North Carolina Assumption Agreement of Loan Payments

Description

How to fill out Assumption Agreement Of Loan Payments?

You might spend hours online looking for the legal document format that meets the federal and state criteria you require.

US Legal Forms offers thousands of legal documents that have been reviewed by specialists.

You can download or print the North Carolina Assumption Agreement of Loan Payments from my services.

If available, use the Preview option to review the document format as well. If you wish to find another version of the document, use the Lookup field to find the format that suits your needs and requirements. Once you have located the format you desire, click Acquire now to proceed. Choose the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Locate the document in your files and download it to your device. Make edits to your document if necessary. You can complete, modify, sign, and print the North Carolina Assumption Agreement of Loan Payments. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download option.

- Then, you can complete, modify, print, or sign the North Carolina Assumption Agreement of Loan Payments.

- Each legal document you obtain is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure you have selected the correct format for the region/city of your choice.

- Read the form description to ensure you have chosen the appropriate document.

Form popularity

FAQ

A loan assumption agreement is a legal document that transfers the responsibility of an existing loan from one borrower to another. This agreement outlines the terms of the loan, including payment obligations and any conditions that must be met. In the context of a North Carolina Assumption Agreement of Loan Payments, it is important to understand how this agreement affects your financial responsibilities. Utilizing platforms like US Legal Forms can help you create a compliant and comprehensive agreement.

A loan assumption is documented through a formal agreement that outlines the terms and responsibilities of both parties involved. This documentation typically includes the original loan details, the assumption terms, and any necessary legal disclosures. When you pursue a North Carolina Assumption Agreement of Loan Payments, ensure that all documentation is thorough and compliant with state laws. Using resources like US Legal Forms can simplify this process and provide the necessary templates.

Yes, North Carolina does allow prepayment penalties, but it is not mandatory for every loan. The presence of a prepayment penalty typically depends on the loan agreement and lender's rules. When dealing with a North Carolina Assumption Agreement of Loan Payments, it's crucial to understand whether such penalties apply to your loan. Always check your agreement to avoid unexpected costs.

In many cases, a down payment may not be necessary for a loan assumption. This largely depends on the terms set forth in the original loan agreement and the lender's policies. When navigating a North Carolina Assumption Agreement of Loan Payments, it's essential to review the specific loan terms to determine if a down payment applies. Consulting with a legal expert can provide clarity on your situation.

A loan assumption in North Carolina requires specific criteria to be met for the transfer of responsibility. Primarily, the new borrower must qualify under the lender's guidelines, demonstrating financial stability and creditworthiness. Moreover, you will need to fill out the North Carolina Assumption Agreement of Loan Payments, which outlines the terms and conditions agreed upon by all parties involved.

To complete a North Carolina Assumption Agreement of Loan Payments, you typically need several key documents. These include the original loan agreement, a written request for assumption, and financial statements from the person assuming the loan. Additionally, you may need to provide proof of income and creditworthiness to ensure compliance with lender requirements.

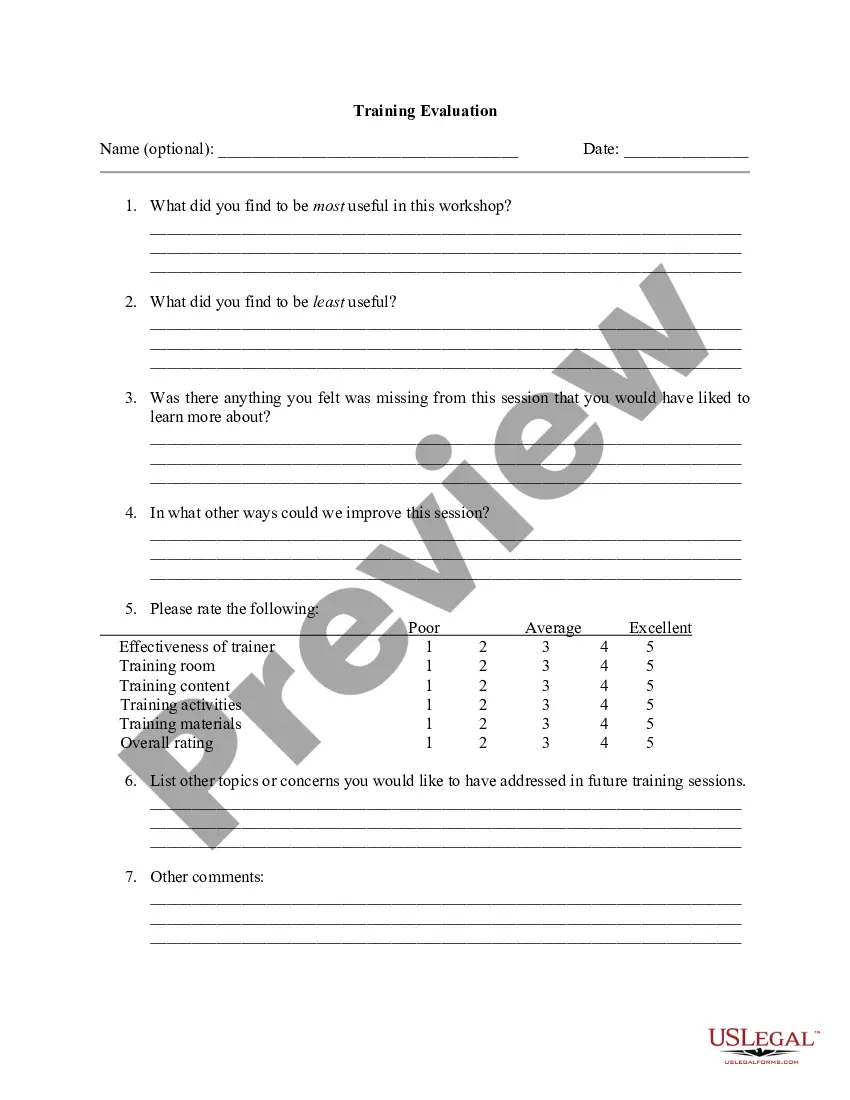

How long does the assumption process take? Assumption TypeProcessing TimeStandard Assumption60 ? 90 DaysAssumption Due to Divorce60 ? 90 DaysAssumption After Death30 ? 60 Days

The Bottom Line. Most FHA, VA and USDA mortgages are easy to assume, though each is treated differently. Some conventional loans are harder to assume. When you assume a mortgage, you take on the exact terms, including the interest rate, monthly payment and any mortgage insurance payment.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.