North Carolina Loan Commitment Agreement

Description

How to fill out Loan Commitment Agreement?

Choosing the right authorized file template can be quite a have difficulties. Of course, there are a lot of layouts available on the Internet, but how would you discover the authorized form you require? Take advantage of the US Legal Forms web site. The service delivers a huge number of layouts, such as the North Carolina Loan Commitment Agreement, that can be used for organization and personal demands. All the forms are checked by pros and meet state and federal requirements.

When you are currently listed, log in to your bank account and click on the Down load option to have the North Carolina Loan Commitment Agreement. Utilize your bank account to look through the authorized forms you have ordered formerly. Check out the My Forms tab of your respective bank account and get one more copy from the file you require.

When you are a new end user of US Legal Forms, listed below are easy instructions that you should follow:

- Initially, be sure you have chosen the correct form for the town/county. You may look through the form utilizing the Review option and look at the form outline to make sure it is the best for you.

- If the form is not going to meet your preferences, utilize the Seach industry to obtain the right form.

- When you are certain that the form is suitable, click on the Get now option to have the form.

- Choose the costs program you need and type in the needed information and facts. Make your bank account and pay money for the order making use of your PayPal bank account or bank card.

- Select the file formatting and download the authorized file template to your device.

- Total, revise and print out and sign the attained North Carolina Loan Commitment Agreement.

US Legal Forms will be the largest collection of authorized forms where you can find a variety of file layouts. Take advantage of the service to download appropriately-created documents that follow status requirements.

Form popularity

FAQ

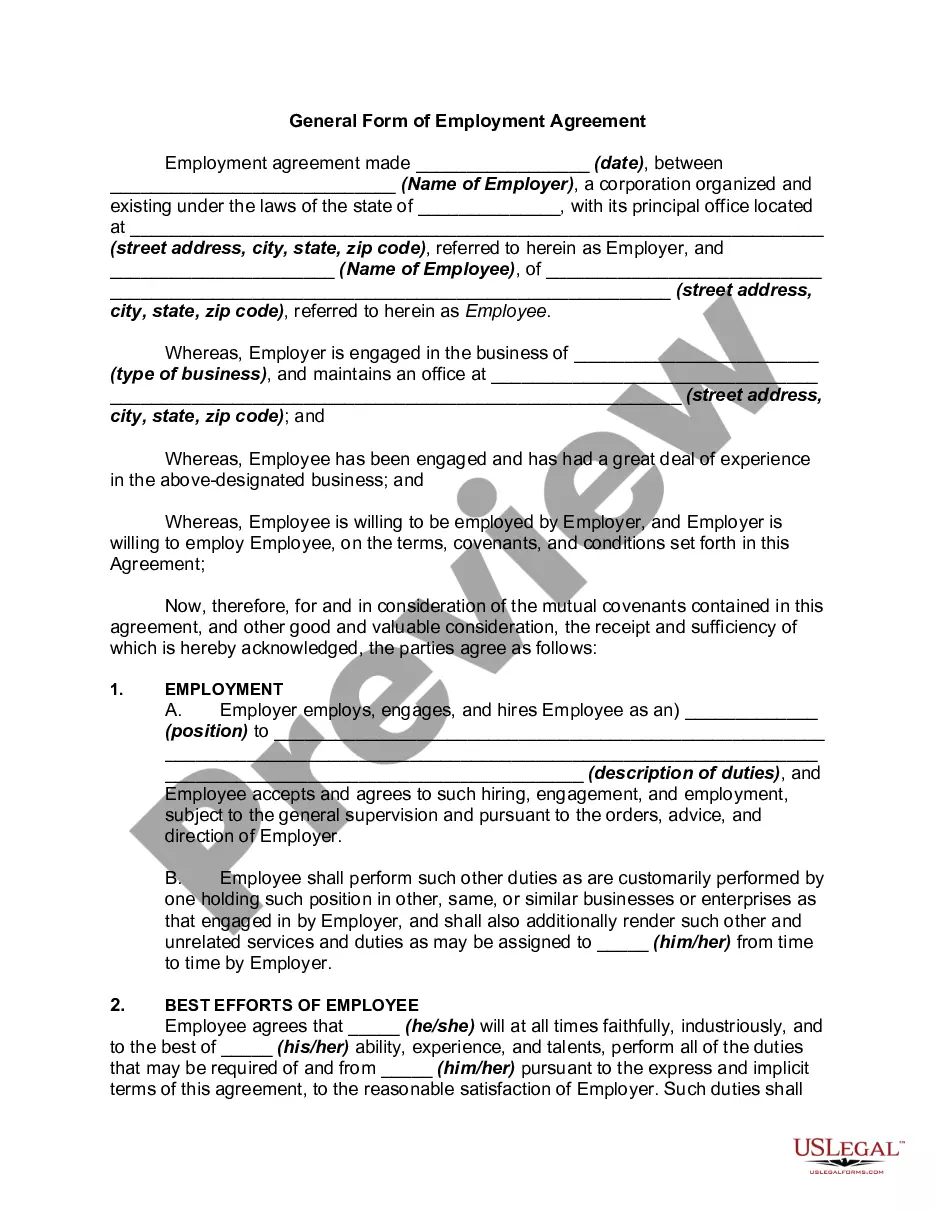

The qualification of the loan is dependent on the borrower's income and credit history. A loan commitment is when a financial institution makes an agreement to lend a certain amount of cash to an individual or business.

A loan commitment is a letter from a lender indicating your eligibility for a home loan. In essence, it is the lender's promise to fund the loan as stated by the terms in the letter. You receive a loan commitment letter once your application has been reviewed and the underwriting process is complete.

The offer and acceptance form the agreement between the parties. The offer must be communicated, it must be complete and the offer must be accepted in its exact terms. Mutuality of agreement is a must. The parties to a contract must agree to the same thing inn the same sense.

Loan commitments increase a bank's risk by obligating it to issue future loans under terms that it might otherwise refuse. However, moral hazard and adverse selection problems potentially may result in these contracts being rationed or sorted.

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money. A loan commitment is useful for consumers looking to buy a home or a business planning to make a major purchase.

A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

Does A Loan Commitment Letter Mean I'm Approved? After you're preapproved, you'll receive a conditional mortgage commitment letter. That does not mean you're approved for the loan. With this conditional approval, you'll still have steps to take in the mortgage application process.

The agreement's contents include loan type, parties involved, expiration date, loan amount, terms and conditions, cancellation policy, interest rate, and others. The six types involve revolving, non-revolving, secured, unsecured, conditional, and standby commitments.