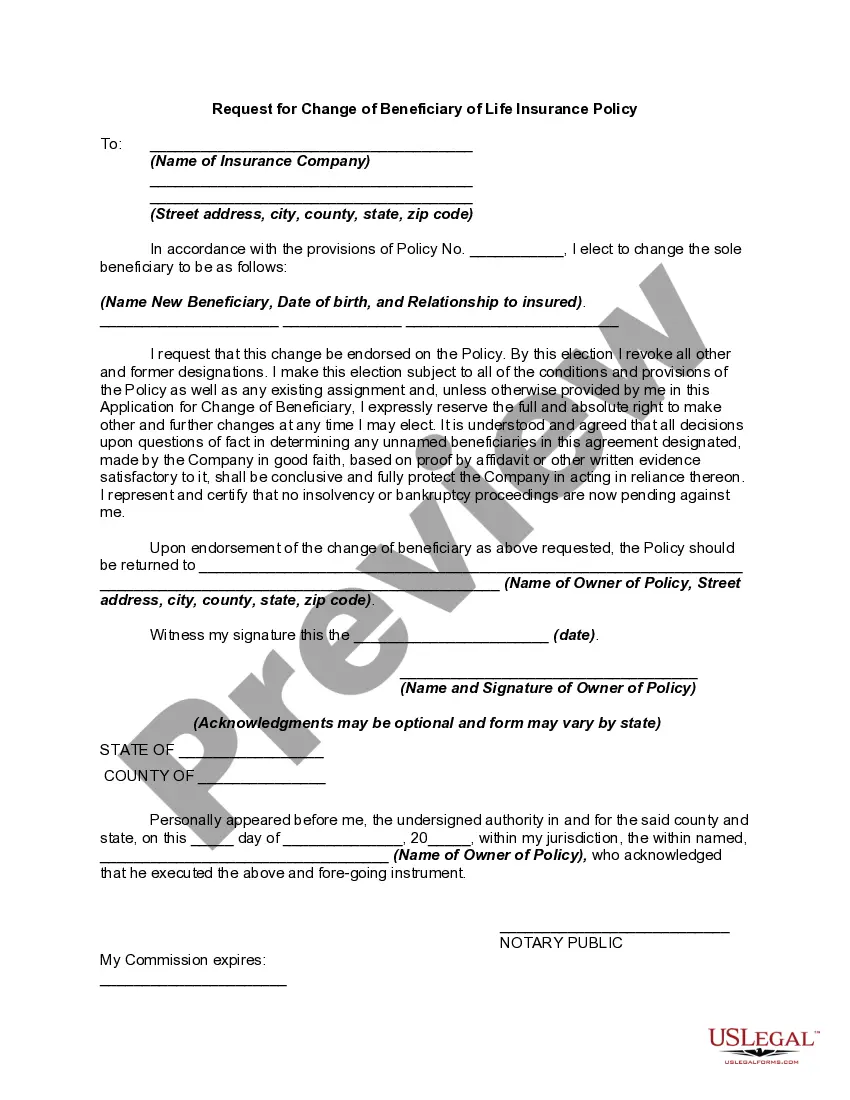

If the method of changing beneficiaries in insurance policies is prescribed by statute or by the policy itself, the required formalities must be observed. If the beneficiary has a vested right in the policy or if the policy does not reserve the right of the insured to change the beneficiary, the consent of the beneficiary must be obtained to change the beneficiary. Relevant state statutes must be consulted to determine if they require the consent of the beneficiary to effectuate a change of the beneficiary.

North Carolina Request for Change of Beneficiary of Life Insurance Policy

Description

How to fill out Request For Change Of Beneficiary Of Life Insurance Policy?

US Legal Forms - one of the greatest libraries of legitimate forms in the USA - gives a wide range of legitimate record themes it is possible to download or print. While using internet site, you can find a large number of forms for organization and personal reasons, sorted by groups, says, or keywords.You will discover the most up-to-date types of forms like the North Carolina Request for Change of Beneficiary of Life Insurance Policy in seconds.

If you already have a monthly subscription, log in and download North Carolina Request for Change of Beneficiary of Life Insurance Policy through the US Legal Forms catalogue. The Obtain button will show up on every single kind you look at. You have access to all formerly downloaded forms from the My Forms tab of your respective account.

If you would like use US Legal Forms the very first time, here are basic instructions to help you started:

- Ensure you have picked out the best kind for your personal area/county. Click the Review button to examine the form`s information. Read the kind information to actually have selected the correct kind.

- If the kind does not suit your requirements, make use of the Lookup field on top of the display to get the one which does.

- Should you be happy with the shape, affirm your choice by simply clicking the Acquire now button. Then, opt for the prices plan you want and supply your accreditations to sign up to have an account.

- Method the transaction. Use your bank card or PayPal account to complete the transaction.

- Pick the file format and download the shape on your device.

- Make changes. Load, modify and print and indicator the downloaded North Carolina Request for Change of Beneficiary of Life Insurance Policy.

Each design you added to your account lacks an expiration date and is the one you have permanently. So, if you would like download or print another backup, just check out the My Forms area and then click on the kind you need.

Gain access to the North Carolina Request for Change of Beneficiary of Life Insurance Policy with US Legal Forms, one of the most comprehensive catalogue of legitimate record themes. Use a large number of expert and state-particular themes that satisfy your organization or personal needs and requirements.

Form popularity

FAQ

? A person may insure his or her own life for the sole use and benefit of his or her spouse, or children, or both, and upon his or her death the proceeds from the insurance shall be paid to or for the benefit of the spouse, or children, or both, or to a guardian, free from all claims of the representatives or creditors ...

Change a beneficiary Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online. Otherwise, you'll have to complete, sign, and mail a paper form.

Most beneficiaries are revocable beneficiaries in that the policy owner can remove them or change their benefit allocation as they see fit. An irrevocable beneficiary is a beneficiary that cannot be removed or have their portion of the death benefit altered without their consent.

Only the policyholder can change a life insurance policy's beneficiaries, with rare exceptions. Here's how and when to make a beneficiary change, and when you might need another person's sign-off. The policy owner is the only person who can change the beneficiary designation in most cases.

The policyowner can change the beneficiary. A policyowner may change a beneficiary at any time. However, consent may be needed by the current beneficiary if designated as irrevocable. J chooses a monthly premium payment mode on his Whole Life insurance policy.

The wording of the beneficiary designation must stipulate ?irrevocable.? If an irrevocable beneficiary has been named at the time the insured enrolls for life coverage, both the insured and irrevocable beneficiary must sign the enrollment form. To change the beneficiary will require both signatures.

Life Insurance Beneficiaries Can Be Contested If they believe they are entitled to the policy's payout, they may initiate a dispute to contest it. Disputing who was named as the beneficiary can be a complicated, expensive ordeal. Only the court may overturn the person named as beneficiary.

Key takeaways An irrevocable beneficiary is a person who is guaranteed to receive a death benefit from your life insurance policy unless they consent to forfeit their rights. Children are commonly made irrevocable beneficiaries, but you can choose anyone as your irrevocable beneficiary.