Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees

Description

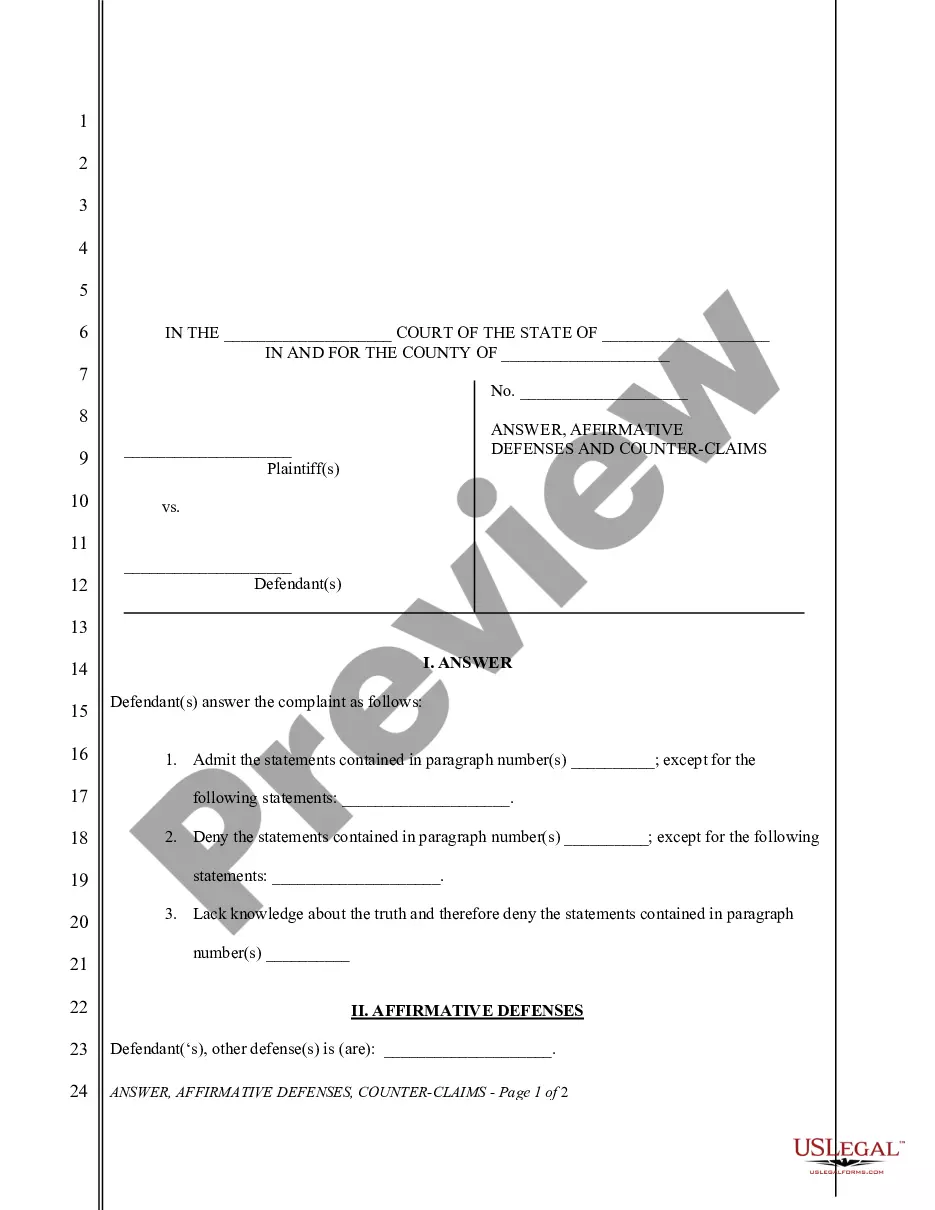

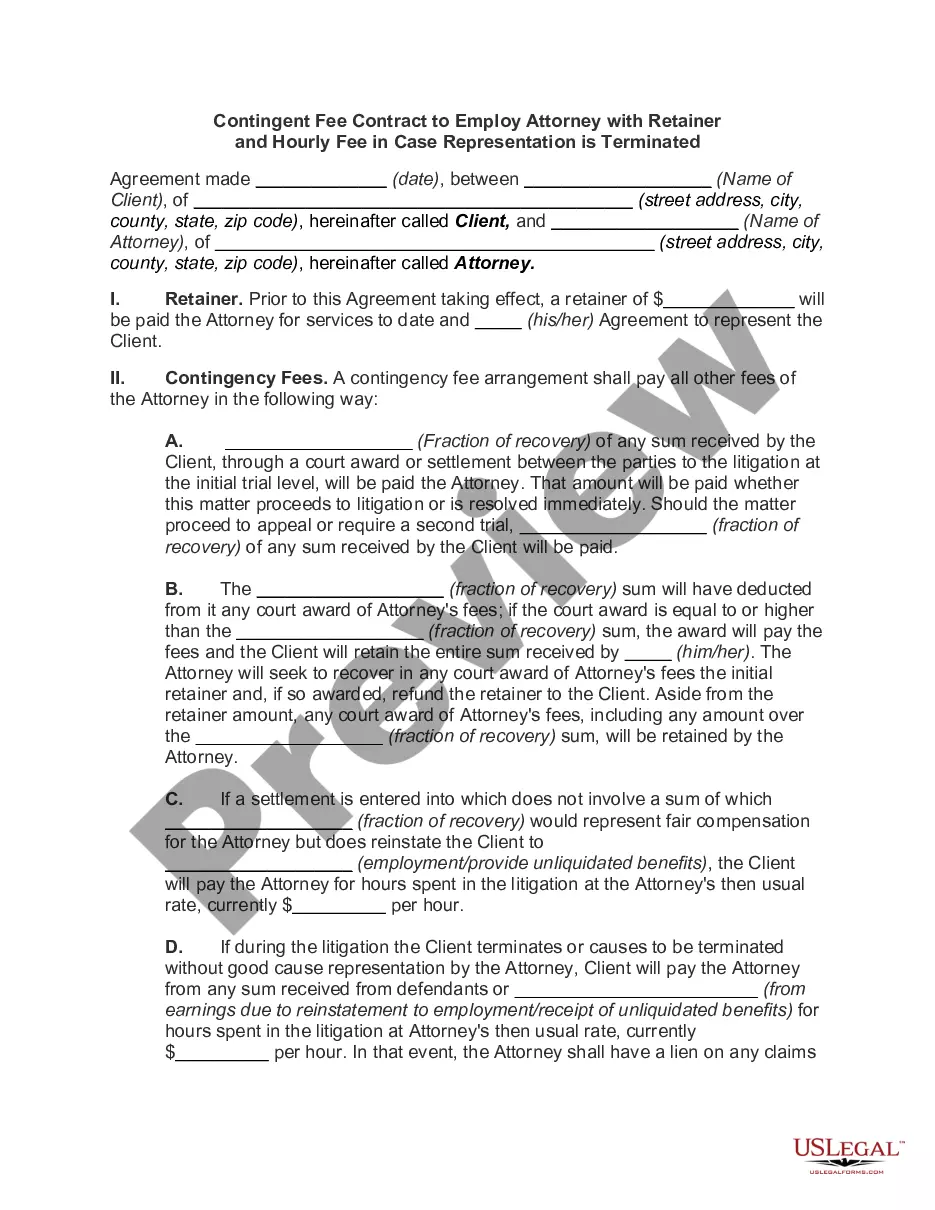

How to fill out Corporate Resolution Establishing A Self-insured Medical Payment Plan For Key Employees?

Selecting the optimal legal document format could pose a challenge. Of course, there are numerous templates accessible online, but how can you find the legal document you need.

Utilize the US Legal Forms website. The platform provides a vast selection of templates, such as the North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, which you can utilize for both business and personal needs. All the documents are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. Use your account to browse through the legal documents you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you require.

Complete, modify, print, and sign the acquired North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. US Legal Forms is the largest repository of legal documents where you can find various document templates. Use the service to download professionally crafted documents that align with state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct document for your city/state. You can review the document using the Preview button and check the document description to verify it is suitable for you.

- If the document does not suit your needs, use the Search field to find the appropriate document.

- Once you are confident the document is appropriate, click the Purchase now button to obtain the document.

- Select the payment plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or a Visa or Mastercard.

- Choose the file format and download the legal document format to your device.

Form popularity

FAQ

The legislation that governs health benefit plans for self-insured employers is primarily ERISA. It sets forth rules that ensure employers maintain certain standards for health benefits. When creating a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, speaking with an expert familiar with ERISA can help ensure compliance and optimal benefit design.

The Self-Insurance Protection Act, enacted in the 1980s, allowed large employers to self-insure employee health care benefits. This legislation was instrumental in shaping how companies manage health benefits for their workforce. To craft a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, it's crucial to grasp the implications of this act.

ERISA, or the Employee Retirement Income Security Act, primarily applies to self-funded plans, but it can also affect fully insured plans. ERISA establishes standards for private sector employee benefit plans. Therefore, understanding how ERISA interacts with a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees is essential for compliance and protection.

To determine if your plan is ACA compliant, review the benefits it offers and confirm they align with the Essential Health Benefits outlined by the ACA. When you create a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, you can consult with legal or compliance experts to assess the plan's adherence to ACA regulations. Regular audits and updates to your plan can also help ensure that it meets all necessary requirements, safeguarding your organization and employees.

Yes, the Affordable Care Act (ACA) does apply to self-funded plans, including a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. These plans must meet specific ACA requirements, such as providing essential health benefits and adhering to annual limit rules. Being aware of these guidelines ensures your plan remains compliant and protects your employees' health coverage.

Self-funded health plans, such as a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, come with certain drawbacks. One major concern is the financial risk; employers must assume the responsibility for all health claims. Additionally, the unpredictability of expenses can pose challenges in budgeting for healthcare costs. Recognizing these limitations allows you to evaluate if this plan is right for your organization.

Self-funded plans are generally not exempt from the Employee Retirement Income Security Act (ERISA). When you consider a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, it's crucial to understand that ERISA sets standards for most employee benefit plans. However, some governmental and church plans may not fall under its jurisdiction. Knowing these details helps you comply with federal regulations while ensuring your plan serves your employees effectively.

Yes, self-funded plans are governed by ERISA, which establishes comprehensive standards for managing employee benefits. ERISA's requirements include reporting, disclosure, and fiduciary responsibilities. This law is key when designing a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, as it ensures that employers meet legal obligations and safeguard employee interests.

Self-funded plans are primarily governed by federal law, but they must also comply with certain state laws, particularly those relating to insurance and employee benefits. While ERISA preempts many state regulations, some states may impose specific requirements. Addressing these state laws is crucial when creating a North Carolina Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees.

insured program is a type of health plan where an employer assumes the financial risk for providing healthcare benefits to its employees. Instead of purchasing insurance, the employer pays for covered expenses directly. Implementing a North Carolina Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees allows companies to effectively manage their healthcare costs while providing valuable benefits.