North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

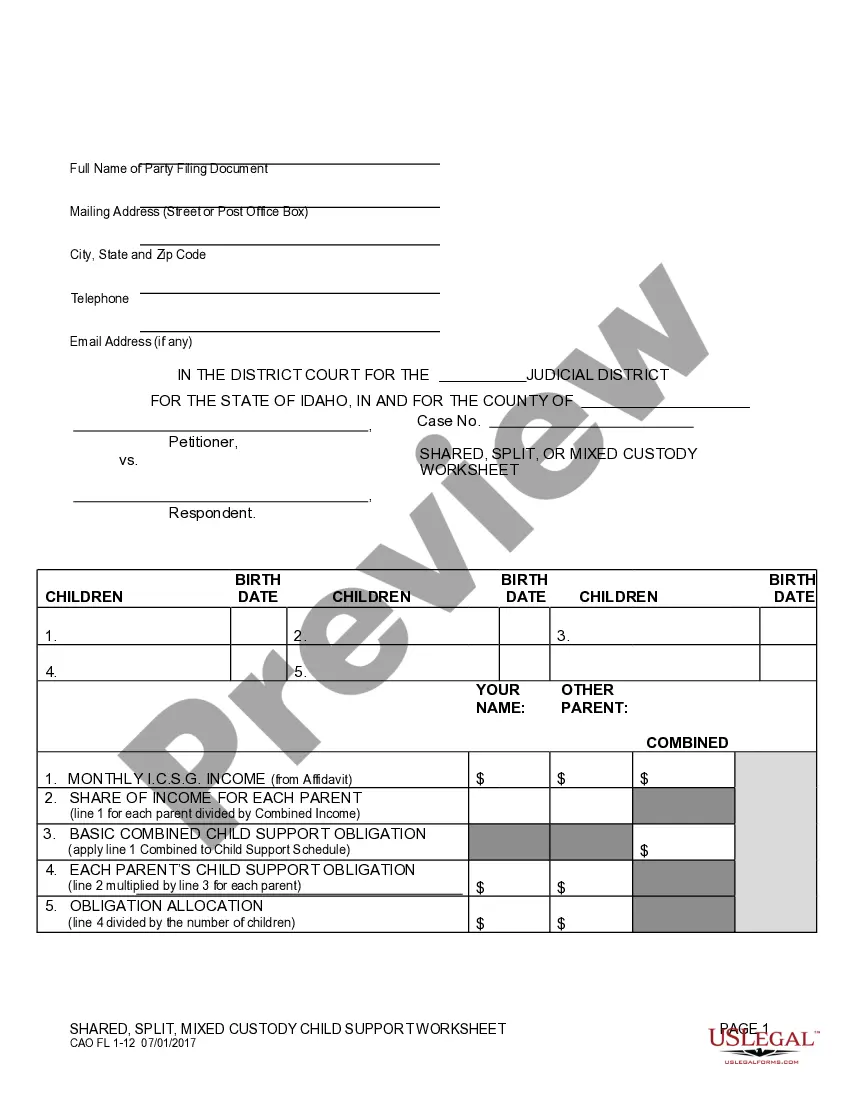

How to fill out Contract For The Sale Of Motor Vehicle - Owner Financed With Provisions For Note And Security Agreement?

If you require to complete, acquire, or print legitimate document templates, utilize US Legal Forms, the largest selection of authentic forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the paperwork you need.

Various templates for business and personal purposes are organized by categories and claims, or keywords.

Step 4. After finding the form you require, click the Buy now button. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s details. Don’t forget to read the information.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

In a seller financing arrangement, the seller typically retains the title until the buyer fulfills all payment obligations. This title retention is a protective measure for the seller, securing their interest in the vehicle. Once the buyer completes the payment terms, the seller will transfer the title to the buyer. A North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement clearly outlines these terms for both parties.

Interest rates on seller financing vary; however, they generally range from 5% to 10%. Factors that can affect the interest rate include the buyer's creditworthiness and the prevailing market rates. Both parties should agree on a reasonable rate that reflects current conditions. When drafting the terms, utilize a North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement to ensure clarity and compliance.

To write a contract for selling a car with payments, you should specify the total sale amount, the payment schedule, and the interest rate if applicable. Include the terms regarding the vehicle's title transfer upon full payment, and state the consequences of missed payments. This type of contract should clearly outline both parties' rights and responsibilities. For a well-rounded approach, consider using the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement offered by USLegalForms to ensure all legal requirements are met.

To transfer ownership of a car in Washington state, both the seller and buyer need to complete the Vehicle Certificate of Title and sign it. The seller should provide the title to the buyer, while also submitting a Report of Sale to the Department of Licensing. It is crucial to settle any remaining payments if the car is under financing. Using a structured agreement such as the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement can clarify ownership and payment details.

In owner financing agreements, the seller retains the deed or title of the vehicle until the buyer completes all payments per the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. This arrangement provides security for the seller while allowing the buyer to use the vehicle. Understanding who holds the deed is crucial for both parties in the transaction.

To sell a car with owner financing, first, you need to create a clear agreement that outlines payment terms, interest rates, and other essential details. Utilize the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement to ensure everything is legally sound. Once you have your documentation, promote your vehicle emphasizing the owner financing option to attract potential buyers seeking flexible payment solutions.

In owner financing arrangements, the seller typically holds the deed until the buyer fulfills payment obligations under the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. This arrangement protects the seller's interest in the vehicle until the transaction is fully completed. It’s important to clarify this in your agreement to avoid confusion.

In seller financing, the seller retains ownership of the title or deed until the buyer completes all payments detailed in the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. This means that while the buyer can use the vehicle, the legal ownership remains with the seller. Once the buyer fulfills the payment obligations, the seller transfers the title to the buyer.

If the buyer defaults on the owner financing agreement under the North Carolina Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, the seller has specific rights. The seller can initiate a repossession process for the vehicle, reclaiming ownership. Additionally, the seller may also be entitled to keep any payments made before the default, depending on the terms outlined in the agreement.