Vermont Deed and Assignment from individual to A Trust

Description

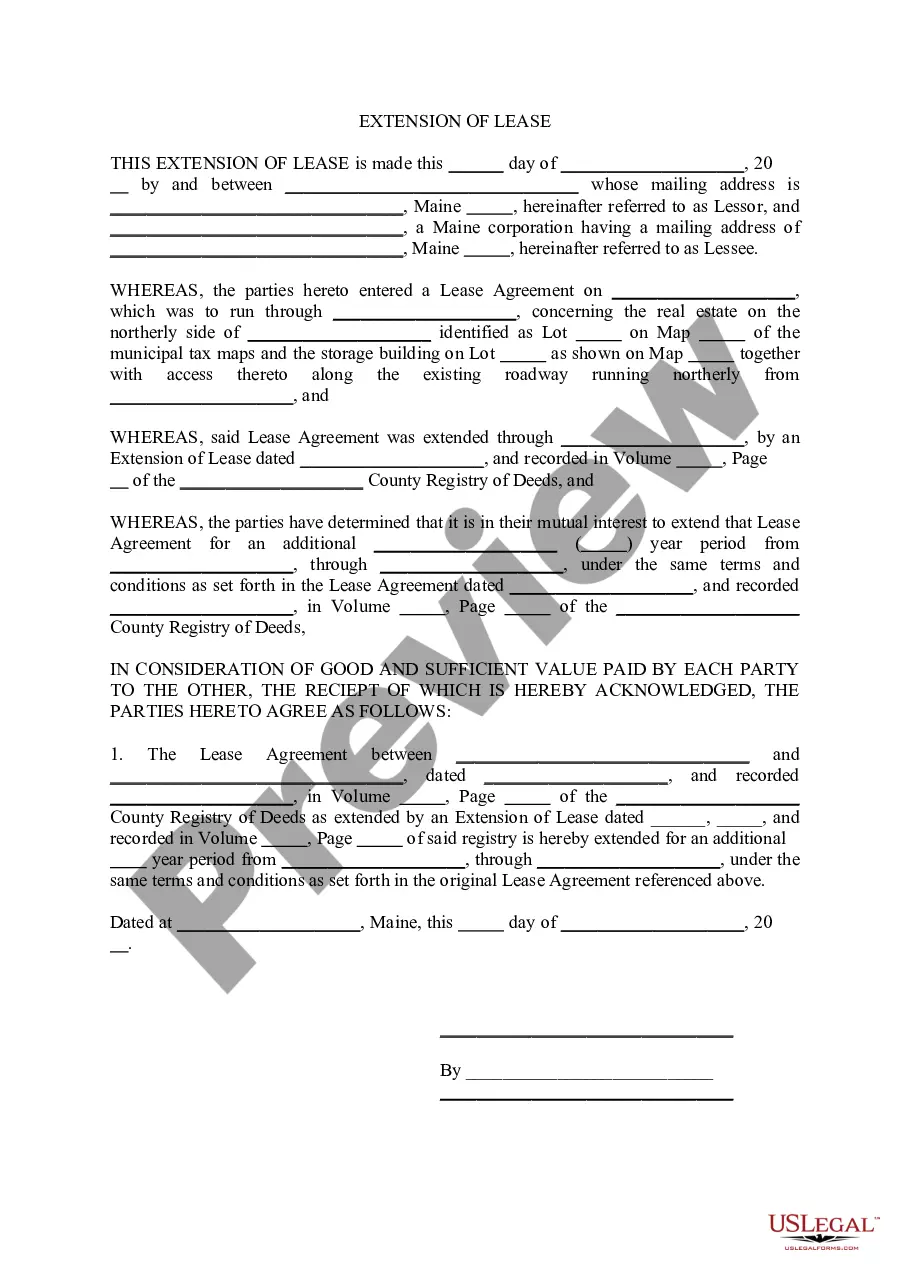

How to fill out Deed And Assignment From Individual To A Trust?

If you want to total, acquire, or print out authorized document themes, use US Legal Forms, the biggest assortment of authorized kinds, that can be found on-line. Take advantage of the site`s simple and practical lookup to discover the paperwork you require. Numerous themes for company and individual functions are categorized by classes and suggests, or keywords. Use US Legal Forms to discover the Vermont Deed and Assignment from individual to A Trust in a handful of clicks.

Should you be already a US Legal Forms buyer, log in to the accounts and click the Down load button to have the Vermont Deed and Assignment from individual to A Trust. You can also accessibility kinds you previously downloaded inside the My Forms tab of your own accounts.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have selected the form to the proper area/land.

- Step 2. Make use of the Review choice to look through the form`s information. Do not overlook to see the information.

- Step 3. Should you be not satisfied together with the form, take advantage of the Look for industry near the top of the screen to locate other versions in the authorized form web template.

- Step 4. Upon having found the form you require, click the Acquire now button. Select the rates program you prefer and add your qualifications to register for the accounts.

- Step 5. Procedure the deal. You can utilize your charge card or PayPal accounts to perform the deal.

- Step 6. Pick the file format in the authorized form and acquire it on the device.

- Step 7. Complete, edit and print out or signal the Vermont Deed and Assignment from individual to A Trust.

Every authorized document web template you get is the one you have eternally. You have acces to every form you downloaded inside your acccount. Click the My Forms area and pick a form to print out or acquire again.

Contend and acquire, and print out the Vermont Deed and Assignment from individual to A Trust with US Legal Forms. There are thousands of professional and condition-distinct kinds you can use for your personal company or individual requirements.

Form popularity

FAQ

A grantor may place a mortgaged home in a living trust by signing a warranty or quitclaim deed from the current owners to the trust. In this case, the deed would name the living trust as grantee and would be and recorded just like any other property transfer. Transferring a Mortgaged Property into a Living Trust milvidlaw.com ? estate-planning ? transferring-a-... milvidlaw.com ? estate-planning ? transferring-a-...

How to Fund a Trust: Bank Accounts and Other Financial Accounts Contact your bank to see what's required to transfer your accounts to the Trust. Your bank will provide any necessary forms. Complete, sign and return forms to your bank. ... Have the bank change the title to the Trustee of the Trust.

To properly convey a deed the deed must be signed in front of a notary and recorded in the county clerks office. If a survey is referenced in the deed, that survey should also be recorded. If a deed divides a parcel a survey should be recorded with the deed. Conveyance of Real Estate in Vermont - Study.com study.com ? academy ? lesson ? conveyance-of-re... study.com ? academy ? lesson ? conveyance-of-re...

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome. Pros And Cons Of Putting Your House In A Trust rouletlaw.com ? blog ? pros-and-cons-of-pu... rouletlaw.com ? blog ? pros-and-cons-of-pu...

For instance, personal property is relatively simple to transfer into a trust. It merely requires a signed statement that lists the assets being transferred. If the personal property is titled in the grantor's name, such as a boat or a motor vehicle, it must be transferred with the correct type of deed. How to Transfer Property into a Trust - White and Bright, LLP whiteandbright.com ? how-to-transfer-prope... whiteandbright.com ? how-to-transfer-prope...

How do I transfer the shares I own to my trust? You will need to inform the company issuing the shares that you will be holding them through a trust and also provide your trust's details. This is necessary to ensure the company's internal records reflect this change.

Key takeaways. A transfer of mortgage is the reassignment of an existing mortgage, usually on a home, from the current holder to another person or entity. Not all mortgages can be transferred; if they are, the lender has the right to approve the person assuming the loan.

Tell your banker you would like to transfer a bank account into a trust. Remove any existing bank account beneficiaries. Present an official copy of the trust to your banker. Sign new signature and ownership cards.

This is done by updating your deed(s) so that it includes your name and lists you as the trustee; for example, ?John Doe, Trustee for the Doe Living Trust.? Tangible personal property includes your car, furniture, boat, jewelry, art, antiques, coin collections, and other personal property.

Your Assets Might Not Be Protected: Another crucial point to note is that not all trusts offer protection from creditors. For instance, in revocable trusts, the assets are not protected from creditors as the grantor retains control of the assets. Potential Tax Burdens: Finally, trusts can carry potential tax burdens.