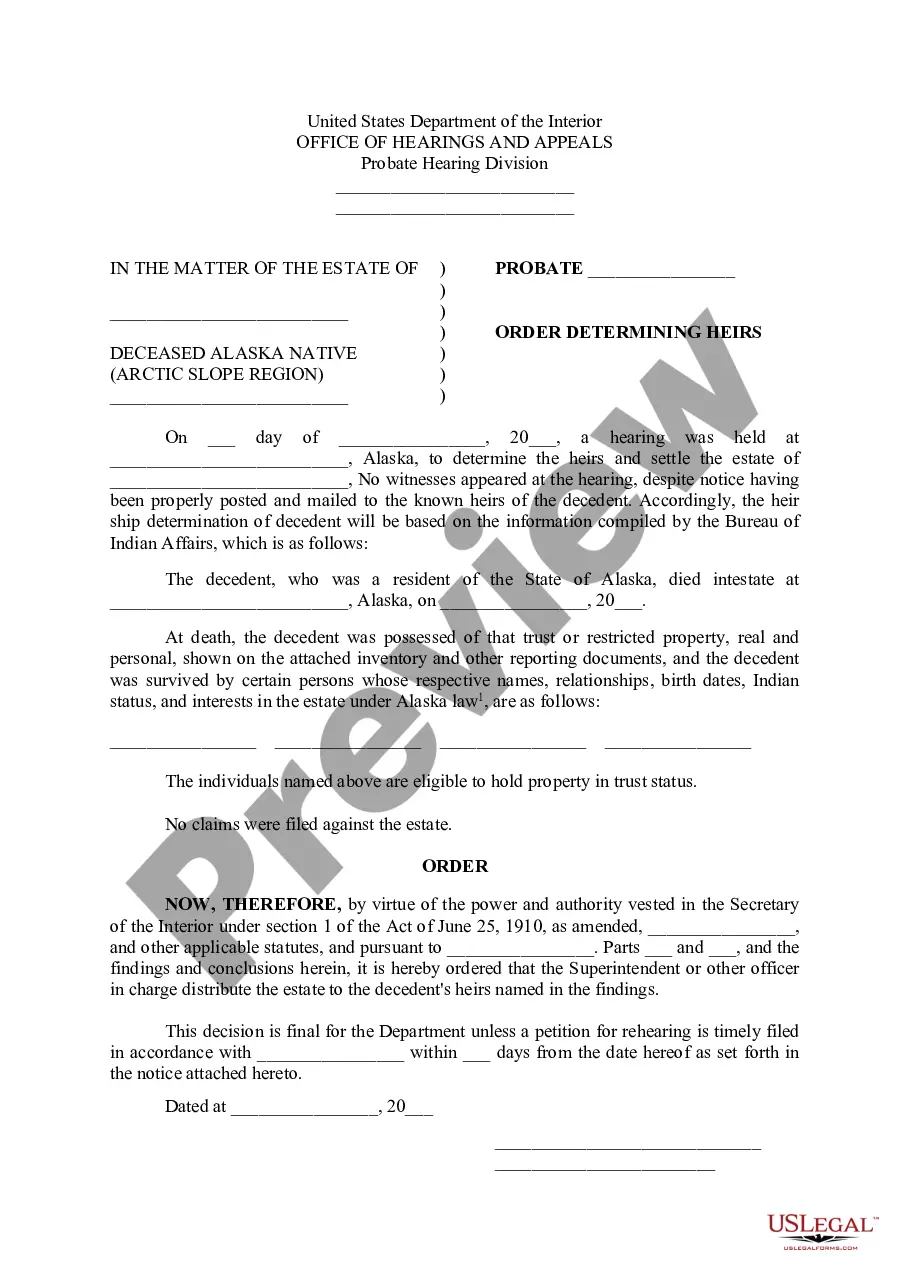

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a wide selection of legal paperwork templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal use, arranged by categories, states, or keywords.

You can obtain the latest versions of forms such as the North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary within moments.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you possess an active monthly subscription, Log In and download the North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary from the US Legal Forms library.

- The Download button will be visible on every type you view.

- You can access all previously downloaded forms within the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are straightforward guidelines to help you get started.

- Ensure that you have chosen the correct form for your specific city/county.

- Click the Review button to examine the form's content.

Form popularity

FAQ

Yes, you can draft your own trust in North Carolina. However, it is crucial to ensure that it meets state laws and effectively represents your intentions. By utilizing resources available on ulegalforms, you can confidently create a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary that aligns with your specific needs.

North Carolina law does not require most trusts to be recorded. Yet, if your trust encompasses real estate or specific assets, recording might be necessary. This decision can directly impact the effectiveness of a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, making it crucial to understand your options.

In North Carolina, a trust return must be filed by the trustee when the trust has any taxable income or if it meets certain criteria set by the IRS. This includes both revocable and irrevocable trusts that generate income. If you are navigating this process, consider leveraging the North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to streamline your responsibilities.

In North Carolina, a trust does not need to be recorded to be valid. However, if your trust holds real estate, you must record it to notify others of your property interests. Understanding the implications of recording a trust is essential, especially when considering a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

To file a trust in North Carolina, you typically complete the necessary trust documents and submit them to the relevant state agencies. Registration requirements may vary based on the type of trust. Using a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can make the process easier. Additionally, consulting with a trusted legal platform like uslegalforms can help ensure you meet all the necessary legal requirements.

North Carolina does require estimated tax payments for some trusts if they meet certain income thresholds. This ensures that the state receives tax revenues throughout the year rather than just at tax time. Understanding your obligations is crucial to remain compliant. As you navigate this process, a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can provide clarity.

In North Carolina, trusts are generally not required to be recorded unless they contain real estate. However, keeping thorough documentation can be beneficial in managing your trust effectively. When drafting a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, ensure you maintain clear records to support your trust administration.

North Carolina does tax trust income, which means that any income generated by the trust is subject to state income tax. The tax structure can vary depending on the type of trust involved. Being aware of the tax implications is essential to ensure compliance. Utilizing the North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can aid in managing these tax responsibilities.

Yes, North Carolina accepts trusts that have federal extensions approved. This acceptance simplifies the filing process for trust administrators and beneficiaries alike. When you have a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, leveraging federal extensions can help you manage your timeline effectively.

The extension deadline for trusts typically aligns with the federal Tax Day, which is usually April 15 each year. If granted an extension, you can file up until September 15. It's crucial to keep this timeline in mind to avoid delays in processing your trust documents. Remember, if you are dealing with a North Carolina Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, stay on top of these deadlines.