North Carolina Direct Deposit Authorization

Description

How to fill out Direct Deposit Authorization?

If you require to complete, obtain, or print valid document templates, utilize US Legal Forms, the primary collection of legal forms available online.

Employ the site`s straightforward and convenient search feature to locate the documents you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you wish to use, click the Proceed to Purchase button. Choose your preferred pricing plan and enter your information to sign up for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Use US Legal Forms to retrieve the North Carolina Direct Deposit Authorization with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the North Carolina Direct Deposit Authorization.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

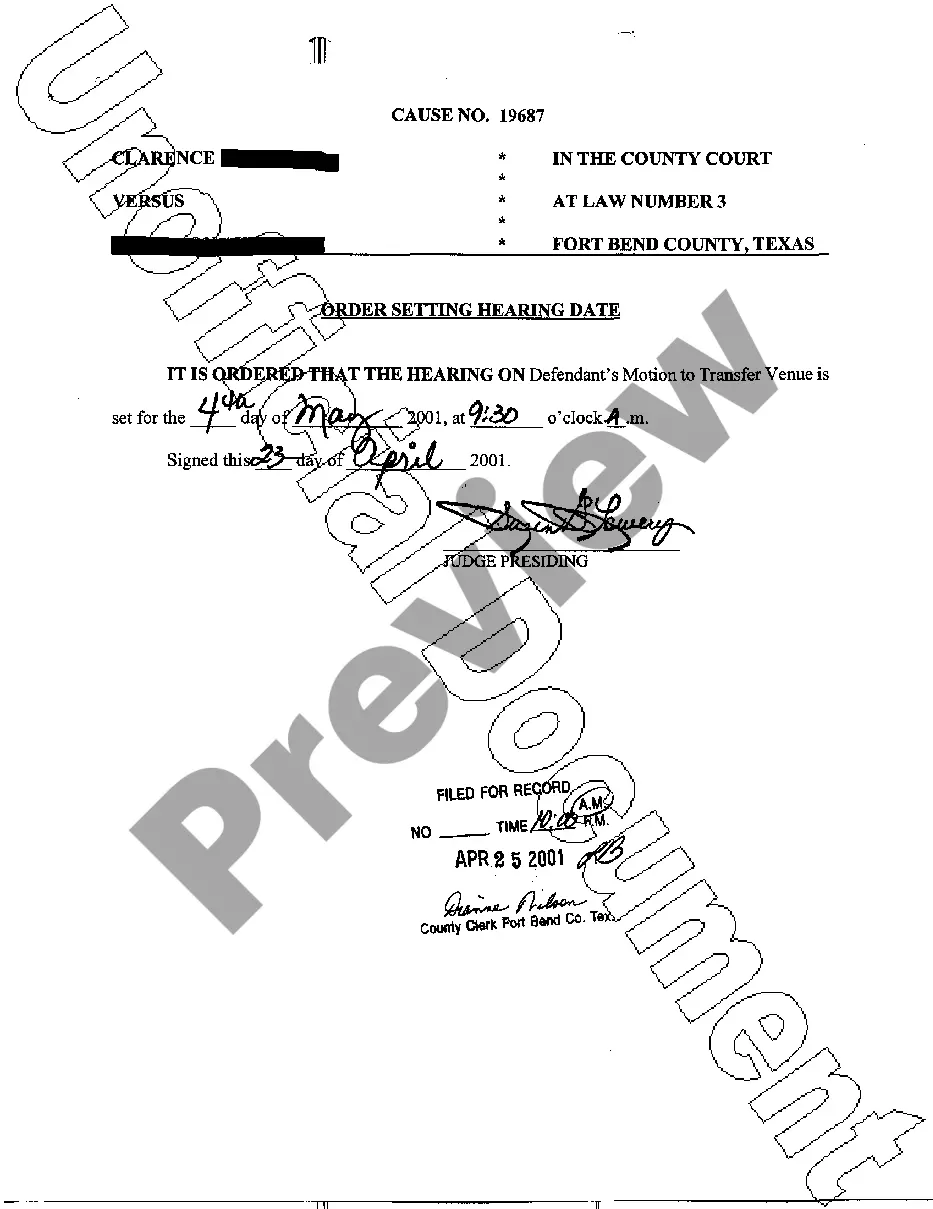

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to find other models in the legal form format.

Form popularity

FAQ

Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

You can also sign on to CIBC Online Banking® to retrieve the form:Select the account you want to set up for your direct deposit or pre-authorized payment.On your Deposit Account Details page, select Manage My Account and then the Void cheque/direct deposit info link from the dropdown menu.More items...

No, you do not need your bank's approval or signature for direct deposit. All you will need is your bank routing number and your account number, which are listed at the bottom of every check. (Note: Do not use numbers from the bottom of a deposit slip.

North Carolina labor laws allow an employer to pay wages by direct deposit so long as the wages are deposited into an institution whose deposits are insured by the federal government or into a financial institution selected by the employee.

No, you do not need your bank's approval or signature for direct deposit. All you will need is your bank routing number and your account number, which are listed at the bottom of every check.

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Commonly, an employer requesting authorization will require a voided check to ensure that the account is valid.

It has been common practice among traditional banks to take one to two days to release direct deposit funds to the customer. However, the sooner the money is in your account, the sooner it can be earning interest or be put to immediate use.

Federal Law The Electronic Fund Transfer Act (EFTA), also known as federal Regulation E, permits employers to make direct deposit mandatory, as long as the employee is able to choose the bank that his or her wages will be deposited into.

North Carolina labor laws allow an employer to pay wages by direct deposit so long as the wages are deposited into an institution whose deposits are insured by the federal government or into a financial institution selected by the employee.

Set up direct depositAsk for a copy of your employer's direct deposit signup form, or download the U.S. Bank Direct Deposit Authorization Form (PDF).Provide your U.S. Bank deposit account type (checking or savings), account number and routing number, and other required information.More items...