North Carolina Employment Application for Photographer

Description

How to fill out Employment Application For Photographer?

Locating the appropriate authorized document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you find the legal form you need.

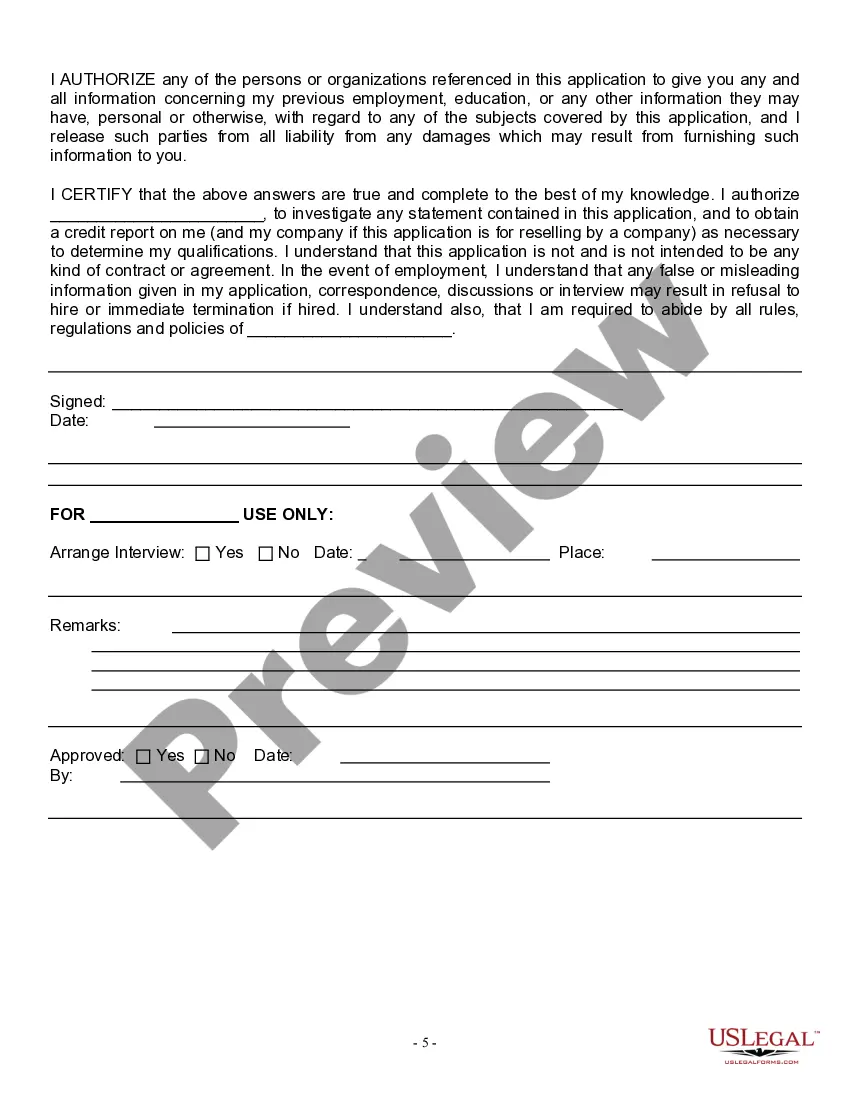

Utilize the US Legal Forms website. This service offers thousands of templates, including the North Carolina Employment Application for Photographer, which you can utilize for both business and personal purposes.

You can review the form using the Preview button and read the form description to ensure it is suitable for you.

- All of the forms are reviewed by experts and comply with federal and state laws.

- If you are already registered, Log In to your account and click the Obtain button to retrieve the North Carolina Employment Application for Photographer.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents section of your account to download another copy of the document you wish.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

27a2 Sales of frames, films and other articles by photographers, photo finishers or others to users or consumers are subject to the 4 75% general State and applicable local to users or consumers are subject to the 4.75% general State and applicable local and transit rates of sales or use tax.

Here are descriptions of the most common photography careers.Photojournalist.Fine Art Photographer.Commercial/Industrial Photographer.Studio/Portrait Photographer.Freelance Photographer.

Qualifications for PhotographerAssociate's or bachelor's degree in photography art preferred.Proven experience as a photographer in a competitive industry.Excellent verbal and written communication skills.Detailed knowledge of photography art and lighting.Strong creative presence and artistic flair.More items...

While the state of North Carolina does not require a general business license, photographers are still required to pay a $50 state privilege license tax every year.

2705North Carolina ServicesGross receipts from sales of photographs, including all charges for developing or printing by commercial or portrait photographers or others, are subject to sales tax, including sitting fees.

In most jurisdictions in the United States, no professional license is required to run or operate a photography business; however, this is not the case in ALL jurisdictions. For example, the City of Milwaukee requires a professional photographer's license to do many types of photography in the city.

2022 General state rate: 4.75 % Certain digital property that is delivered or accessed electronically is not considered 2022 Certain digital property that is delivered or accessed electronically, is not considered tangible personal property, and would be taxable under Article 5 if sold in a tangible medium.

Portrait, Wedding, and other Noncommercial Photography Generally, tax applies to the sale of photographs sold in tangible form for noncommercial use. The sale of related items and services rendered to create or produce the photographs will also be taxable.

27a2 Sales of frames, films and other articles by photographers, photo finishers or others to users or consumers are subject to the 4 75% general State and applicable local to users or consumers are subject to the 4.75% general State and applicable local and transit rates of sales or use tax.

Any business that sells certain taxable goods or services needs a seller's permit, known in North Carolina as a Certificate of Registration. Businesses in certain professions or locations may need additional licenses.