North Carolina Worksheet - Self-Assessment

Description

How to fill out Worksheet - Self-Assessment?

If you need to total, download, or print approved document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and convenient search to find the documents you need.

Many templates for commercial and personal use are categorized by types and categories, or keywords.

Step 4. Once you have found the form you want, click the Buy Now button. Choose the pricing plan you prefer and provide your information to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the North Carolina Worksheet - Self-Assessment in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the North Carolina Worksheet - Self-Assessment.

- You can also find forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have chosen the form for the appropriate city/state.

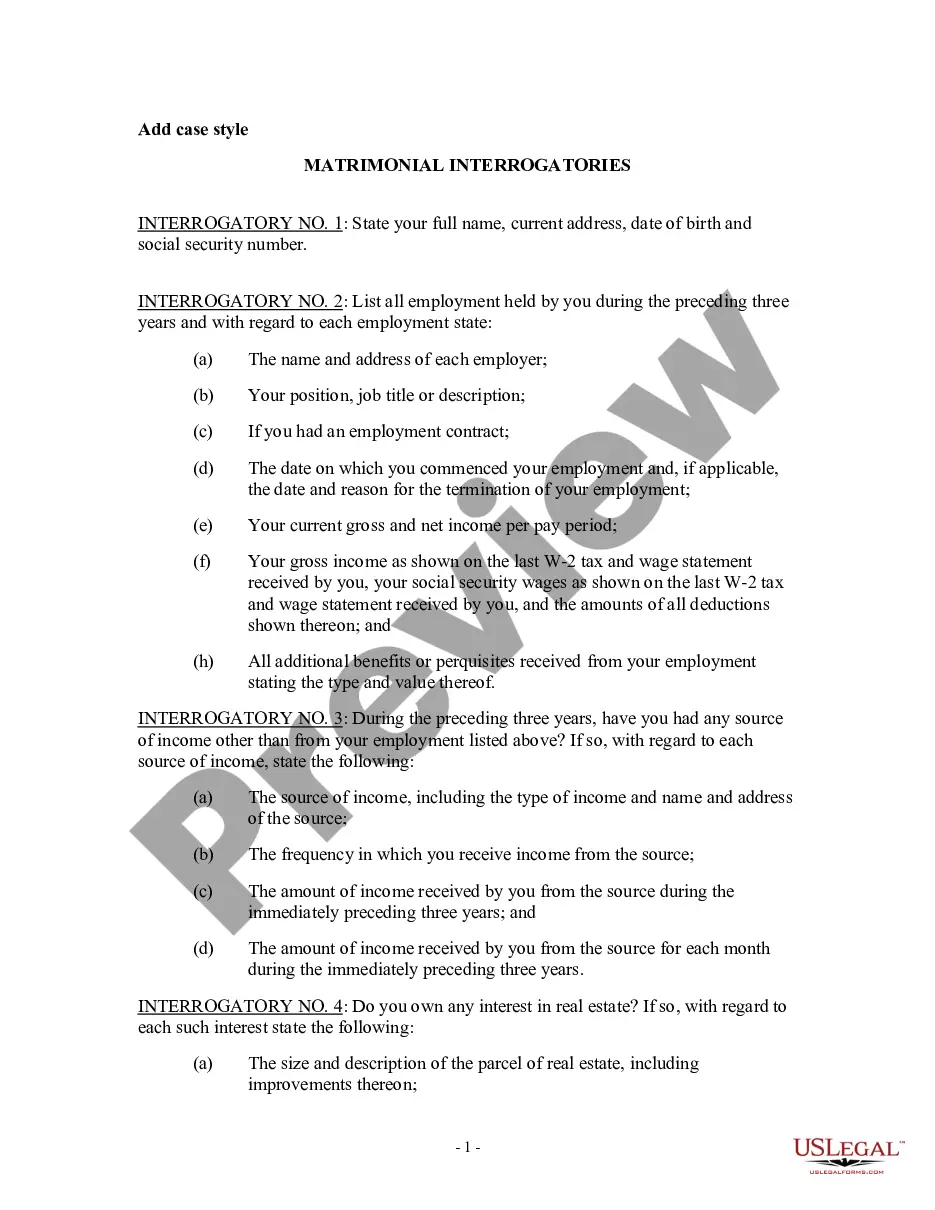

- Step 2. Use the Review function to examine the contents of the form. Do not forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the page to find alternative versions of the legal form format.

Form popularity

FAQ

Self-employed individuals in North Carolina typically use Schedule C to report their income and expenses, alongside the D40 form for filing state taxes. Additionally, self-employed individuals must also account for self-employment taxes using the IRS Form SE. For better understanding and organization of these forms, consider leveraging the North Carolina Worksheet - Self-Assessment available on the US Legal Forms platform.

assessment worksheet is a tool that helps taxpayers evaluate their financial situation for tax reporting purposes. It typically includes sections for income, deductions, and credits that help in preparing tax forms accurately. Using a North Carolina Worksheet SelfAssessment can greatly simplify the filing process by organizing your relevant financial information.