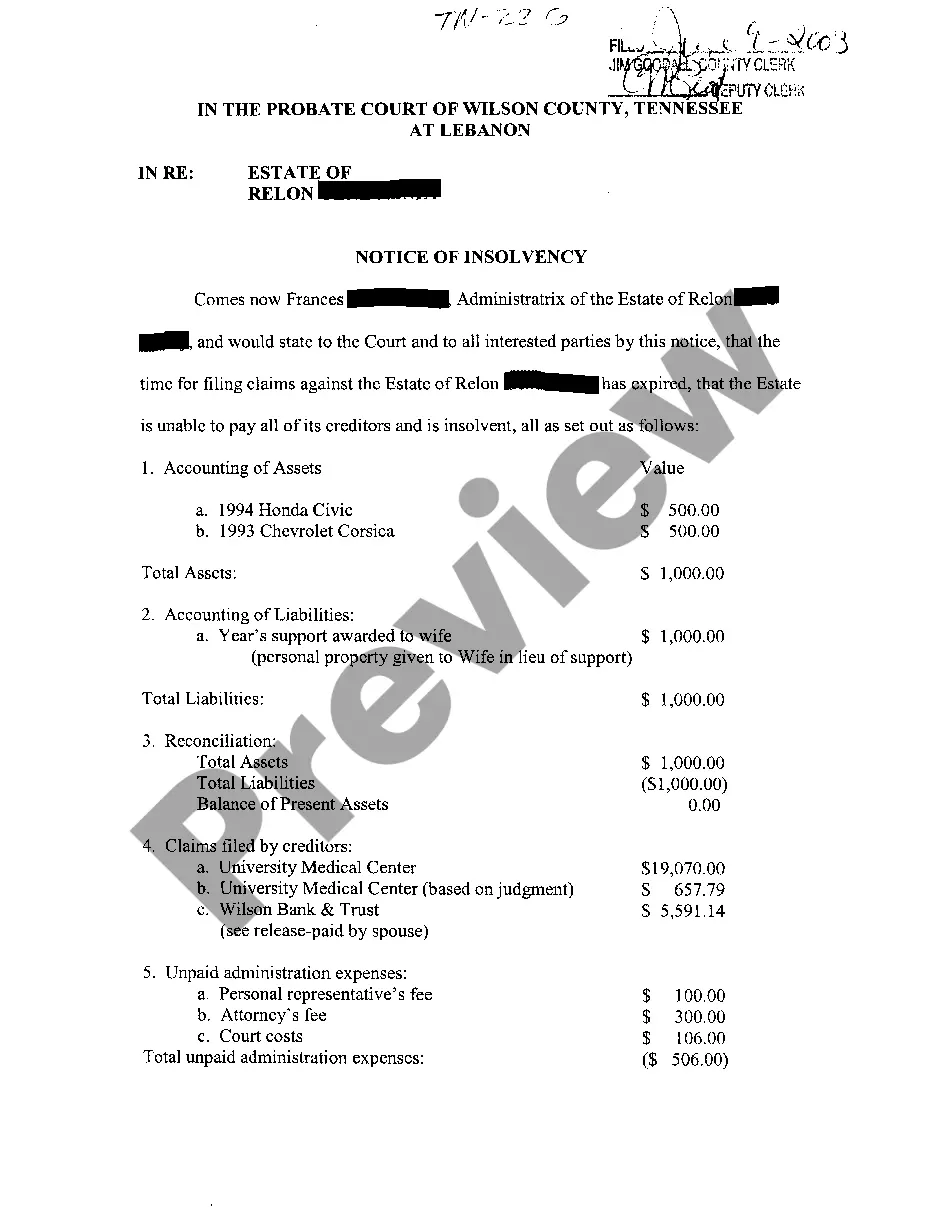

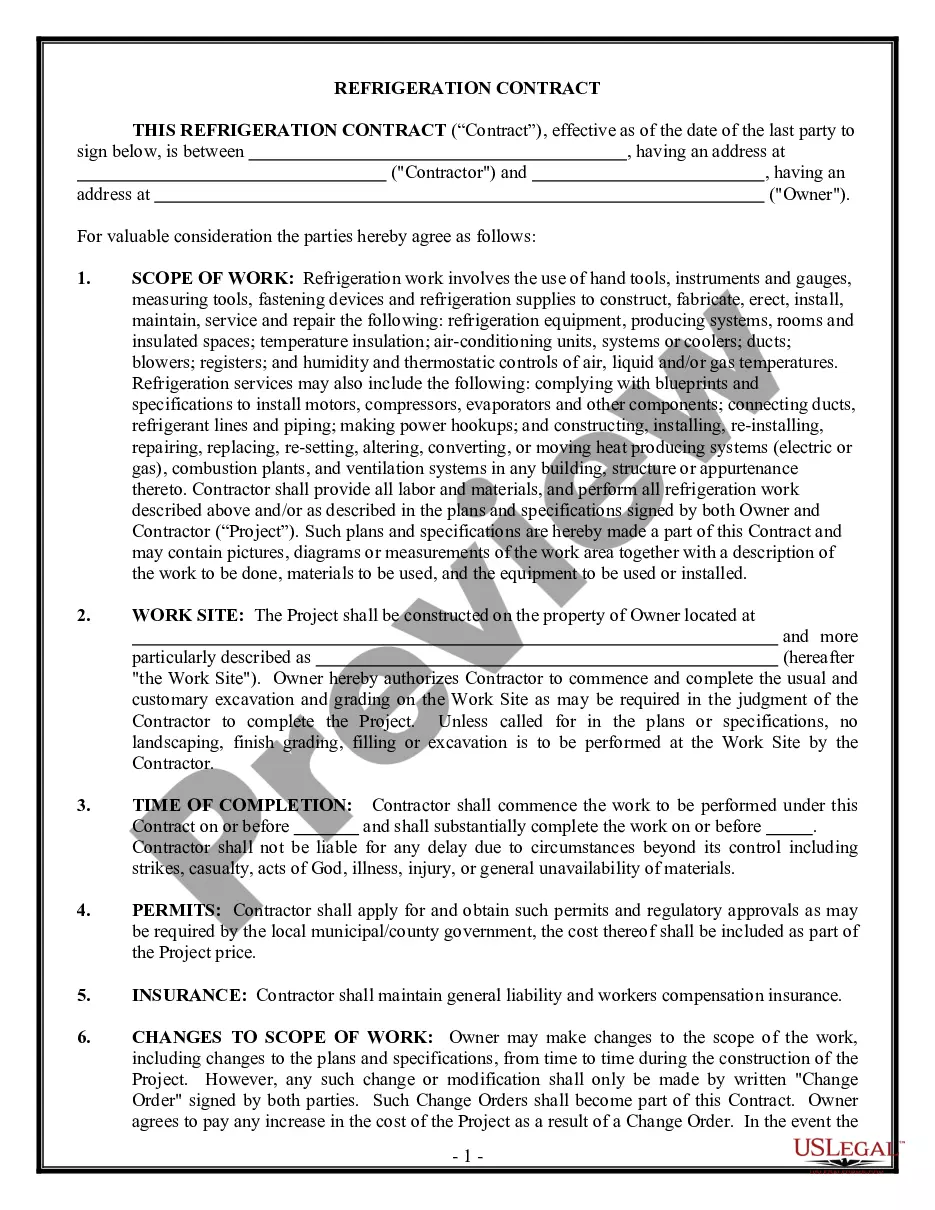

Tennessee Notice of Solvency

Description

How to fill out Tennessee Notice Of Solvency?

Get access to high quality Tennessee Notice of Solvency samples online with US Legal Forms. Prevent days of misused time seeking the internet and lost money on files that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find over 85,000 state-specific authorized and tax templates that you could download and submit in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Find out if the Tennessee Notice of Solvency you’re considering is suitable for your state.

- Look at the form making use of the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by credit card or PayPal to finish making an account.

- Choose a preferred file format to download the file (.pdf or .docx).

You can now open the Tennessee Notice of Solvency example and fill it out online or print it out and do it by hand. Consider giving the document to your legal counsel to ensure all things are filled out appropriately. If you make a mistake, print and fill application again (once you’ve made an account all documents you save is reusable). Make your US Legal Forms account now and get more templates.

Form popularity

FAQ

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Tennessee, however, has no statutory time limit for when an executor must submit the will for probate. There is no penalty for not probating a will. That means if the will is never submitted to probate, the assets remain in the decedent's name so long as the estate continues to pay the required taxes.

First things first: At death, your assets become your estate. The process of dividing up debt after your death is called probate. The length of time creditors have to make a claim against the estate depends on where you live. It can range anywhere from three months to nine months.

Probate is a legal process that is often required in the state of Tennessee after a person's death.In terms of filing for probate, if the estate is small and has a value of $50,000 or less, a small estate affidavit can be filed 45 days after the death of the property owner.

5% on the first $20K. 4% on the next $80K. 3% on the next $150K. 2% on the next $500K.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.

In Tennessee, the longest period that a creditor ever has to file a claim against an estate is twelve months from the date of the death of the deceased. That time period may be shorter (as discussed below).

Paying off debts from the estate Well-established practice is that an executor will wait six months after the date of death to allow for any creditors to intimate their claims before making payment to beneficiaries.