North Carolina Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

Selecting the appropriate authentic document template can be somewhat of a challenge.

Surely, there is a multitude of templates accessible online, but how do you find the authentic type you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the North Carolina Equipment Lease Checklist, which you can use for business and personal needs.

You can browse the form using the Preview button and review the form description to ensure it is suitable for you.

- All the forms are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the North Carolina Equipment Lease Checklist.

- Use your account to search through the authentic forms you have previously ordered.

- Check the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your area/state.

Form popularity

FAQ

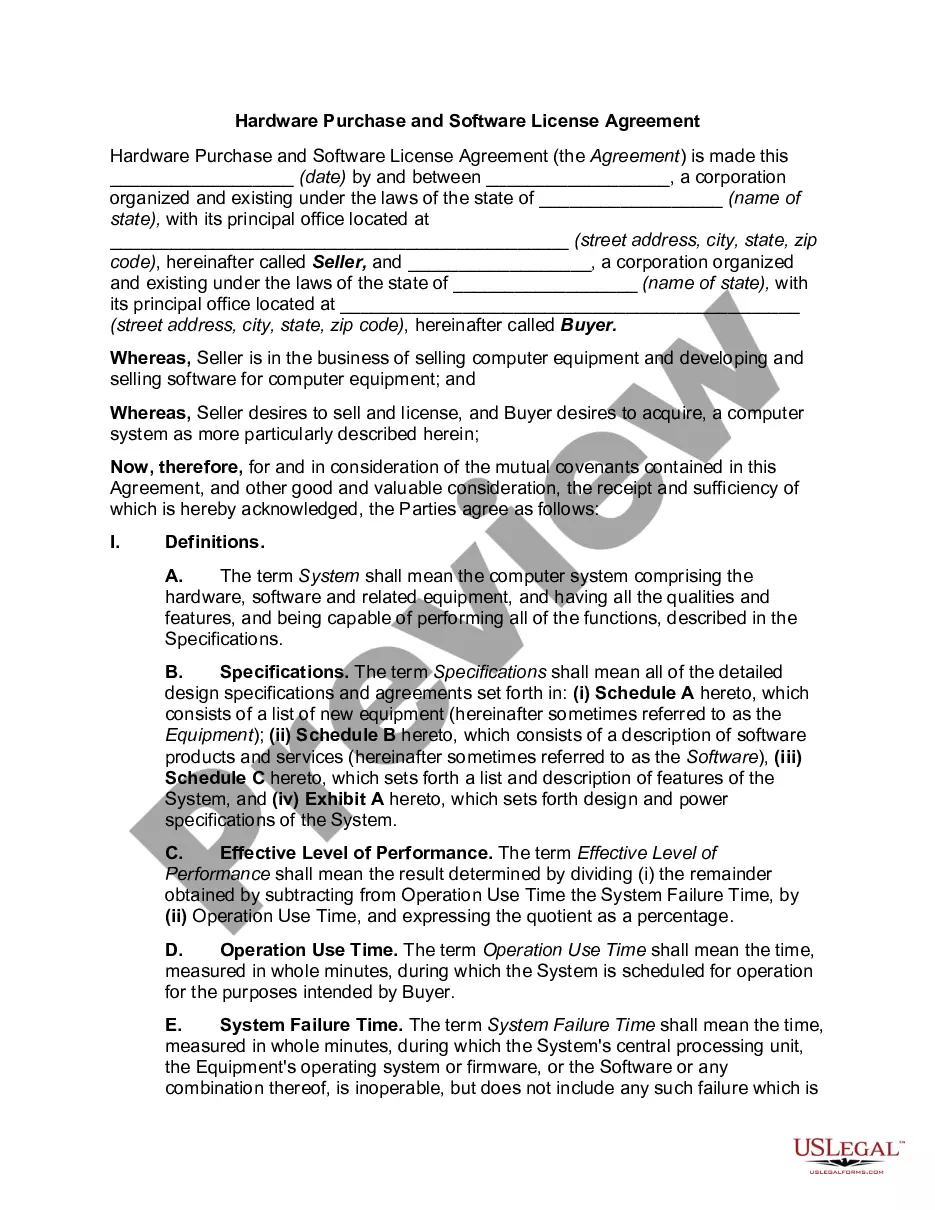

Leased equipment is recorded as an asset on your balance sheet, reflecting the value of the equipment based on the lease agreement. Depending on the type of lease, it may also require recognizing a liability for future lease payments. Using the North Carolina Equipment Lease Checklist can help ensure you record everything accurately in your financial statements.

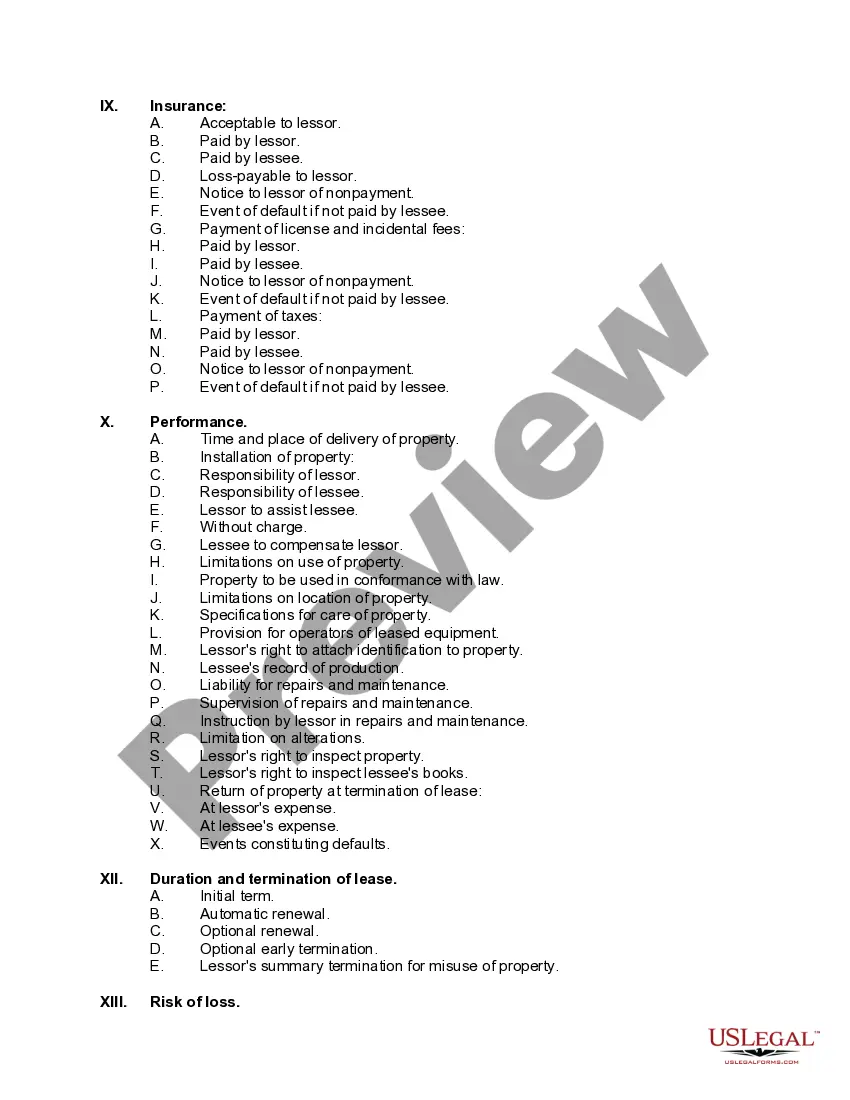

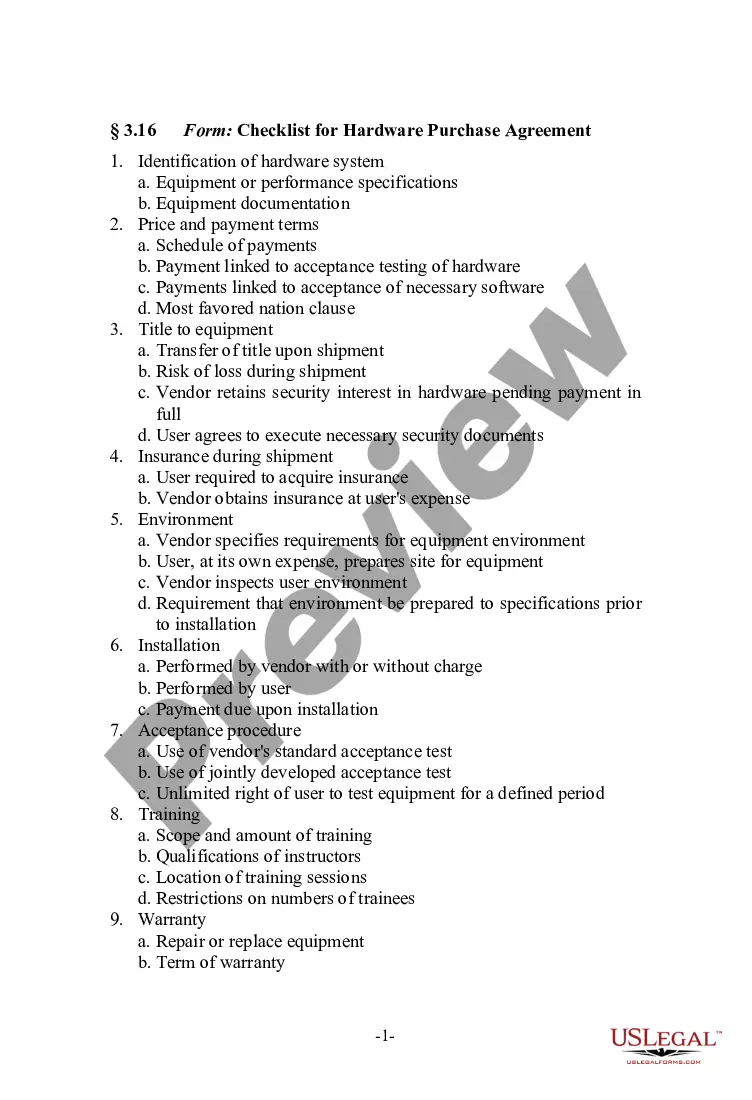

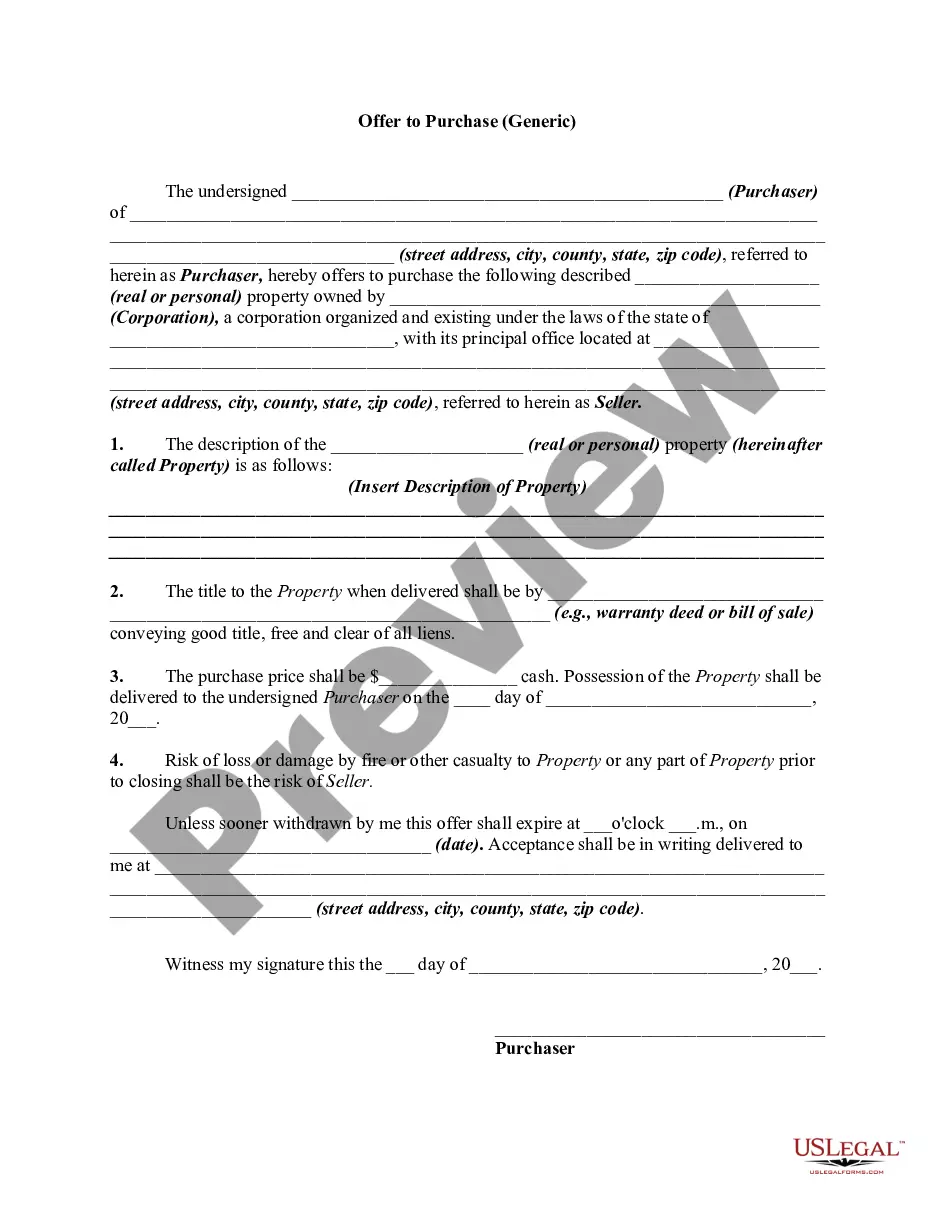

To make an equipment rental agreement, outline the rental terms, equipment details, payment schedule, and liabilities. Ensure both parties agree to the responsibilities involved with the equipment's use and return. The North Carolina Equipment Lease Checklist is a valuable tool for ensuring your agreement is thorough and compliant.

Yes, you can create your own lease agreement, but it’s important to ensure it meets legal requirements. Use templates and guidelines from resources like the North Carolina Equipment Lease Checklist to cover all necessary points. A well-drafted agreement minimizes misunderstandings and protects your rights.

An agreement to lease equipment is a legally binding document that outlines the terms of the lease, including payment amounts, duration, and responsibilities of both parties. This agreement protects your interests and provides clarity which is vital for a smooth leasing process. Referencing the North Carolina Equipment Lease Checklist can help you create a comprehensive agreement.

To set up an equipment lease in QuickBooks, start by creating a new account for the leased equipment under your fixed asset category. Then, enter the lease details, including payment schedule and interest rates, using the North Carolina Equipment Lease Checklist to ensure all elements are accounted for. This process helps you maintain accurate financial records.

To set up an equipment lease, you need to draft a clear lease agreement that outlines the terms, duration, and payment structure. Begin by identifying the equipment you want to lease and determine its fair market value. Additionally, it’s essential to consult the North Carolina Equipment Lease Checklist to ensure compliance with state regulations and best practices.

A good equipment lease rate typically ranges from 4% to 10% of the equipment's value, depending on various factors such as credit score and equipment type. It's important to compare rates before committing. Referencing the North Carolina Equipment Lease Checklist equips you with the knowledge to negotiate favorable terms.

Leased equipment can be considered an asset depending on its classification under ASC 842. If categorized as a finance lease, it appears on the balance sheet as both an asset and a liability. This distinction is critical for financial reporting. For more information, the North Carolina Equipment Lease Checklist explains asset classification in detail.

Setting up an equipment lease involves several steps, including defining the terms, choosing the right equipment, and negotiating payment schedules. Clear communication with the leasing company is essential to outline responsibilities and obligations. For a smoother process, use our North Carolina Equipment Lease Checklist to cover all bases effectively.

Yes, ASC 842 applies specifically to equipment leases. This standard mandates that most leases be included on financial statements, altering how companies report their financial health. Understanding these implications is crucial for compliance. The North Carolina Equipment Lease Checklist provides insights into adapting your accounting practices.