North Carolina Stock Incentive Plan of Ambase Corp.

Description

How to fill out Stock Incentive Plan Of Ambase Corp.?

Are you presently in a place where you require papers for either business or personal purposes virtually every day time? There are plenty of legitimate file web templates available on the Internet, but finding ones you can trust isn`t straightforward. US Legal Forms delivers a huge number of type web templates, just like the North Carolina Stock Incentive Plan of Ambase Corp., which are created in order to meet state and federal demands.

In case you are currently acquainted with US Legal Forms website and possess an account, just log in. Afterward, you may download the North Carolina Stock Incentive Plan of Ambase Corp. web template.

Should you not provide an account and would like to begin to use US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is for your correct town/area.

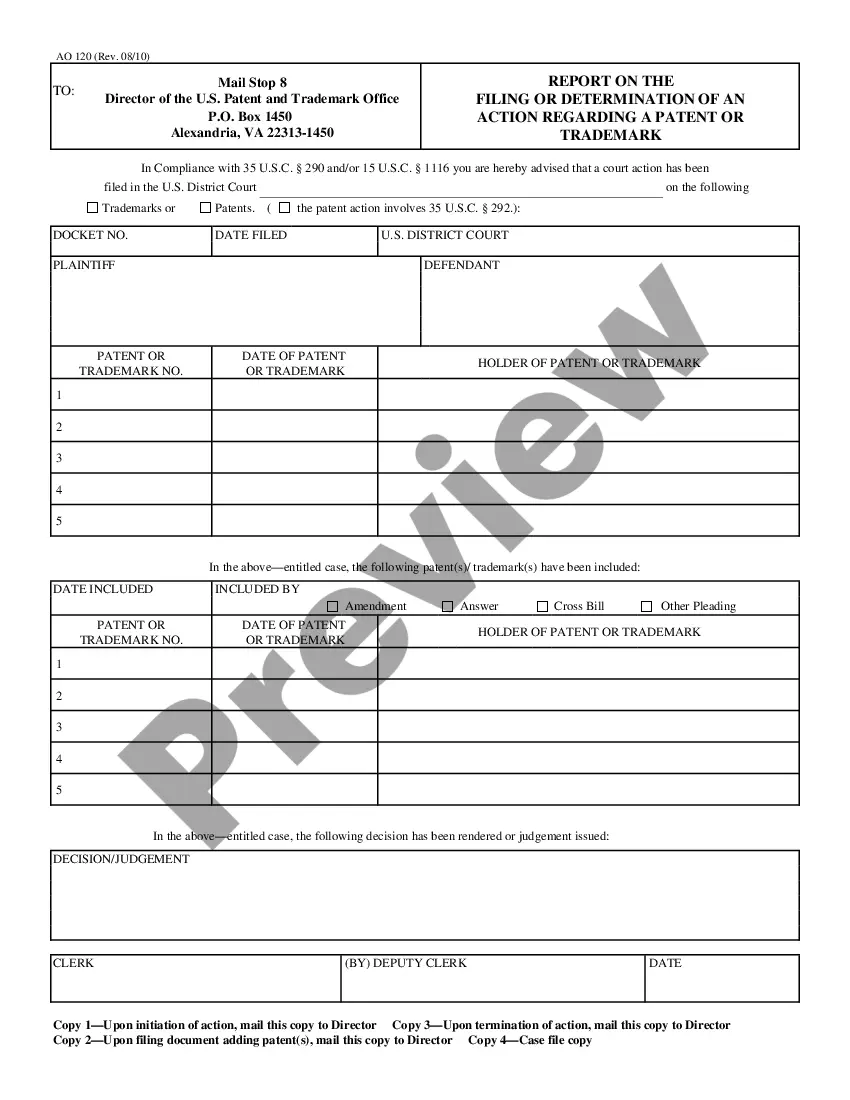

- Take advantage of the Preview option to check the form.

- Look at the outline to ensure that you have selected the correct type.

- When the type isn`t what you`re searching for, utilize the Lookup field to get the type that meets your needs and demands.

- Whenever you discover the correct type, just click Buy now.

- Select the rates strategy you desire, fill in the desired info to create your money, and buy the order making use of your PayPal or credit card.

- Pick a handy data file file format and download your duplicate.

Get all of the file web templates you have bought in the My Forms menus. You can obtain a extra duplicate of North Carolina Stock Incentive Plan of Ambase Corp. any time, if necessary. Just click the needed type to download or print the file web template.

Use US Legal Forms, the most comprehensive assortment of legitimate varieties, to save lots of some time and steer clear of mistakes. The assistance delivers skillfully made legitimate file web templates that can be used for a variety of purposes. Produce an account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

These plans are discussed below: Premium Bonus Plan. Under premium bonus plans, the time taken to complete a job is fixed based on a careful time analysis. ... Profit-Sharing and Co-ownership. ... Group Incentives. ... Indirect Incentive Plans.

Below are the steps you can use when developing and implementing an incentive program for employees: Involve the right people. ... Set goals for the program. ... Identify the incentive audience. ... Increase participant engagement. ... Choose a program structure and budget. ... Determine the rewards. ... Decide how you plan to track involvement.

Here's an example: You can purchase 1,000 shares of company stock at $20 a share with your vested ISO. Shares are trading for $40 in the market. If you already own 500 company shares, you can swap those shares (500 shares x $40 market price = $20,000) for the 1,000 new shares, rather than paying $20,000 in cash.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

A stock incentive plan, or employee stock purchase plan, is a form of compensation by a company for employees or contractors which can be used as an alternative to cash payment. It's designed to motivate employees by offering them the opportunity for future earnings through company stocks.