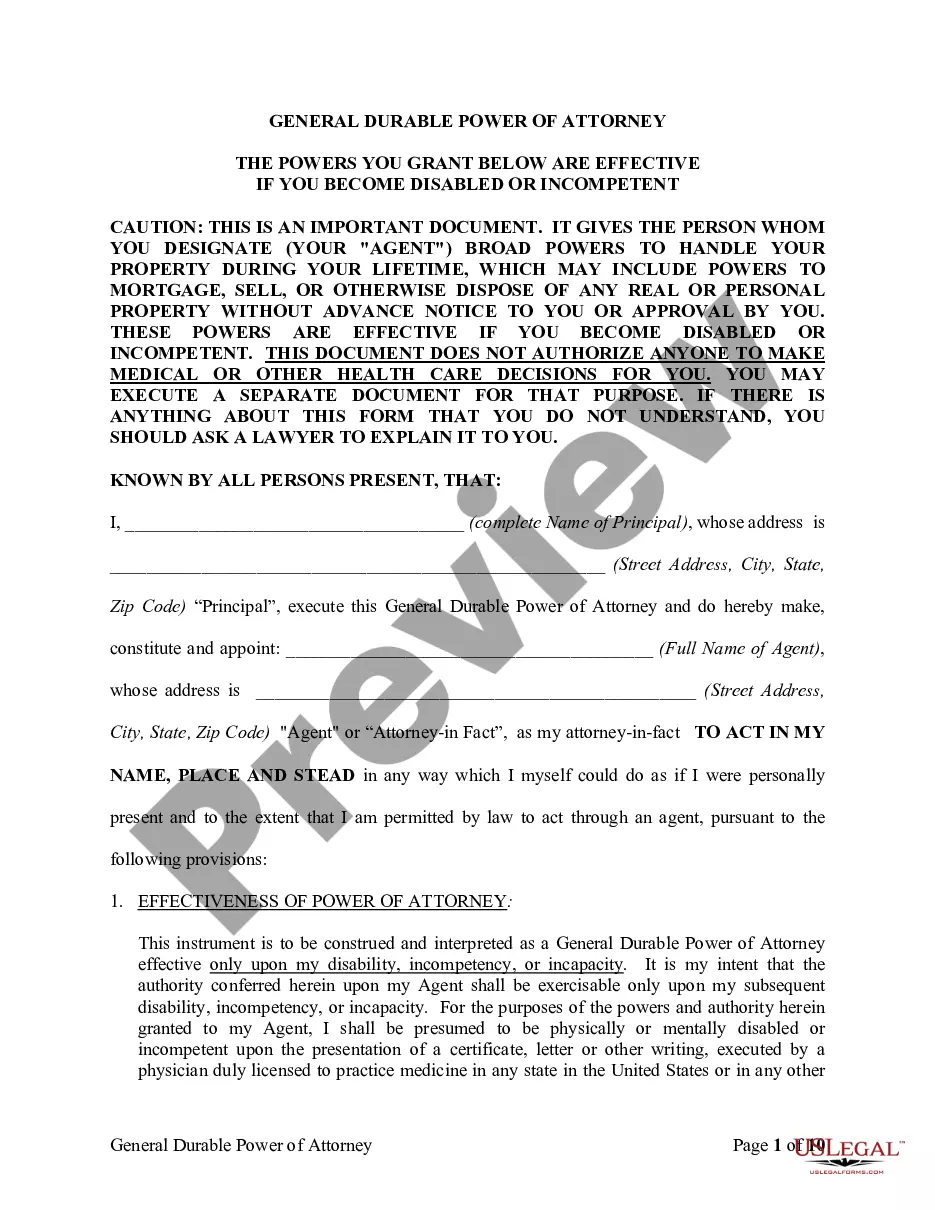

In this agreement the employee service provider promises to maintain worker's compensation insurance on the employees being provided, and further agrees that client shall have no liability for any contributions, taxes or assessments required to be paid or withheld for employees of provider, including but not limited to federal, state or local income, payroll expense, head tax or school board taxes, unemployment compensation, workers' compensation, disability, pension, retirement income security, Medicare, or Social Security.

North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance

Description

How to fill out Agreement Of Employee Service Provider To Maintain Workers Compensation Insurance?

Locating the appropriate legal documents web template might be a challenge. Naturally, there are numerous designs available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service offers a vast selection of templates, including the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance, which can be utilized for business and personal needs. All the documents are reviewed by experts and fulfill state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance. Use your account to browse the legal documents you have previously obtained. Navigate to the My documents section of your account to get another copy of the document you need.

Choose the file format and download the legal documents web template to your device. Complete, modify, and print out and sign the acquired North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance. US Legal Forms is the largest collection of legal documents where you can find numerous form templates. Take advantage of the service to download professionally crafted documents that adhere to state requirements.

- Firstly, ensure you have selected the correct form for your specific area/county.

- You can preview the form using the Review option and examine the form summary to confirm it is suitable for you.

- If the form does not satisfy your needs, use the Search field to find the appropriate form.

- Once you are confident the form is correct, click the Get now option to retrieve the form.

- Select the pricing plan you prefer and input the required information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Filing a workers' comp claim can be worthwhile if you have sustained an injury that affects your ability to work. Benefits can cover your medical expenses, lost wages, and rehabilitation costs. Understanding the ins and outs through the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance can help you make an informed decision about your claims process.

Filing for workers' compensation in North Carolina involves notifying your employer about the injury and completing a claim form, usually Form 18. This formal declaration allows you to access benefits associated with the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance. It's recommended to seek assistance from resources such as USLegalForms to ensure your claim is filed correctly.

Workers' compensation settlements in North Carolina are generally calculated based on several factors, including your medical expenses, lost wages, and the extent of your injury. The process considers both your economic and non-economic losses. Consulting resources on the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance can provide clarity on this intricate calculation.

In North Carolina, you can receive workers' compensation benefits as long as you are unable to work due to your injury. Typically, this duration lasts until you reach maximum medical improvement or are medically cleared to return to work. Understanding your rights is vital, especially in relation to the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance, which provides important protections.

A Form 33 is a document used in North Carolina to request a hearing for workers' compensation claims. It is crucial for employees who want to seek resolutions regarding their disputes after filing a claim. By filling out this form, you initiate a process that can help clarify your rights under the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance.

In North Carolina, most businesses with three or more employees are required to carry workers' compensation insurance. This insurance covers medical expenses and lost wages if an employee gets injured on the job. It is advisable to follow the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance for compliance. This way, you protect both your employees and your business from potential liabilities.

Filing for workers' compensation in North Carolina involves several critical steps. First, notify your employer about the injury, and they will provide you with the necessary forms. Then, complete the Workers' Compensation Form and submit it to the NC Industrial Commission. For guidance, refer to the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance for detailed procedures.

In North Carolina, if you hire 1099 employees, you generally do not need to provide workers' compensation insurance for them. However, it is crucial to review the North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance for clarity. Misclassifying workers can lead to legal issues, so ensure you understand the distinctions. Always consult with a legal expert to safeguard your business.

In North Carolina, a contract is legally binding when it includes all essential elements: mutual consent, a definite subject matter, valuable consideration, and lawful purpose. When you create a North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance, you ensure that both parties have a clear understanding of their obligations. This clarity helps prevent disputes and reinforces the commitment to protect workers. For comprehensive templates and support, consider using the US Legal Forms platform to simplify the process of drafting legally sound contracts.

A few states in the U.S. do not mandate workers' compensation insurance for all types of employers. For instance, Texas allows employers to opt-out of providing this coverage, which is unique among states. However, in North Carolina, it is essential to comply with the requirement, and entering into a North Carolina Agreement of Employee Service Provider to Maintain Workers Compensation Insurance ensures that employers protect their employees adequately.