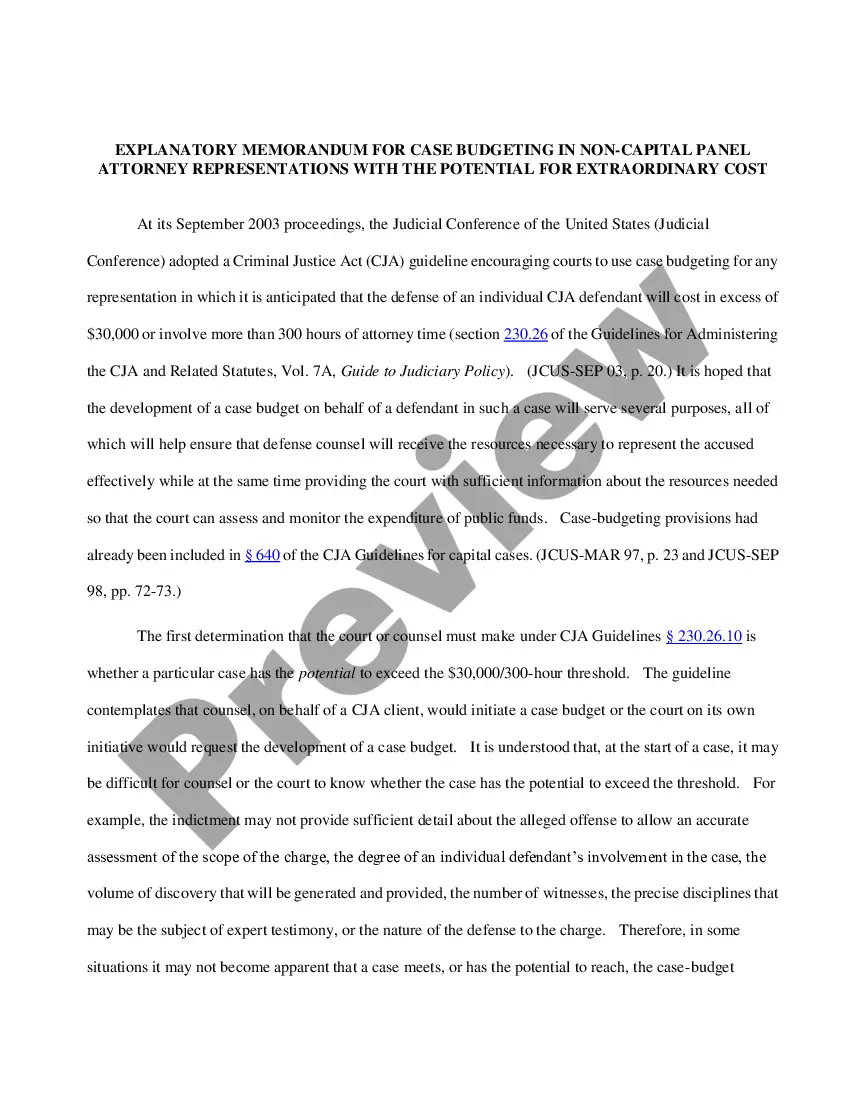

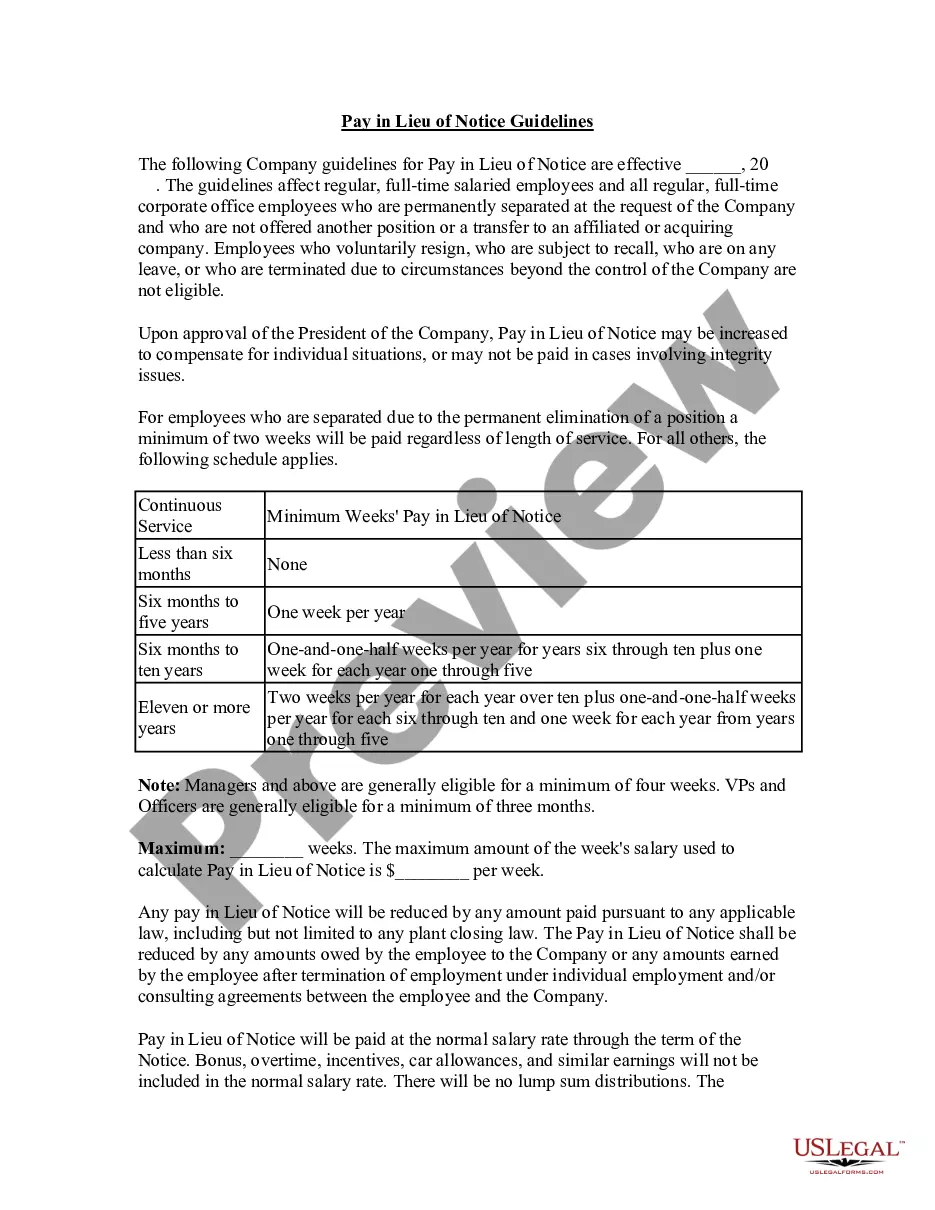

- Initial, ensure you have chosen the right type for the area/area. You may examine the shape making use of the Review switch and study the shape outline to ensure it will be the best for you.

- In the event the type does not satisfy your requirements, utilize the Seach field to discover the proper type.

- Once you are sure that the shape is acceptable, click the Buy now switch to obtain the type.

- Opt for the costs program you need and type in the needed information. Make your account and pay for your order making use of your PayPal account or bank card.

- Choose the file structure and down load the legitimate record template to your device.

- Full, edit and printing and signal the obtained North Carolina Employee Stock Option Plan of Emulex Corp..

US Legal Forms may be the largest catalogue of legitimate types for which you can discover a variety of record web templates. Make use of the company to down load appropriately-produced documents that follow express demands.

Form popularity

FAQ

Differences between options and stocks A stock is an ownership stake in a company, and it rises and falls over time depending on the profitability of the business. In contrast, an option is a side bet among traders over what price a stock will be worth by a certain time.

It might seem as though a DSPP would be very similar to an ESPP but really their only similarities are: (1) it provides a way for you to purchase company stock and (2) you save up to buy company stock by setting aside money with each paycheck.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.