Delaware Certificate of Trust - Indebtedness

Description

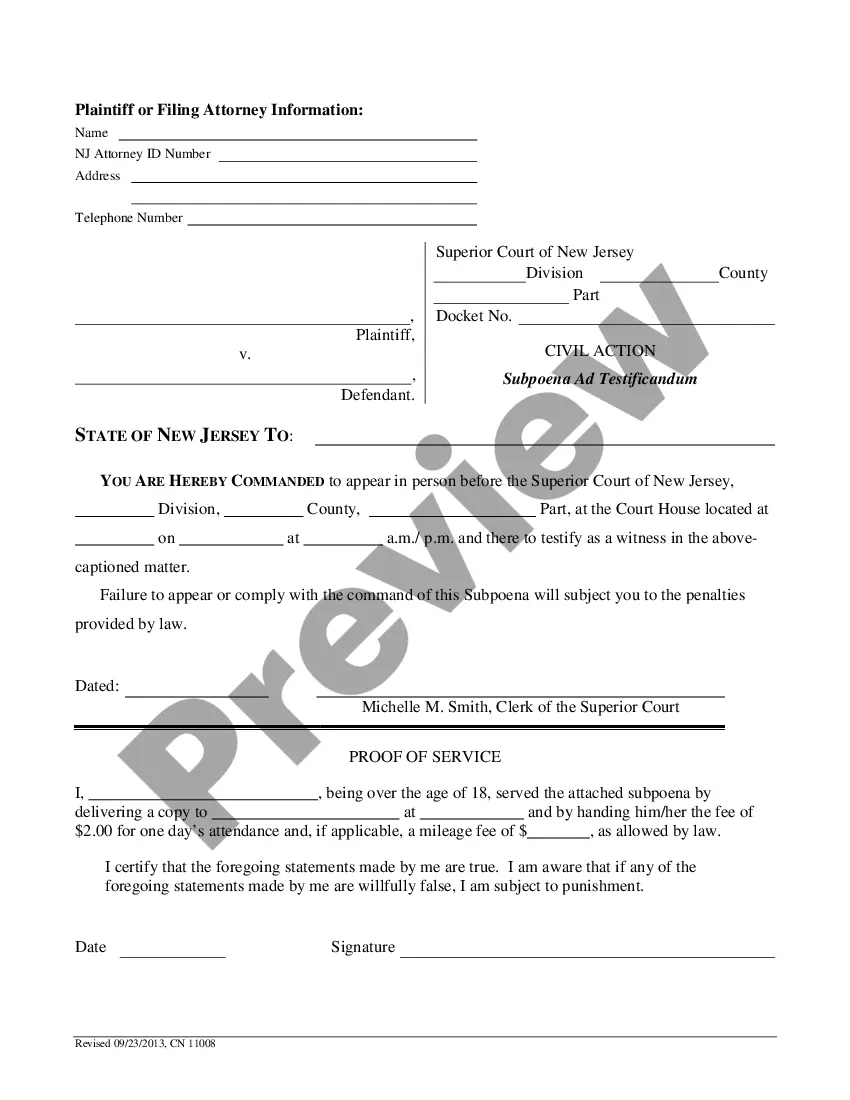

How to fill out Certificate Of Trust - Indebtedness?

Are you currently inside a situation the place you need files for possibly business or individual uses almost every time? There are plenty of legal papers layouts available on the Internet, but locating kinds you can rely isn`t easy. US Legal Forms provides a huge number of type layouts, much like the Delaware Certificate of Trust for Property, which can be published to fulfill state and federal needs.

Should you be previously informed about US Legal Forms internet site and possess a merchant account, basically log in. Next, you can down load the Delaware Certificate of Trust for Property template.

If you do not offer an accounts and would like to start using US Legal Forms, follow these steps:

- Get the type you want and ensure it is for your proper town/area.

- Utilize the Preview button to examine the shape.

- Look at the information to actually have selected the correct type.

- When the type isn`t what you are looking for, utilize the Search area to discover the type that meets your requirements and needs.

- Whenever you get the proper type, click on Acquire now.

- Pick the costs program you need, submit the specified information and facts to create your money, and pay for the order utilizing your PayPal or Visa or Mastercard.

- Decide on a practical paper formatting and down load your version.

Get each of the papers layouts you possess bought in the My Forms food selection. You can obtain a additional version of Delaware Certificate of Trust for Property whenever, if required. Just go through the needed type to down load or print out the papers template.

Use US Legal Forms, by far the most substantial variety of legal kinds, in order to save time and steer clear of faults. The service provides appropriately made legal papers layouts which you can use for a variety of uses. Make a merchant account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

Unlike many states that limit the duration of a trust, Delaware allows most trusts to continue in perpetuity. Delaware eliminated the Rule Against Perpetuities for assets other than real estate held directly by a trust.

A living trust is created in Delaware by signing a Declaration of Trust, which will name the trustee, beneficiary and terms of the trust. You need to sign the declaration in the presence of a notary. Once that is complete, the trust must be funded by transferring assets into it.

Tax Savings Delaware does not impose income tax on accumulated income or capital gains if the irrevocable Delaware trust has only nonresident remainder beneficiaries. In addition, Delaware imposes no income tax on required income distributions to beneficiaries not residing in Delaware. Transfer tax savings.

Delaware law allows individuals to create self-settled trusts that protect their assets ? especially intangible assets ? from claims of unforeseen creditors.

Although a DST can own nearly any real estate asset of any quality, the underlying real estate held by DSTs tends to be high-grade institutional property.

To make a living trust in Delaware, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

Delaware Trusts, made easy. Leave nothing to chance with a Revocable Trust built specifically for Delaware state laws. Get your Trust and other essential documents for just $500.