Connecticut Certificate of Trust - Indebtedness

Description

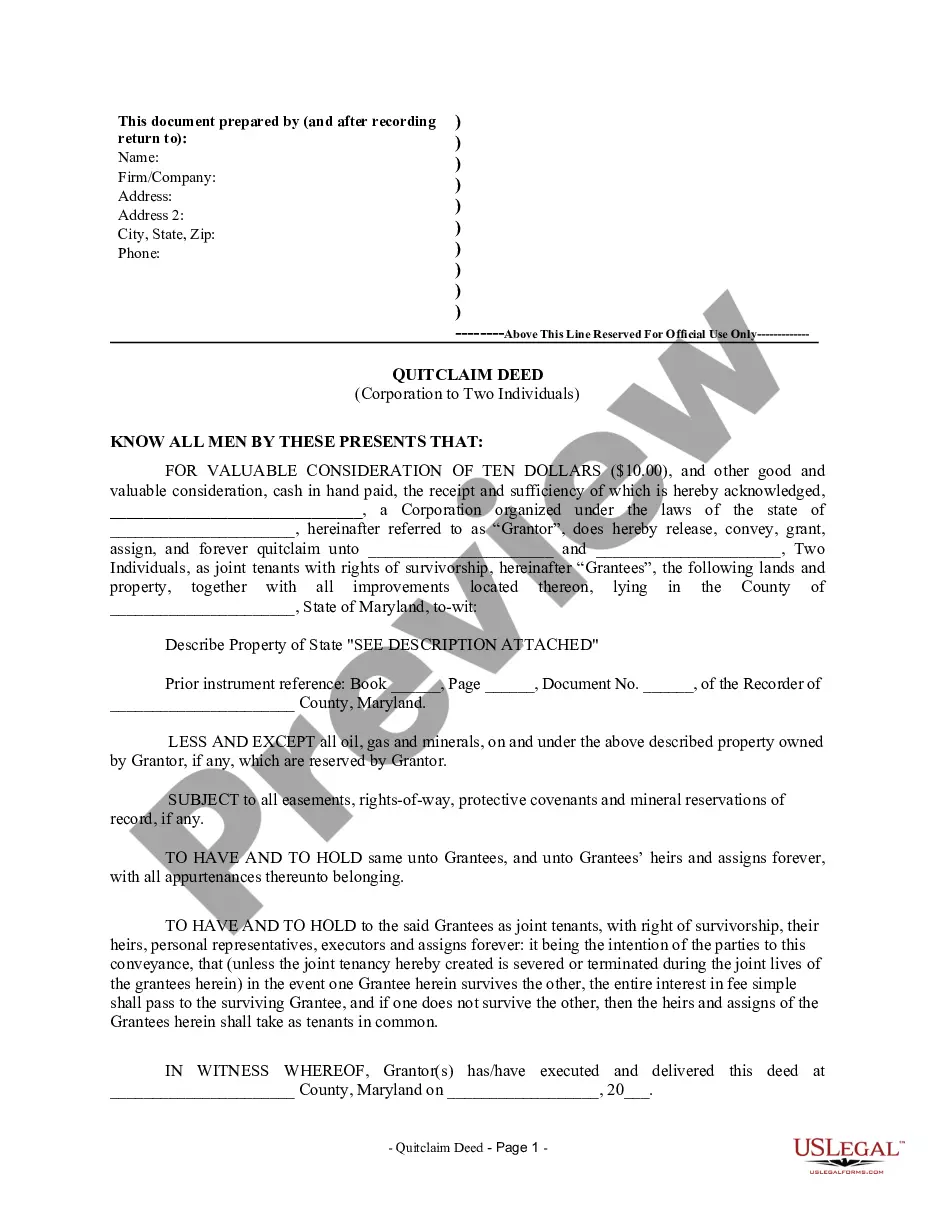

How to fill out Certificate Of Trust - Indebtedness?

You can dedicate hours online searching for the official document template that meets the state and federal requirements you need.

US Legal Forms offers a wide array of legal forms that have been reviewed by experts.

You can download or print the Connecticut Certificate of Trust for Property from their services.

If available, use the Review button to view the document template as well. If you want to find another version of the form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you need, click on Get now to proceed. Select the pricing plan you desire, enter your information, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, modify, sign, and print the Connecticut Certificate of Trust for Property. Acquire and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you may Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the Connecticut Certificate of Trust for Property.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for the county/town of your choice.

- Check the form details to ensure you have chosen the proper document.

Form popularity

FAQ

A trust certificate provides just enough information to prove a trust exists and share information about its key terms ? without disclosing any sensitive information. It also verifies that the trustee has the legal authority to act on behalf of the trust (either in general or with respect to certain transactions).

A Trust Certification gives a Trustee the ability to provide anyone who needs it (think: financial institutions or other third parties) important information about the Trust - like the date it was formed, the legal/formal name of the Trust, who the Trustee is (or Trustees are) and other information institutions may ...

Key Rights of Trust Beneficiaries in Connecticut This includes the right to receive a copy of the trust document, accountings, and updates on the trust's assets and investments. Right to Distributions: Beneficiaries have the right to receive distributions from the trust as specified in the trust document.

The main benefit of putting your home into a trust is avoiding probate. Placing your home in a trust also keeps some of the details of your estate private.

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

Create the trust document. You can get help from an attorney or use Willmaker & Trust (see below). Sign the document in front of a notary public. Change the title of any trust property that has a title document?such as your house or car?to reflect that you now own the property as trustee of the trust.

Key Takeaways. In financed real estate transactions, trust deeds transfer the legal title of a property to a third party?such as a bank, escrow company, or title company?to hold until the borrower repays their debt to the lender. Investing in trust deeds can provide a high-yielding income stream.

Trust certificates offer investors a high degree of safety in comparison with unsecured or uncollateralized bonds. They also typically pay a lower level of interest than those investors willing to take greater risks.