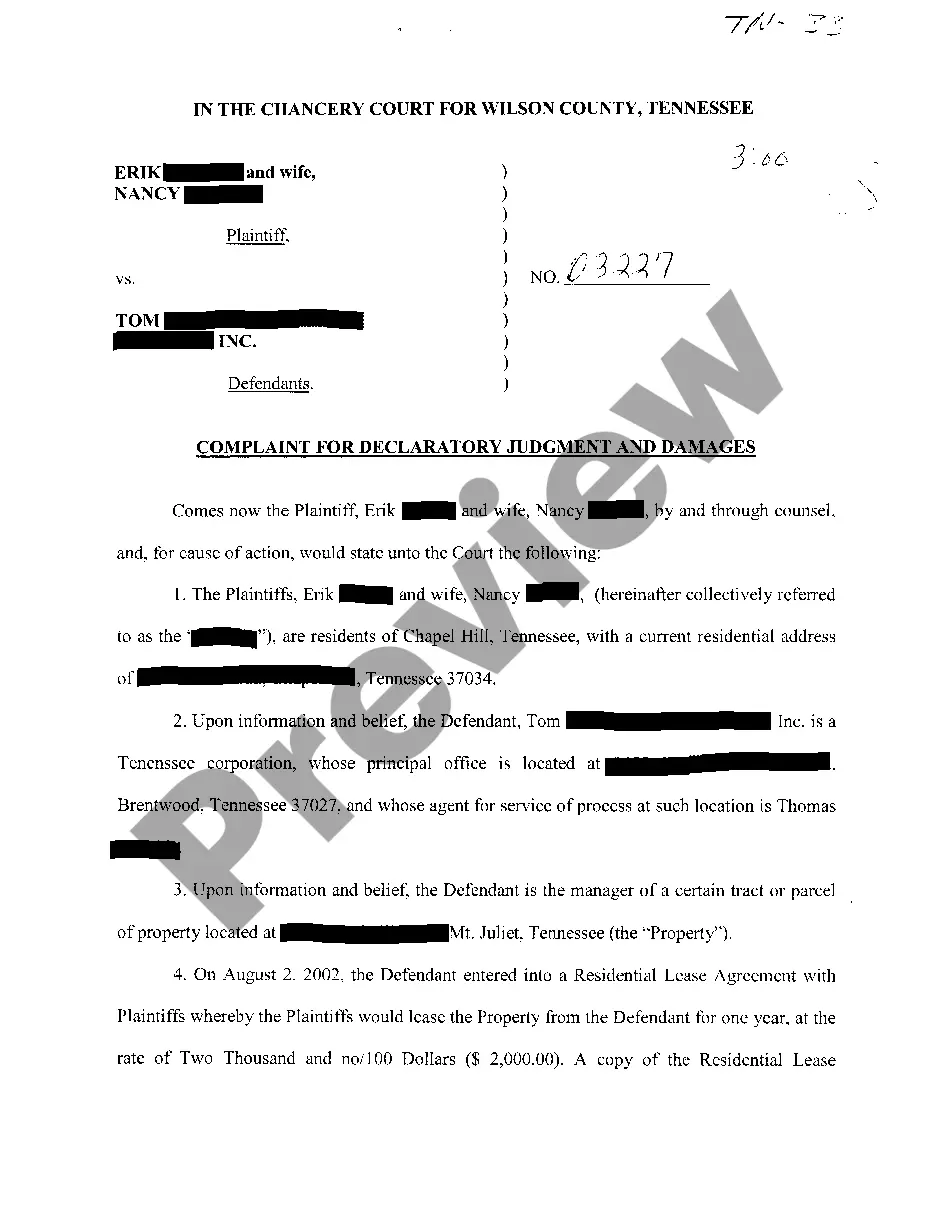

Delaware Form PF-4 is a form used by corporations and limited liability companies (LCS) registered in the State of Delaware for filing a statement of dissolution with the Delaware Secretary of State. The form is available for different types of entities, including corporations, limited liability companies, and limited partnerships. The form requires the dissolution statement to be signed by the Secretary of State, all members of the company, and any other persons authorized to sign the document. The form also requires information about the company’s registered agent, registered office, and all members of the company. Delaware Form PF-4 must be accompanied by a $50 filing fee. There are three types of Delaware Form PF-4: one for corporations, one for LCS, and one for limited partnerships.

Delaware Form PF-4

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Form PF-4?

US Legal Forms is the easiest and most lucrative method to find appropriate legal templates.

It’s the largest online repository of business and personal legal documents created and validated by attorneys.

Here, you can access printable and fillable forms that adhere to national and local laws - just like your Delaware Form PF-4.

Review the form description or preview the document to ensure you have found the one that suits your needs, or find another one using the search feature above.

Click Buy now when you’re confident of its compliance with all the requirements, and select the subscription plan that you prefer most.

- Acquiring your template requires just a few uncomplicated steps.

- Users who already possess an account with an active subscription only need to Log In to the online service and download the document onto their device.

- Later, they can access it in their account in the My documents section.

- And here’s how you can get a properly prepared Delaware Form PF-4 if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

In Delaware, the power of attorney form for tax purposes is known as the Delaware Department of Revenue's Power of Attorney form. This allows a designated individual to act on behalf of another in tax matters. It is critical to complete this form accurately to ensure that your tax affairs are handled smoothly. Using uslegalforms can simplify the process by providing you with the appropriate templates and guidance.

Delaware does not have a specific W-4 form like other states, but it does require employees to complete a state withholding form. This state-specific form helps determine the correct amount of state income tax to withhold from your paycheck. Proper completion of this document is crucial for ensuring the right tax deductions. For more guidance on tax forms, you might consider exploring uslegalforms' resources.

The Delaware Form PF-4 is primarily used by investment advisers managing private funds. This includes hedge funds, private equity funds, and venture capital funds. These advisers use the form to report their assets under management and related risks to regulatory agencies. By effectively using Form PF, advisers can demonstrate their commitment to regulatory compliance and transparency.

Obtaining a Certificate of Formation in Delaware can be quite efficient. Typically, it takes about one to two business days if filed online, and longer if submitted by mail. This swift process is beneficial for new businesses looking to establish themselves quickly. By utilizing the services offered through uslegalforms, you can simplify this application process, making it even faster.

Yes, Exempt Reporting Advisers (ERAs) must file the Delaware Form PF-4 if they manage qualifying private funds. While ERAs benefit from lighter regulations compared to fully registered advisers, filing Form PF is mandatory for those managing assets above the established thresholds. This ensures that they remain compliant with statutory reporting requirements. Consequently, it helps foster a transparent market environment.

The Delaware Form PF-4 is an important document that certain investment advisors must file. Specifically, private fund advisers that qualify under the SEC's guidelines are required to submit this form. Ensuring compliance with Form PF helps these advisers communicate their operations transparently. Therefore, it's essential for advisers to understand their filing obligations.

Yes, you can file your Delaware state taxes online, making the process faster and more efficient. By using the Delaware Form PF-4, you can complete your tax filing digitally from anywhere, as long as you have Internet access. This option makes it simple to meet your tax obligations promptly. For a seamless experience, visit US Legal Forms to find the online tools required for your Delaware state tax filing.

Yes, Delaware provides an efile form that allows you to submit your tax documents electronically. This makes it convenient and efficient to file your Delaware Form PF-4, as you can complete the process right from your home or office. Electronic filing also helps reduce the risk of errors and speeds up processing time. Explore the options available on US Legal Forms to access the efile form for your filing needs.

Filing your Delaware annual franchise tax report involves gathering the necessary financial information for your business. You will need to complete the Delaware Form PF-4 to report your company's income and calculate the franchise tax owed. Be sure to review the deadlines to avoid penalties. Consider using the US Legal Forms platform to easily access the Delaware Form PF-4 and streamline your filing process.

Filling out a W-4 form involves providing your personal information, marital status, and any deductions or adjustments. Consider using the IRS's worksheet to help guide you through the process. For clarity and assistance, services like uslegalforms can provide resources to ensure you complete the form accurately and efficiently.