North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner Assets Of A Building And Construction Business?

Are you currently in a circumstance that requires documentation for either business or personal reasons almost all the time.

There is a multitude of legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers an extensive selection of form templates, such as the North Carolina Agreement to Terminate and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, which are designed to comply with federal and state regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and finalize the purchase with your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the North Carolina Agreement to Terminate and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and ensure it matches your specific city/county.

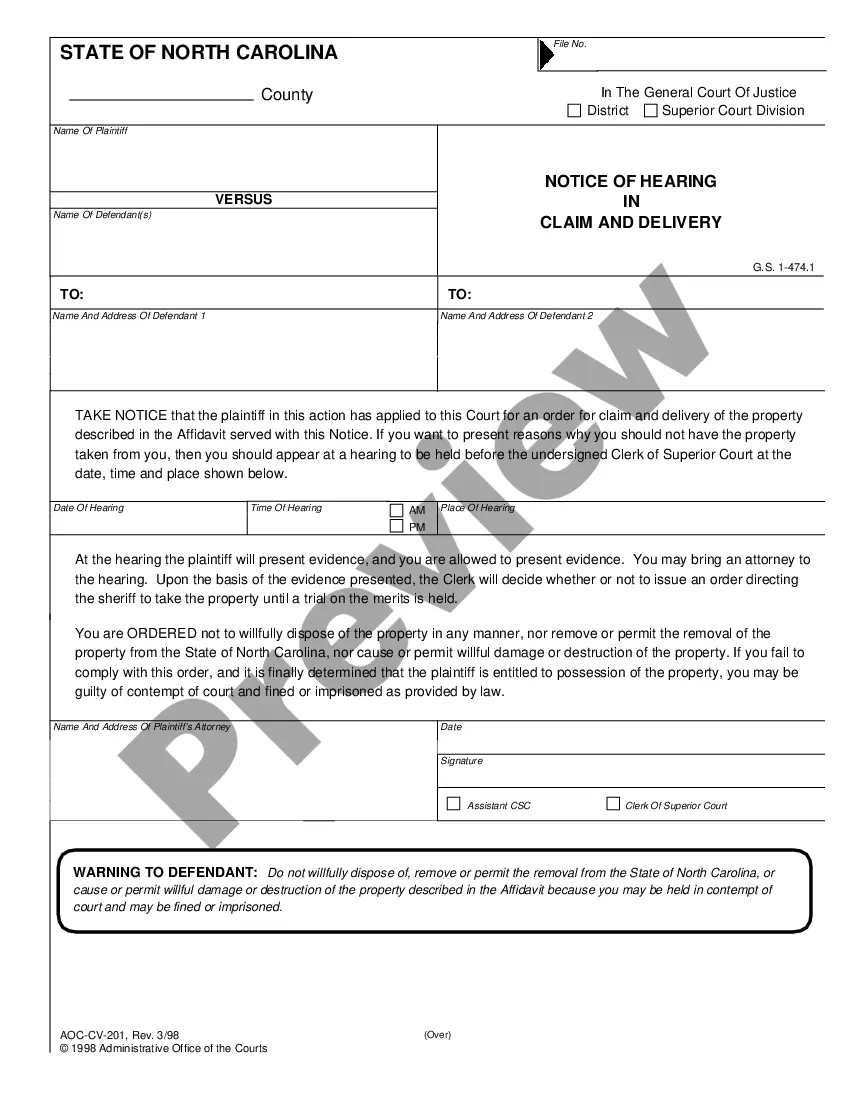

- Use the Review option to inspect the document.

- Check the details to confirm you have selected the correct form.

- If the form is not what you need, use the Search section to locate the document that fits your requirements.

- Once you find the appropriate form, click on Buy now.

Form popularity

FAQ

Walking away from a partnership without proper legal procedures can lead to serious consequences. It is important to follow the guidelines laid out in the North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business to avoid potential legal issues. Responsible dissolution can protect your interests and those of your partners, ensuring a fair and legal exit from the partnership.

The distribution of assets upon the dissolution of a partnership is guided by the partnership agreement and state laws, particularly the North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. Typically, assets are allocated based on each partner's capital contribution or as otherwise agreed upon. It is advisable to consult with legal professionals to ensure proper distribution and compliance with state regulations.

Yes, a partner has the ability to dissolve the partnership, but they should carefully consider the terms set out in the North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. This agreement can provide clarity on the process and help address any concerns regarding the distribution of assets or other obligations. Communication and collaboration with other partners can make this process more manageable.

Generally, a partner can initiate the dissolution of a partnership, but specific terms may depend on the partnership agreement. The North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business guides partners through the necessary steps and ensures compliance with state laws. Always consider discussing your intentions with your partners before proceeding.

Yes, a partner can dissolve the partnership at any time, but it is crucial to follow the procedures outlined in the North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business. This agreement will help ensure that the dissolution process is smooth and legally sound. Consulting with legal professionals and understanding your rights and obligations is essential during this process.

The procedure to dissolve a partnership firm requires careful planning and execution. Initially, partners should reach a consensus and discuss their wishes openly. Subsequently, drafting a North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business lays the groundwork for resolving obligations and distributing remaining assets amicably.

Dissolving a partnership involves several crucial steps to ensure compliance and fairness among partners. First, partners should notify all stakeholders and creditors of the dissolution intention. After that, they can work on a North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, which dictates how to handle asset liquidation and debt settlement.

If one partner wants to leave the partnership, it can significantly impact the business's operations. The partnership agreement typically provides a framework for this scenario, including details on how to value the departing partner's share. In such cases, a North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business can help facilitate the process and ensure a smooth transition.

To dissolve a partnership in North Carolina, partners must follow a few essential steps. They should first review their partnership agreement for any specific provisions regarding dissolution. Next, partners can draft a North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business, which outlines the terms for asset division and settling debts.

If your business partner is not interested in selling, it is important to understand their perspective and explore potential compromises. Engaging in open discussions can lead to alternative solutions, such as a partial sale or restructuring. Should negotiations become challenging, consider a North Carolina Agreement to Dissolve and Wind Up Partnership with Sale to Partner Assets of a Building and Construction Business as a strategic path forward. This document can serve to clarify the exit strategy and protect your interests.