North Carolina Employee Information Form

Description

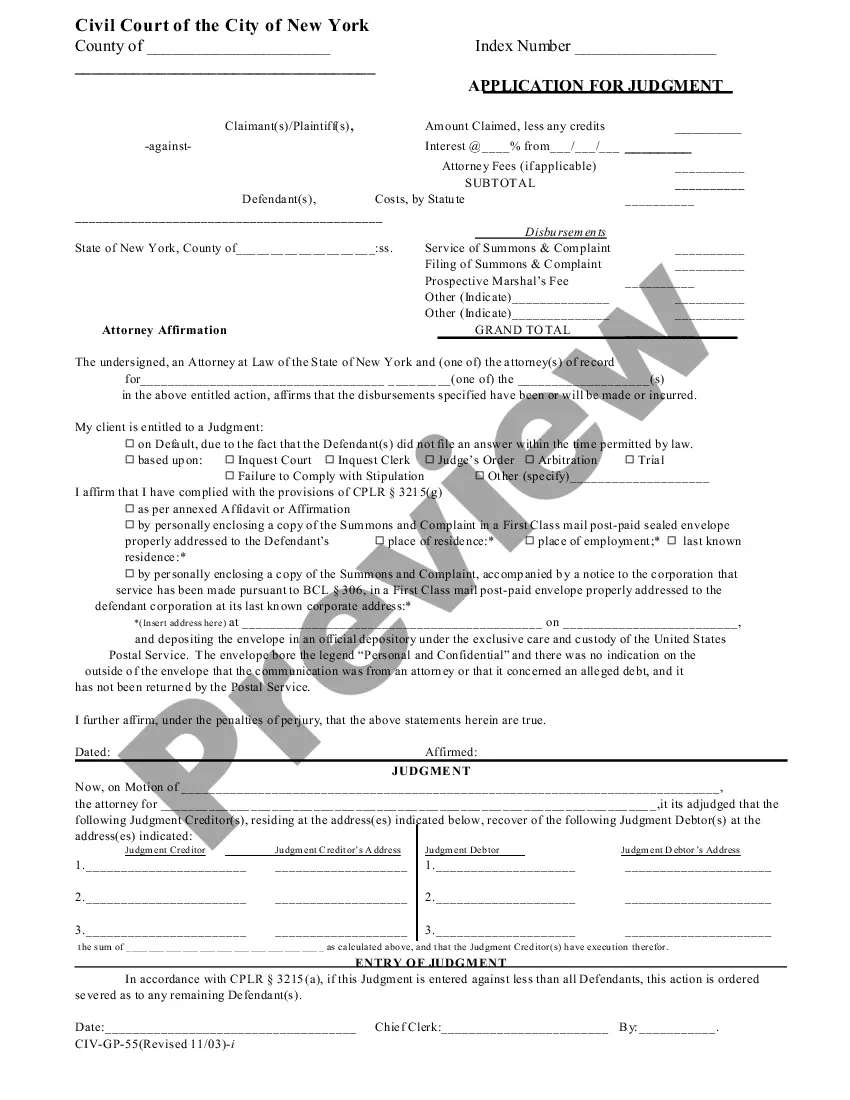

How to fill out Employee Information Form?

You can spend time on the internet attempting to locate the legal document template that complies with the federal and state requirements you will require.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

It is easy to download or print the North Carolina Employee Information Form from my services.

If available, utilize the Review option to check the document template as well. If you wish to locate another version of the form, use the Search field to find the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you are able to Log In and click the Download option.

- Then, you can complete, modify, print, or sign the North Carolina Employee Information Form.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any acquired form, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the jurisdiction/area of your choice.

- Review the form description to confirm you have chosen the correct template.

Form popularity

FAQ

When beginning a new job, an employee must complete several forms, including the North Carolina Employee Information Form, a W-4 for tax withholding, and an I-9 form for verifying work eligibility. These documents help the employer manage payroll accurately and comply with employment laws. Providing access to resources, like those offered by USLegalForms, can assist employees in completing these forms accurately and efficiently.

Every new employee must complete the North Carolina Employee Information Form as part of their onboarding process. This form provides vital information necessary for tax and payroll purposes, making it a legal requirement. Ensure new hires understand the importance of this form, as accurate information is crucial for a successful employment relationship.

To create an effective employee information form, start by identifying the essential information you need to collect, such as personal and tax details. Utilize templates or tools available on platforms like USLegalForms, which can guide you in developing a compliant and user-friendly form. Tailor the North Carolina Employee Information Form to meet your organization’s unique needs while ensuring it meets legal requirements.

New employees typically need to complete several forms, including the North Carolina Employee Information Form, tax withholding forms, and an I-9 for employment eligibility. These documents gather crucial information for payroll processing and compliance with federal and state laws. Providing clear instructions and resources helps new hires complete this paperwork accurately, ensuring a smooth start to their employment.

An employee information form is a document that collects essential details from employees when they start a job. This form typically includes personal information such as name, address, Social Security number, and emergency contact details. In North Carolina, accurate completion of the Employee Information Form is vital for compliance with state employment regulations. Ensuring this form is filled out correctly helps streamline the onboarding process.

Filling out an employee information form involves entering your name, address, and contact details at the top. Then, carefully provide employment specifics such as job title, department, and Social Security number. Be diligent when including information for taxation, like W-4 or NC-4 details. Using a North Carolina Employee Information Form can guide you through this essential process.

For new employees in North Carolina, several forms are necessary, including the W-4 for tax withholding and the NC-4 for state tax purposes. Employers may also require an I-9 form to verify identity and work eligibility. Furthermore, having a North Carolina Employee Information Form can ensure all relevant employee details are collected systematically and efficiently.

You can file the NC D 400 form with the North Carolina Department of Revenue. It’s important to ensure that your filing is completed by the specified deadline to avoid penalties. You may submit the form through traditional mail or, if applicable, utilize online submission options when available. When filing, having your North Carolina Employee Information Form handy can help ensure you include all necessary data.

Yes, North Carolina offers electronic filing options for certain forms, making it easier for both employers and employees to manage necessary documents. You can check the North Carolina Department of Revenue’s official website for details on e-filing. This feature helps in filing employment taxes and ensures that you meet state requirements efficiently. Using a North Carolina Employee Information Form can further simplify document management.

An employee information form should include critical details such as full name, address, phone number, email, and Social Security number. Additionally, it should capture employment-specific information like job title, hiring date, and tax withholding status. Including spaces for emergency contacts and direct deposit information is also beneficial. A well-structured North Carolina Employee Information Form encompasses all of these elements.