North Carolina Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock

Description

How to fill out Form Of Certificate Of Designations, Preferences And Rights Of Series C Convertible Preferred Stock?

Are you in the place where you will need papers for both company or person purposes nearly every day time? There are tons of legitimate papers themes available on the Internet, but finding kinds you can rely is not simple. US Legal Forms provides a large number of develop themes, such as the North Carolina Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock, that happen to be written to fulfill federal and state specifications.

If you are currently familiar with US Legal Forms website and get your account, basically log in. After that, you are able to acquire the North Carolina Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock template.

If you do not provide an accounts and would like to begin using US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for your correct city/county.

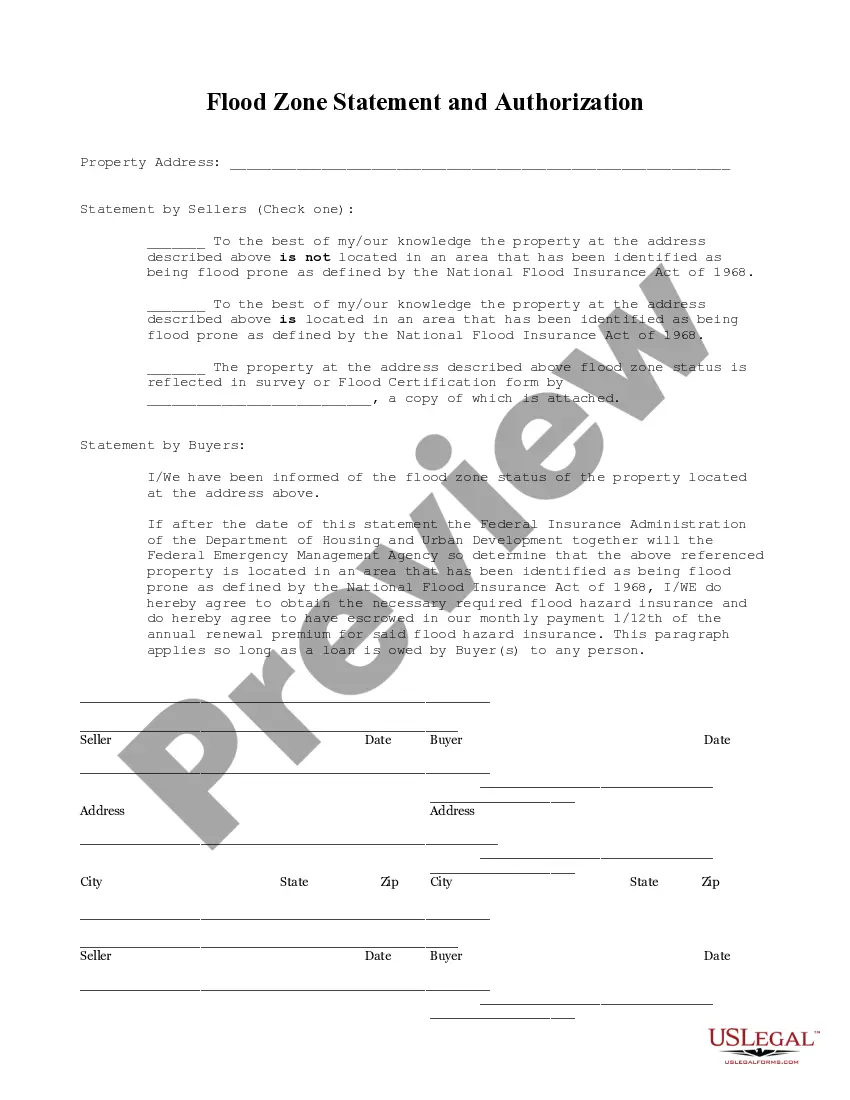

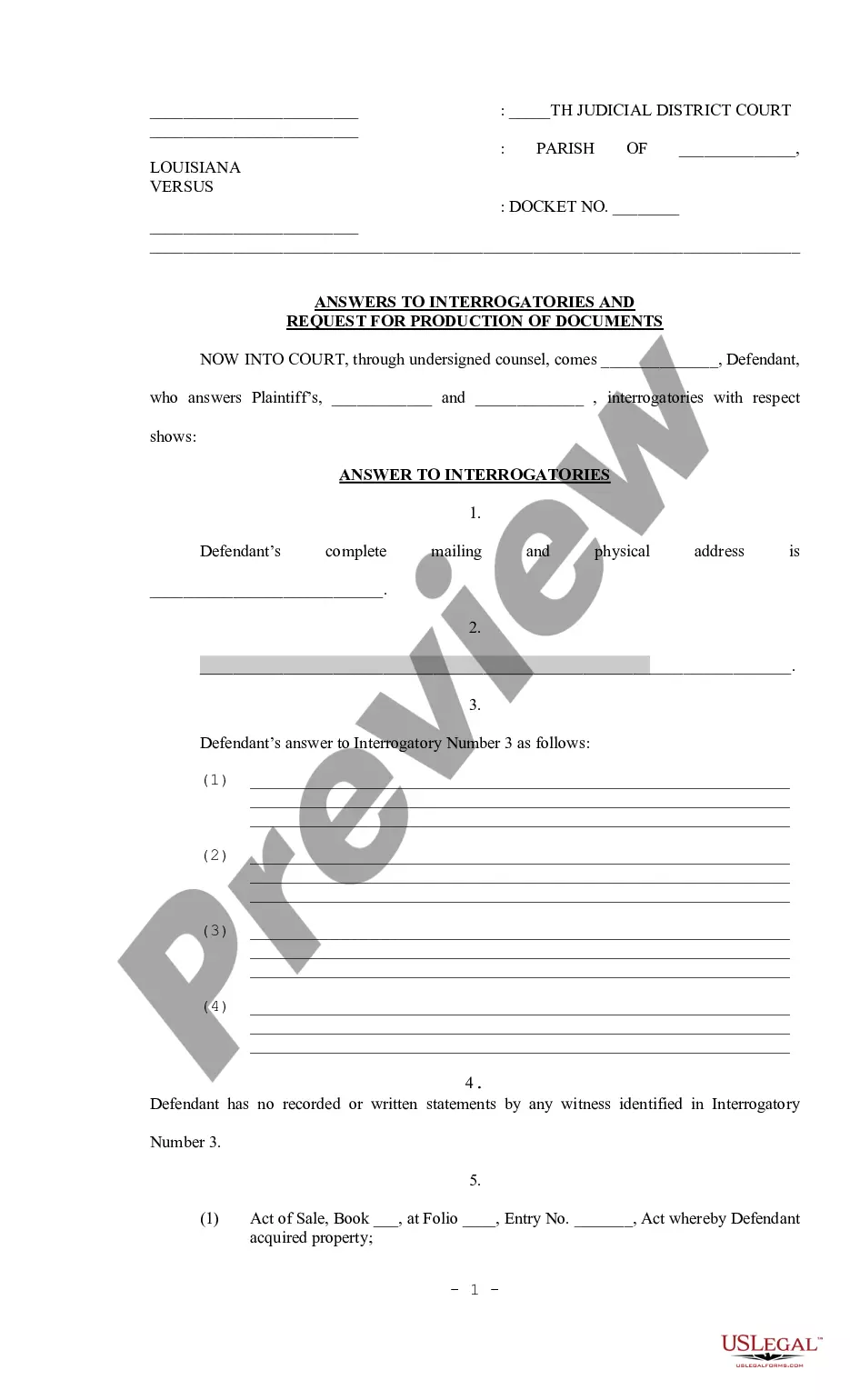

- Use the Review switch to examine the form.

- Look at the explanation to actually have chosen the correct develop.

- In case the develop is not what you`re seeking, utilize the Lookup industry to get the develop that meets your requirements and specifications.

- If you get the correct develop, simply click Purchase now.

- Pick the prices program you would like, fill out the necessary details to produce your money, and buy the transaction utilizing your PayPal or charge card.

- Select a handy file file format and acquire your version.

Find all of the papers themes you possess purchased in the My Forms food selection. You can obtain a additional version of North Carolina Form of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock anytime, if possible. Just click on the required develop to acquire or print the papers template.

Use US Legal Forms, probably the most comprehensive collection of legitimate types, in order to save some time and stay away from blunders. The assistance provides skillfully produced legitimate papers themes which you can use for a selection of purposes. Produce your account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Convertible notes are usually faster and cheaper to negotiate and close than preferred equity, as they involve less legal documentation and due diligence. They also defer the valuation of the startup until the Series A round, which can be beneficial if the startup grows significantly in the meantime.

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

Redeemable convertible preference share It is liable to be redeemed by that body corporate. On redemption, the shareholder receives: an agreed cash amount; or. an agreed number of ordinary shares in the issuing body corporate.

An account designation is the name given to an investment account where shares cannot be directly held by the beneficial owner (e.g. a minor) and instead, are registered in the name of a trustee (e.g. a parent).

Preferred Designation means the Certificate of Designation with respect to the Series D Preferred Stock, the Series E Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock and the Series I Preferred Stock adopted by the Board of Directors of the Company and duly filed ...

A preferred stock certificate is a document that identifies the ownership share of an investor in a corporation.

Stock Designation with respect to a share of Company Common Stock means a designation by the holder of such share, provided by the Company to Parent no later than the Designation Deadline, to the effect that such share is designated to receive the Stock Designation Consideration.

Series C Convertible Preferred Stock means the Series C Convertible Redeemable Preferred Stock, par value $. 01 per share, of the Company, having the same voting rights as the Class A Common Stock determined on an as converted basis.

Issuing convertible preferred stock is one of the many ways companies can raise capital to fund their operations and expansion. Companies will choose to sell convertible preferred stock because it enables them to avoid taking on debt while limiting the potential dilution of selling additional common stock.

However, convertible preferred stock also has several drawbacks, such as dilution of ownership, lower dividend rates, higher costs, and risk of conversion.