North Carolina Software Maintenance Agreement

Description

How to fill out Software Maintenance Agreement?

You can dedicate hours online looking for the valid document template that meets the local and federal criteria you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You are able to download or create the North Carolina Software Maintenance Agreement through our service.

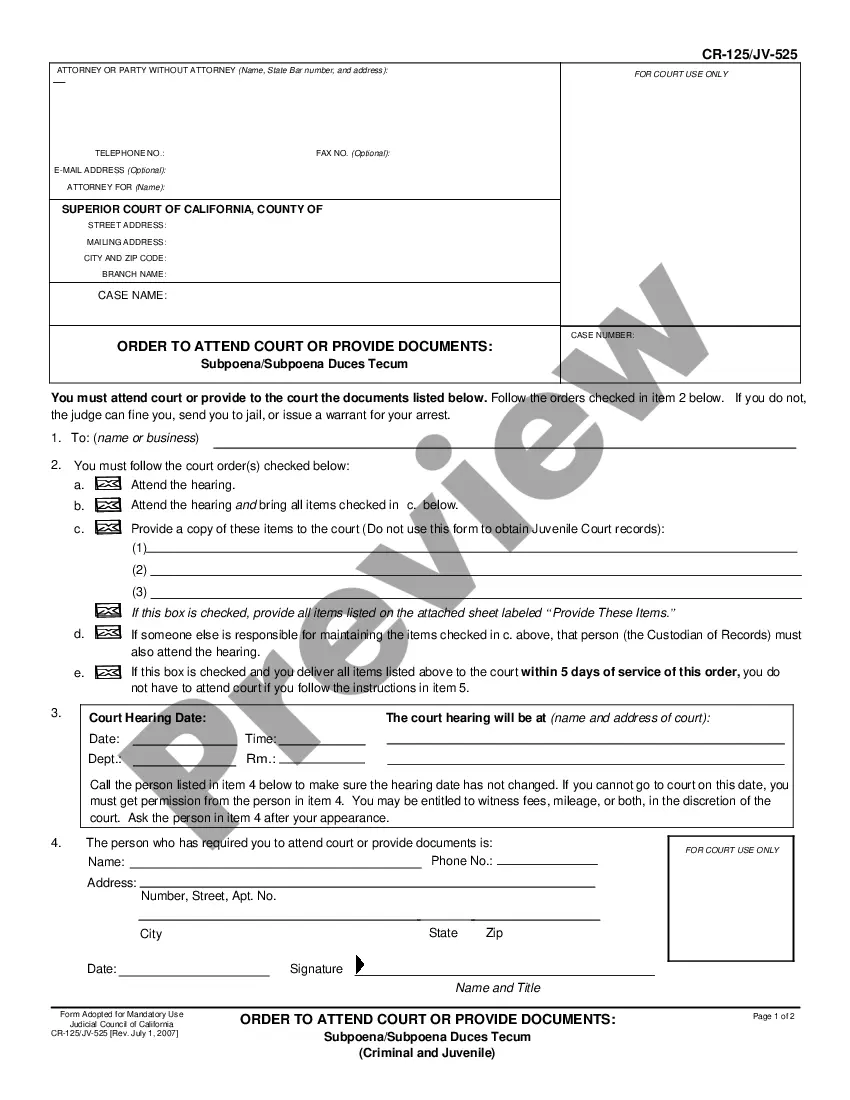

If available, utilize the Preview button to browse through the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the North Carolina Software Maintenance Agreement.

- Every legal document template you purchase is yours to keep forever.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions provided below.

- First, ensure you have selected the correct document template for your chosen region/city.

- Check the form outline to confirm you have picked the right form.

Form popularity

FAQ

The sales price of or the gross receipts derived from a service contract sold at retail is subject to the general 4.75% State, applicable local (2.00% or 2.25%), and applicable transit (0.50%) rates of sales and use tax. Service contracts are taxed in accordance with N.C. Gen. Stat. § 105-164.4I.

Software maintenance is the process of changing, modifying, and updating software to keep up with customer needs. Software maintenance is done after the product has launched for several reasons including improving the software overall, correcting issues or bugs, to boost performance, and more.

The North Carolina Department of Revenue issued a private letter ruling, concluding that subscription fees for a Software as a Service (SaaS) product are non-taxable.

Effective March 1, 2016, N.C. imposes a sales tax on repair, maintenance, and installation services. Optional computer software maintenance contracts with respect to prewritten software that only provide support services that meet the definition of repair, maintenance, and installation services are fully taxable,

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

Prescription Medicine, groceries, and gasoline are all tax-exempt. Some services in North Carolina are subject to sales tax.

A service maintenance contract is a legal agreement between a company and a maintenance service provider. It specifies the terms and conditions of the agreement between the two parties.

AMC is a maintenance contract or an insurance policy for your technological advancement. It is a software update service for which your company has to pay annually, to the software provider.

Maintenance agreements provide routine maintenance, access to emergency repairs, and constant upgrades to software and your system's hardware. More importantly, the agreement make you a priority and allows you to build a relationship with your maintenance provider.

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.