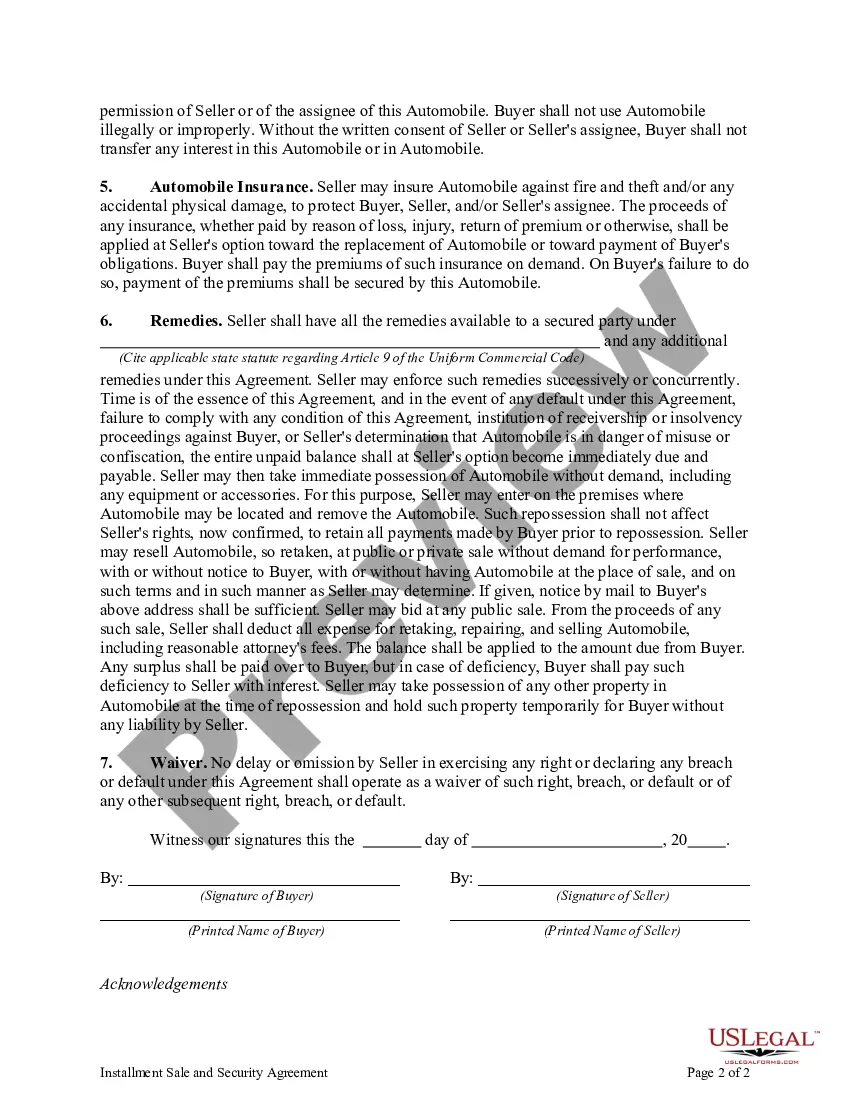

North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another

Description

How to fill out Installment Sale And Security Agreement Regarding Sale Of Automobile From One Individual To Another?

Are you presently in a location where you require documents for potential business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers a vast array of form templates, including the North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Person to Another, designed to meet state and federal regulations.

Once you find the right form, click Get now.

Select the pricing plan you prefer, fill out the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Person to Another template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to your appropriate area/state.

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, utilize the Search field to locate the form that fits your needs and requirements.

Form popularity

FAQ

Yes, in North Carolina, both parties must be present to have a title notarized. This requirement ensures that both the buyer and seller agree to the terms laid out in agreements such as the North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another. This process protects both parties from potential disputes and confirms that the transaction is valid.

When buying a car from a private seller in North Carolina, you will need several important documents. First, ensure you have the vehicle's title, signed by the seller to transfer ownership. You will also need a Bill of Sale, which can encapsulate the terms of the North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another. Additionally, keep a copy of the seller's driver's license for identity verification.

The standard for installment sales generally requires transparent communication about the terms, including payment amounts, due dates, and any penalties for late payments. Furthermore, the agreement must abide by state and federal laws to be enforceable. When creating a North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, adhering to these standards ensures a smooth transaction for all parties involved.

In an installment sale, the seller typically retains ownership of the automobile until all payments are completed. Once the buyer fulfills their payment obligations, ownership transfers to them. Specifying these terms in your North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another helps clarify ownership rights and expectations throughout the transaction.

The Retail Installment Sales Act in North Carolina regulates installment sales transactions, ensuring fair practices for both buyers and sellers. It mandates clear disclosures about terms, payments, and the buyer's rights. When drafting a North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, compliance with this Act is essential to safeguard all parties involved.

The IRS allows for installment sales under Section 453 of the Internal Revenue Code. This provision permits sellers to report gains as they receive payments over time, rather than all at once. Understanding how this applies to your North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another can help you manage tax obligations more effectively.

An installment sale may be disqualified if the terms do not comply with state laws, such as failing to provide a clear payment schedule or not addressing potential default scenarios. Additionally, if the agreement does not properly reflect the intention of both parties or includes misleading information, it can be deemed unenforceable. Ensuring your North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another adheres to legal standards is essential.

Selling your car privately to a friend involves discussing the sale terms and ensuring both parties agree. It’s wise to draft a North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another if you plan to set up installment payments. Ensure both of you handle the necessary paperwork, including the title transfer and bill of sale, for a smooth transaction. Maintaining good communication with your friend throughout the process helps avoid misunderstandings.

To report an installment sale in North Carolina, both parties must maintain accurate financial records, including the terms outlined in the installment sale agreement. You should report the income generated from the sale on your tax return. It’s important to use a North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another to ensure compliance with tax regulations. Keeping thorough records can help facilitate accurate reporting.

When selling a car privately in North Carolina, you need the vehicle title, a bill of sale, and a completed Odometer Disclosure Statement. This paperwork will ensure a legal transfer of ownership. Additionally, if you are using an installment sale option, a North Carolina Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another is essential for outlining payment terms. Accurate documentation will protect both parties involved.