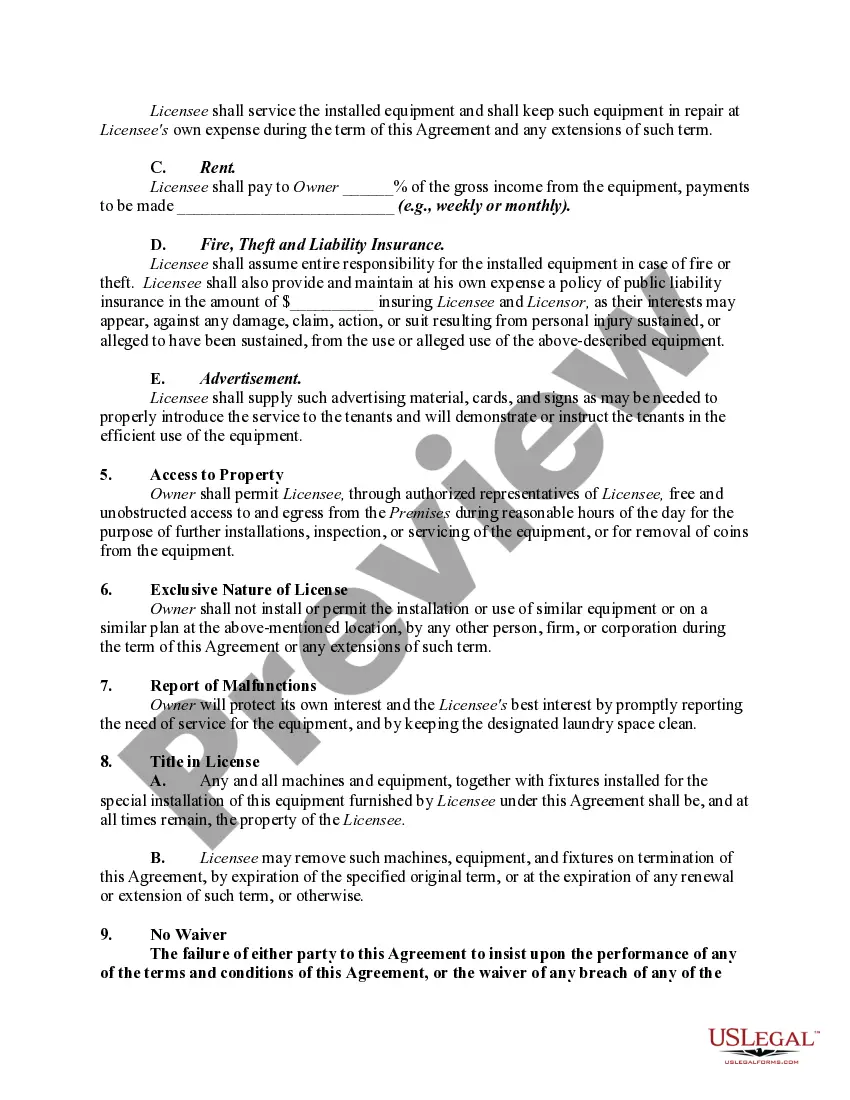

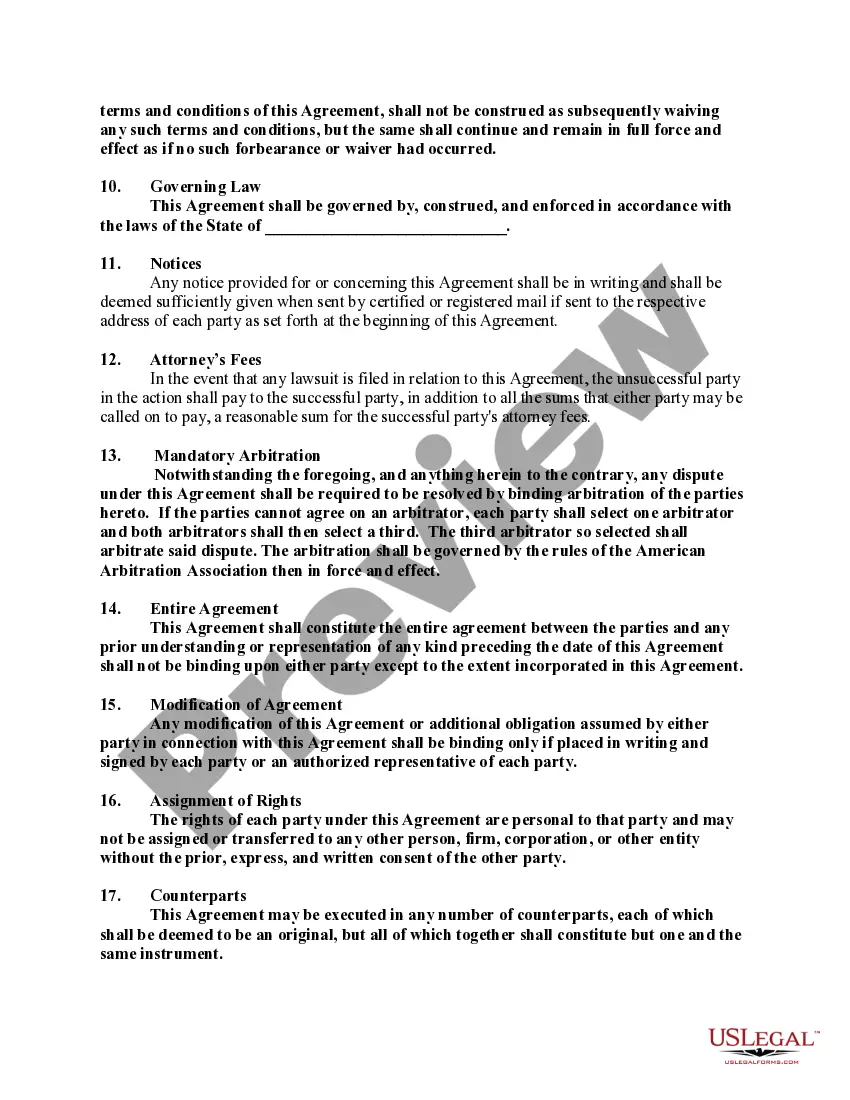

A license gives the permission of the owner to an individual or an entity to use real property for a specific purpose. A license is not an interest in land, but is a privilege to do something on the land of another person. Generally, a license in respect of real property (since it is a mere personal privilege), cannot be assigned or transferred by the licensee. A license does not pass with the title to the property, but is only binding between the parties, expiring upon the death of either party. This form is an example of such.

North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another

Description

How to fill out License Agreement Allowing The Operation Of Washing, Drying, And Laundry Equipment On Real Property Of Another?

You can dedicate several hours online trying to locate the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to download or print the North Carolina License Agreement Permitting the Operation of Washing, Drying, and Laundry Equipment on Another's Real Property from our service.

First, ensure that you have selected the correct document template for the state/town of your choice. Review the form description to confirm you have selected the right one. If available, use the Review button to preview the template as well.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the North Carolina License Agreement Permitting the Operation of Washing, Drying, and Laundry Equipment on Another's Real Property.

- Every legal document template you acquire is yours indefinitely.

- To get an additional copy of any purchased template, navigate to the My documents tab and click the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions provided below.

Form popularity

FAQ

NC statute 105 164 pertains to the taxation of services and products within the state. This statute details what constitutes taxable services, including those related to the North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another. Familiarity with this law is crucial for businesses in the laundry sector to ensure compliance. Resources like UsLegalForms can assist you in navigating these legalities efficiently.

Certain items and services are exempt from North Carolina sales tax, including specific household goods and certain transactions. The North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another can outline exemptions relevant to the operation of laundry services. By understanding these exemptions, businesses can effectively manage their financial responsibilities. It’s wise to keep abreast of guidelines from the North Carolina Department of Revenue.

In North Carolina, services related to cleaning, such as laundry and dry cleaning, may be subject to sales tax. However, the North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another can help clarify tax obligations related to these services. It’s essential for service providers to understand their tax responsibilities to avoid potential liabilities. Always consult with a tax professional for the most accurate guidance.

In model building, 'wash' generally refers to a painting technique used to enhance the details and depth of models. While this has no direct relation to laundry services, understanding techniques in various crafts can share principles with effective operations. A North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another ensures that model building facilities can effectively manage their equipment, much like in laundry operations.

Wash management refers to the oversight and administration of laundry services, including equipment maintenance, service schedules, and customer support. Effective wash management can significantly enhance the user experience in multifamily communities. Ensuring compliance with a North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another can streamline these operations further.

Yes, North Carolina does have a manufacturing exemption that can apply to certain equipment used in production processes. This exemption may benefit businesses involved in laundry operations, especially when utilizing a North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another. Owners should consult legal advice to effectively leverage this exemption.

In North Carolina, several services, including personal services and certain laundry operations, may be subject to sales tax. However, qualifying services under the North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another may not have the same tax implications. It's crucial for operators to understand these distinctions to ensure full compliance.

Wash Multifamily is a service that provides laundry equipment and management to apartment buildings and communities. Their service model focuses on convenience and efficiency for residents while ensuring the best practices in laundry services are upheld. A North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another is essential in formalizing such operations within residential properties.

The term 'wash wash' typically refers to a colloquial expression for washing laundry more than once or ensuring thorough cleanliness. In the context of the North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, it emphasizes the importance of maintaining cleanliness standards in laundry operations across shared facilities.

Wash Multifamily is operated by a division of the larger Wash Holdings, which specializes in laundry services for multifamily communities. They aim to provide efficient and reliable laundry solutions to apartment complexes and residential buildings. By using a North Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, owners can ensure compliance and operational efficiency in their facilities.