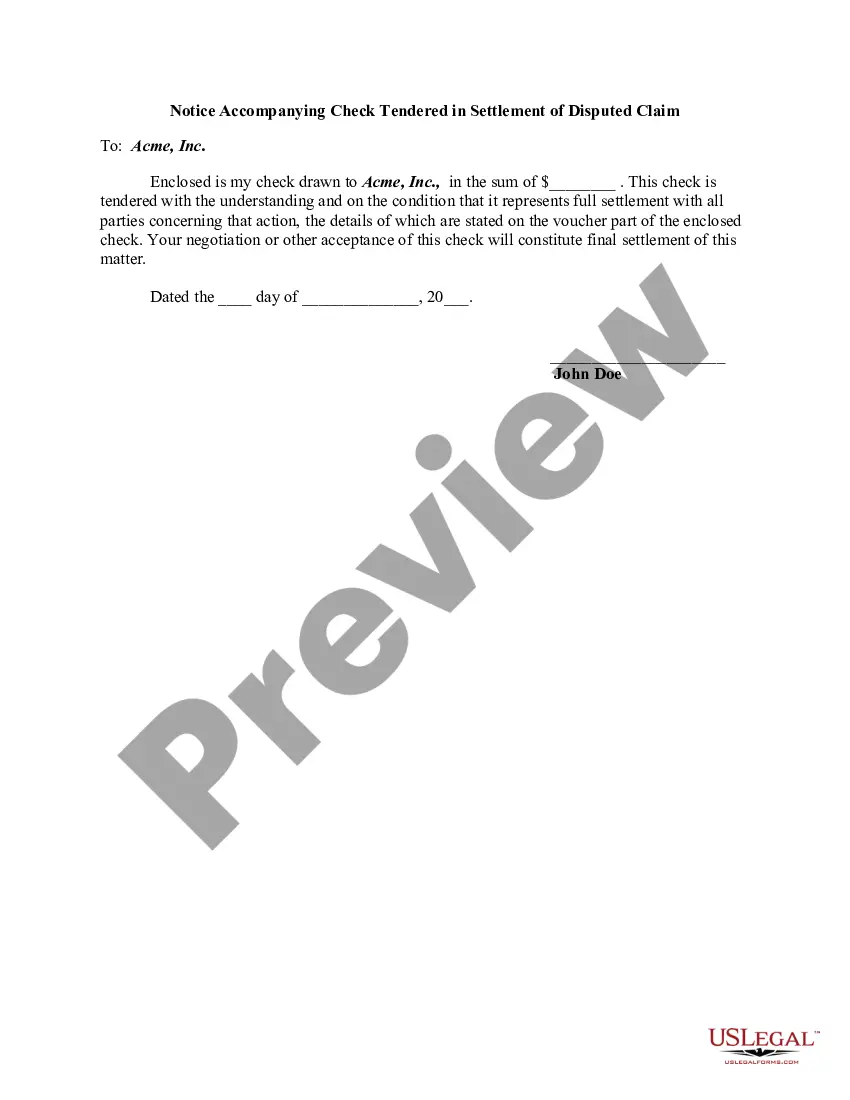

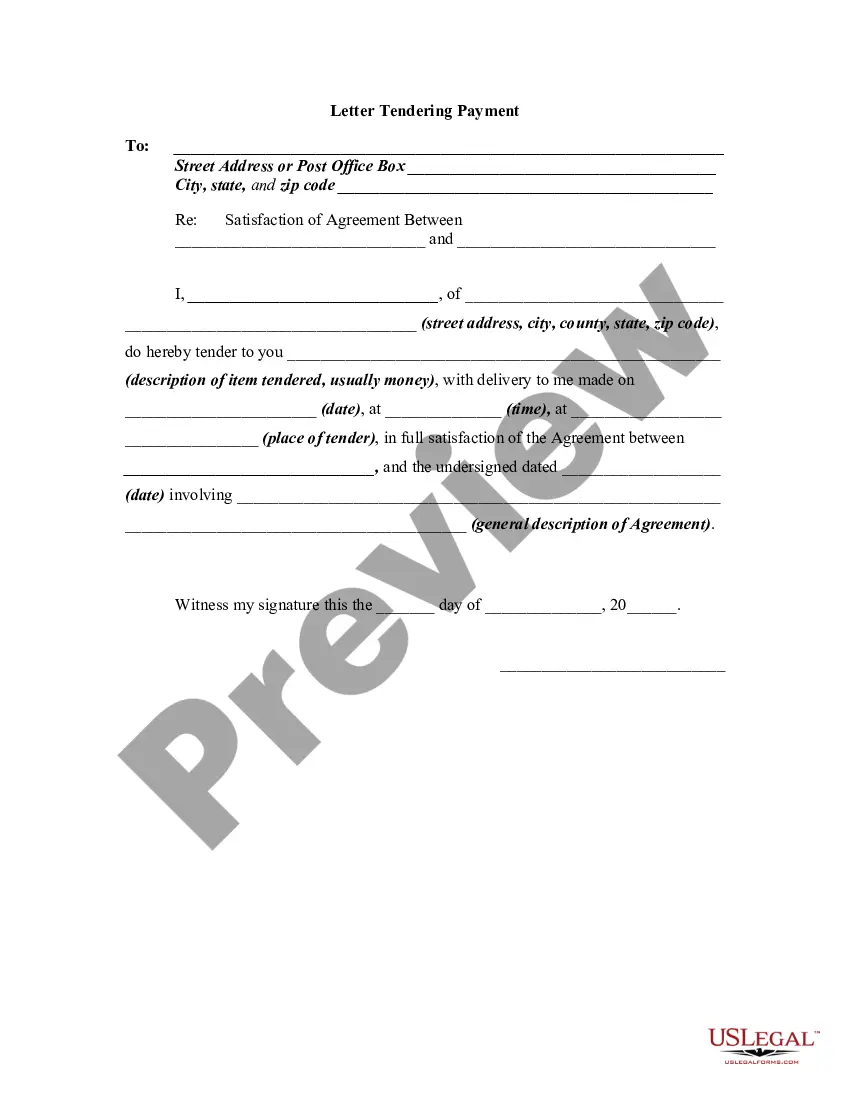

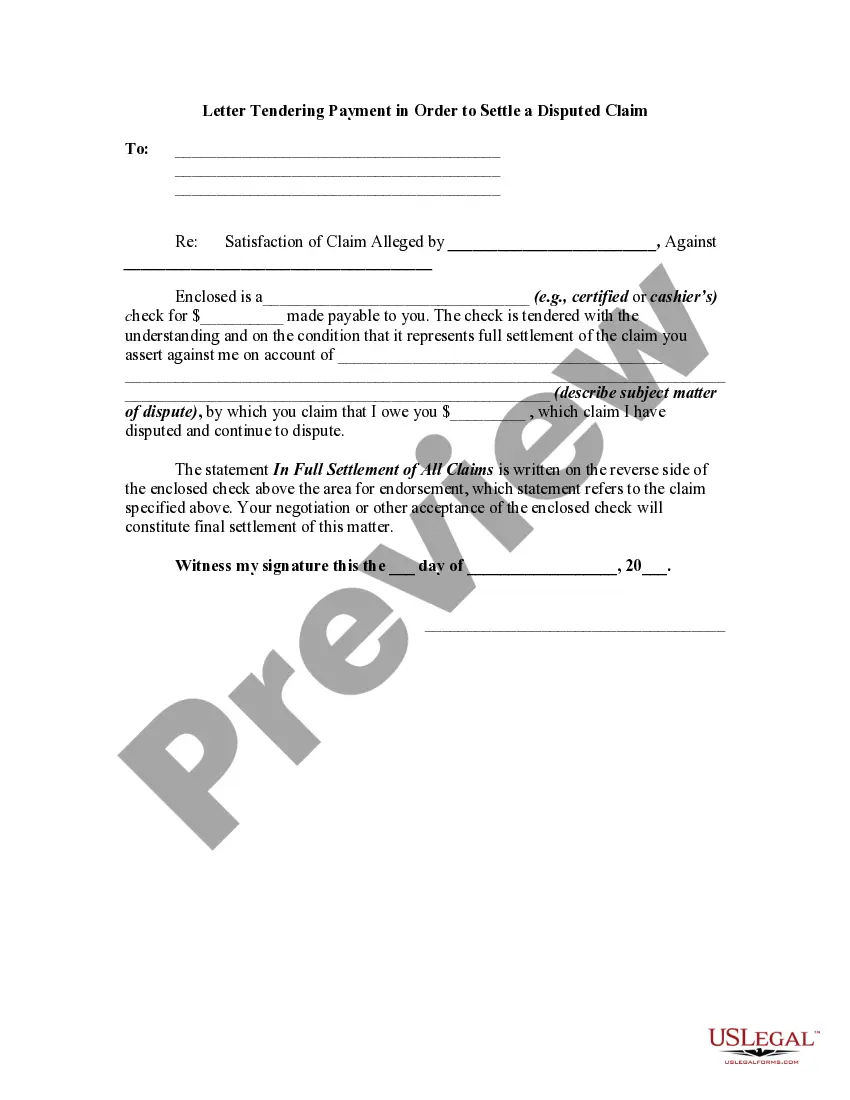

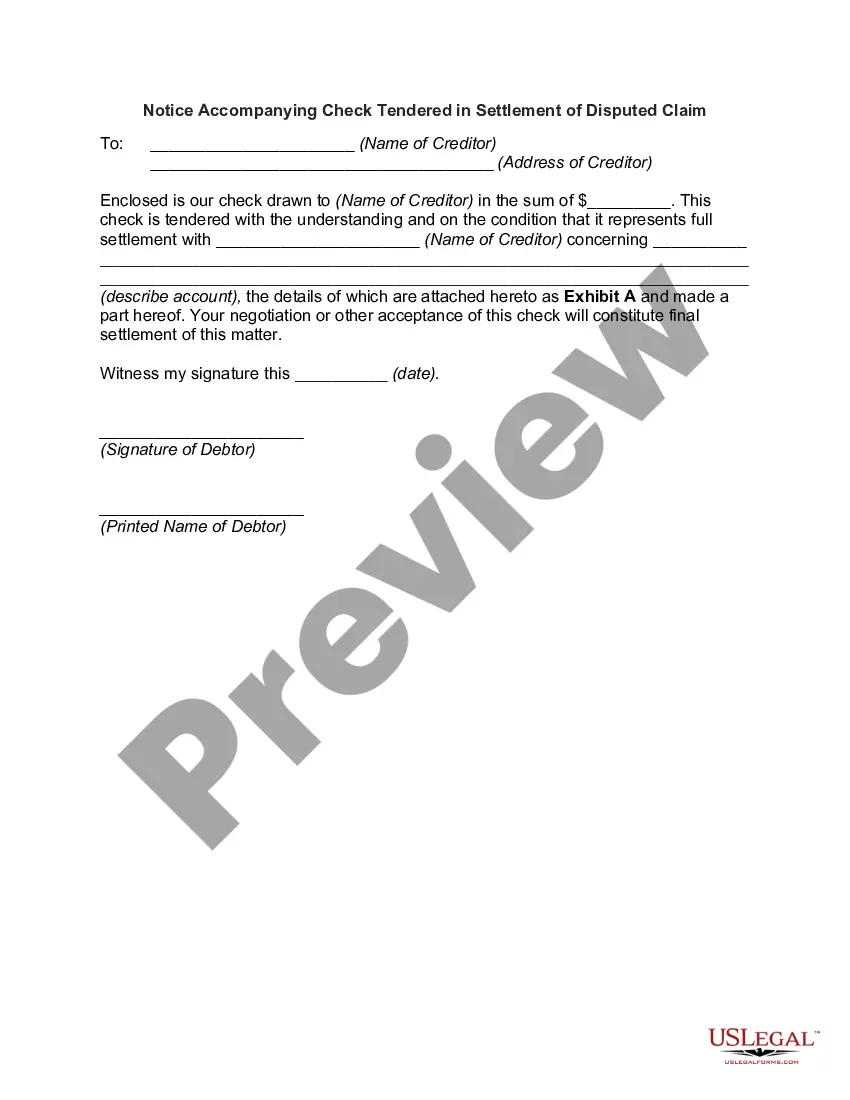

Where a claim is disputed, and where the creditor fails to reject a check for a lesser amount remitted to the creditor by the debtor on the clear condition that it be accepted in full satisfaction, the acceptance on the part of the creditor amounts to an accord and satisfaction of the creditor's larger claim. No particular language is required to be used by a debtor in making a tender of a check in full settlement of a claim against the debtor, so long as the tender clearly indicates that acceptance by the creditor of the amount offered must be in full satisfaction of the claim.

North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim

Description

How to fill out Letter Tendering Payment In Order To Settle A Disputed Claim?

You can dedicate multiple hours online searching for the authentic document template that meets the federal and state guidelines you desire.

US Legal Forms provides thousands of authentic forms that have been evaluated by experts.

You can download or print the North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim from their services.

First, ensure you have chosen the correct document template for your area/city of choice. Review the form summary to guarantee you have selected the proper form. If available, utilize the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim.

- Every legitimate document template you purchase is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions listed below.

Form popularity

FAQ

After a judgment is entered against you in North Carolina, you may receive a notification about the ruling. You have the option to appeal or settle the matter, which is where a North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim comes into play. Utilizing this method can help you resolve the dispute and avoid harsher penalties.

Once a judgment is entered in North Carolina, it becomes a matter of public record and can affect your credit score. You may also face wage garnishments or property liens. If you wish to avoid such consequences, exploring a North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim can be an effective strategy.

In North Carolina, a judgment typically lasts for ten years from the date it was entered. After this period, the judgment may be renewed. This is important to consider, especially if you receive a North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim, as it can impact your options moving forward.

When writing a check for and satisfaction, you should include the phrase 'in full and satisfaction of all claims' in the notes section or memo line. This explicitly communicates that the check is intended to settle the disputed claim. Additionally, incorporating a North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim can further clarify your intent and protect your interests.

The phrase 'in full and satisfaction' written on a check indicates that the payment is intended to settle the entire claim between the parties. It is a clear message that by cashing the check, the recipient agrees to accept the payment as the final resolution. Including this phrase is crucial in the context of a North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim.

To prove and satisfaction, you need to keep proper records of the payment and the written agreement. A North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim should be documented, showing that both parties consented to the resolution. Having a clear acknowledgment from the creditor about the payment can also serve as evidence of satisfaction.

An example of an and satisfaction occurs when a debtor sends a payment, along with a letter clearly indicating the intent to settle a disputed claim. The letter serves as a North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim, stating that the payment resolves the disagreement. This communication ensures both parties are in agreement and helps prevent further disputes.

When asking for a settlement, start by clearly stating your request and the reasons for your proposal. Include details on your financial situation and any relevant communication history with the creditor. It is essential to communicate respectfully and show your willingness to collaborate. This letter can be a strong stepping stone toward creating an effective North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim, fostering constructive dialogue.

To request a payment arrangement, outline your financial situation succinctly and propose a specific payment plan. Indicate the amounts and timings of each proposed payment, showing your commitment to settling the debt responsibly. Clear communication in this letter can pave the way for a successful North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim, as it demonstrates your willingness to cooperate.

When writing a letter of payment relief, clearly explain your current financial hardships and request a temporary reduction or deferral of payments. Specify the relief you seek, whether it’s a lowered payment or a pause in payment requirements. Include your account information to streamline the process. This letter may serve as a foundation for any North Carolina Letter Tendering Payment in Order to Settle a Disputed Claim in the future.