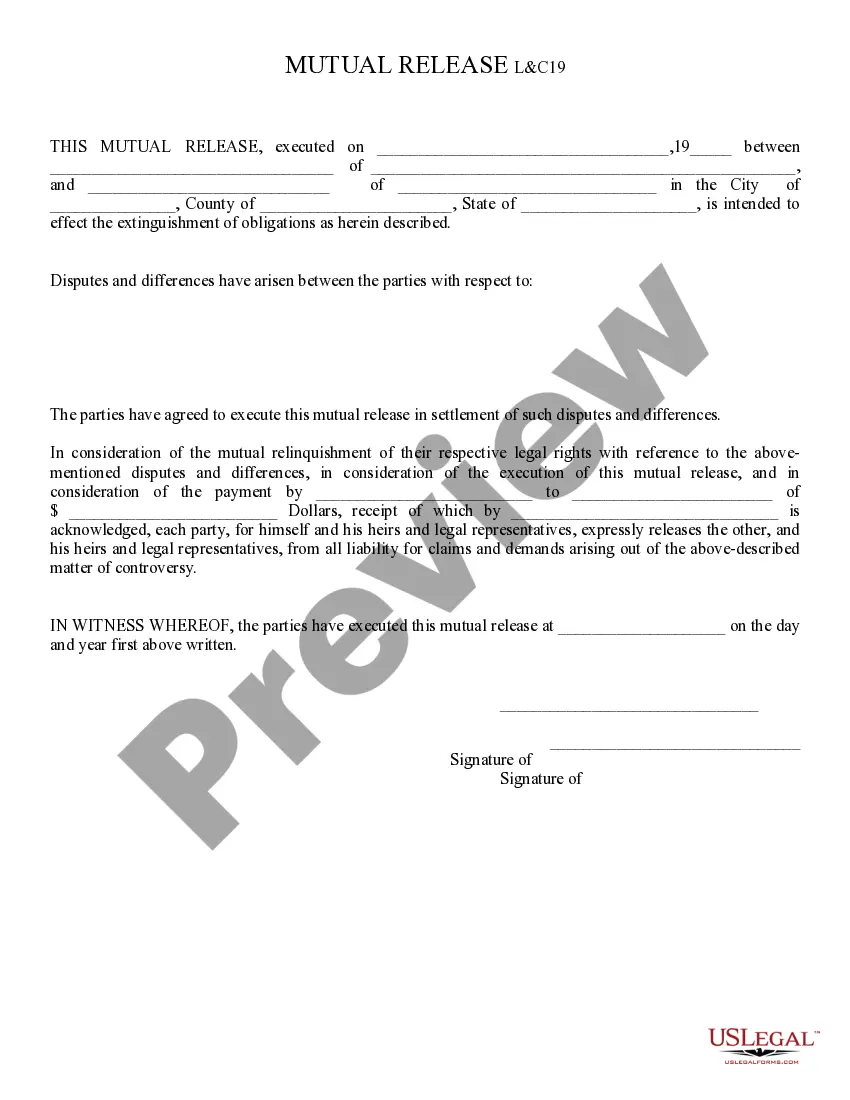

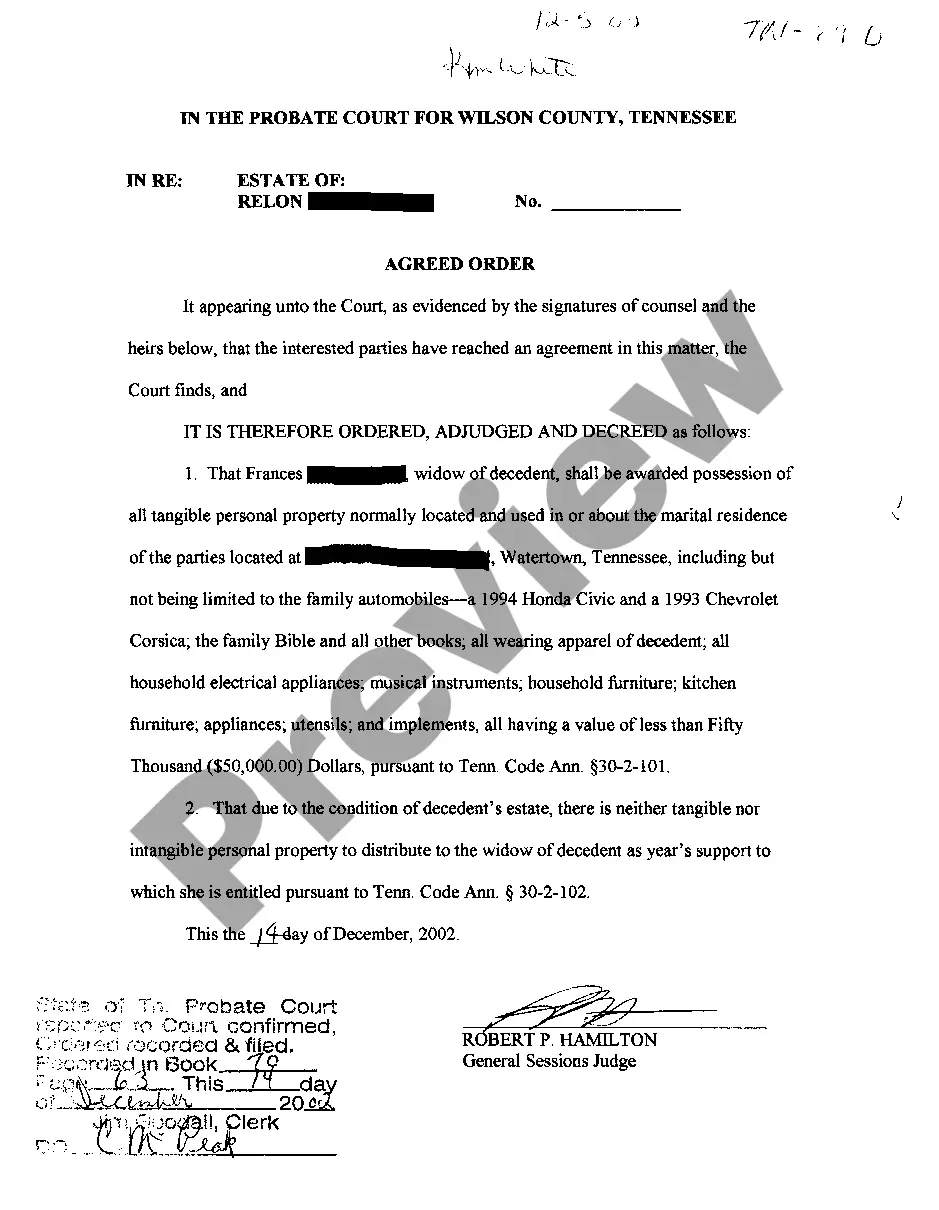

Delaware Form PF-1 is the state's form for filing a Protective Filing for a Creditor's Claim. The form is required when an individual or entity is seeking to protect a claim against the assets of a debtor who has filed for bankruptcy protection in Delaware. There are two types of Delaware Form PF-1: PF-1A for individuals and PF-1B for businesses. Each form requires information about the creditor, the debtor, the claim, and the debtor's bankruptcy filing. PF-1A and PF-1B both require supporting documents that must be attached to the form to be valid. Once the form and supporting documents have been filed, the creditor's claim is protected.

Delaware Form PF-1

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Form PF-1?

How much duration and effort do you typically invest in preparing formal documentation.

There’s a better choice to obtain such forms than engaging legal professionals or spending hours browsing the internet for an appropriate template.

Another advantage of our library is that you can retrieve previously downloaded documents that you securely store in your profile in the My documents tab. Access them anytime and re-complete your paperwork as often as you require.

Conserve time and energy finalizing official documents with US Legal Forms, one of the most dependable online solutions. Enroll with us now!

- Examine the form content to ensure it aligns with your state requirements. To achieve this, verify the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, search for an alternative using the search tab located at the top of the page.

- If you are already a member of our service, Log In and retrieve the Delaware Form PF-1. Otherwise, continue to the subsequent steps.

- Click Buy now once you locate the appropriate document. Choose the subscription plan that works best for you to gain access to our library’s complete service.

- Register for an account and complete your subscription payment. You can process a transaction with your credit card or through PayPal - our service is completely trustworthy for this.

- Download your Delaware Form PF-1 to your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

Yes, Delaware has a state withholding form that employers use to report and remit employee income tax withholdings. This form ensures that the correct amount of taxes is deducted from your paychecks. If you're self-employed or managing your own taxes, understanding this form alongside the Delaware Form PF-1 is essential for proper tax compliance.

Yes, Delaware does impose a personal state income tax on residents and those earning income within the state. The rates vary based on income levels and filing status. Understanding how this tax impacts you can guide your financial planning and filing processes, particularly with forms like the Delaware Form PF-1.

If you earn income in Delaware, you are required to file a Delaware income tax return, which typically includes the Delaware Form PF-1. Even residents who earn income from outside the state may still need to file. It's crucial to assess your income sources to determine your filing requirements accurately.

Yes, Delaware Form PF-1 is publicly available. Anyone can access the form through the Delaware Division of Revenue’s website or various tax preparation platforms. This transparency helps taxpayers understand their responsibilities and access the required information easily.

Form 5403 in Delaware is a tax form used for reporting specific types of income and investments for tax purposes. This form helps the state calculate your tax obligations accurately. It's important to understand the difference between this form and the Delaware Form PF-1 to ensure you file the correct documents.

You should file Delaware Form PF-1 on an annual basis. The state requires you to submit this form every year, typically by April 30th, for the previous tax year. Keeping up with the deadlines is essential to avoid penalties and to maintain proper financial records.

Yes, Delaware does have a state income tax form. Residents and non-residents who earn income in Delaware must fill out the necessary forms, including the Delaware Form PF-1. Filing this form ensures compliance with state tax regulations and helps you manage your tax liabilities effectively.

Anyone managing qualifying private funds must file the Delaware Form PF-1. This requirement primarily targets registered investment advisers with significant assets under management. Filing the form not only fulfills regulatory duties but also contributes to the overall stability of the financial marketplace. If you are unsure about your filing status, uslegalforms provides resources to clarify your obligations.

The Delaware Form PF-1 is primarily used by private fund managers and investment advisers. These professionals utilize the form to report information to regulators, which aids in the oversight of the financial system. Understanding who uses this form can help you determine your filing obligations. uslegalforms can assist you in navigating these requirements effortlessly.

Individuals and entities that manage private investment funds often must file the Delaware Form PF-1. This requirement typically applies to registered investment advisers with assets under management exceeding a certain threshold. It's crucial for managers to understand these obligations to ensure compliance with regulatory standards. By filing the form, you help maintain transparency in the financial industry.