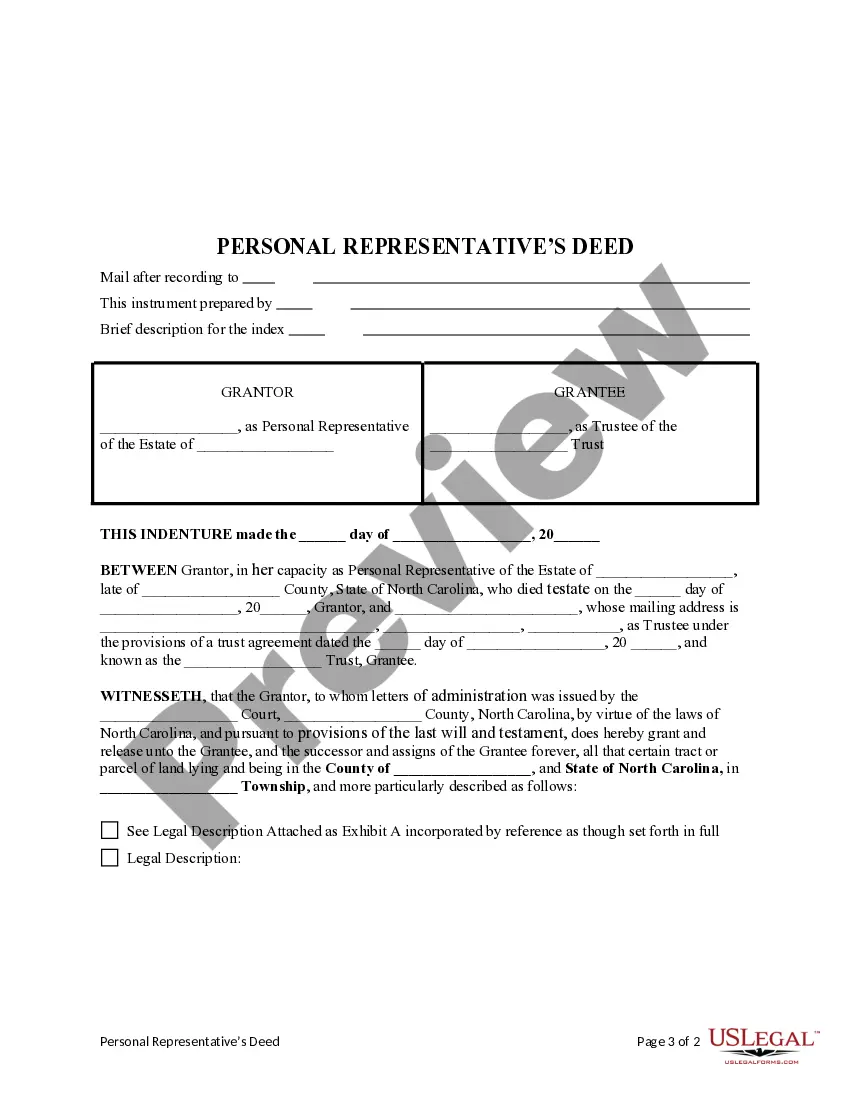

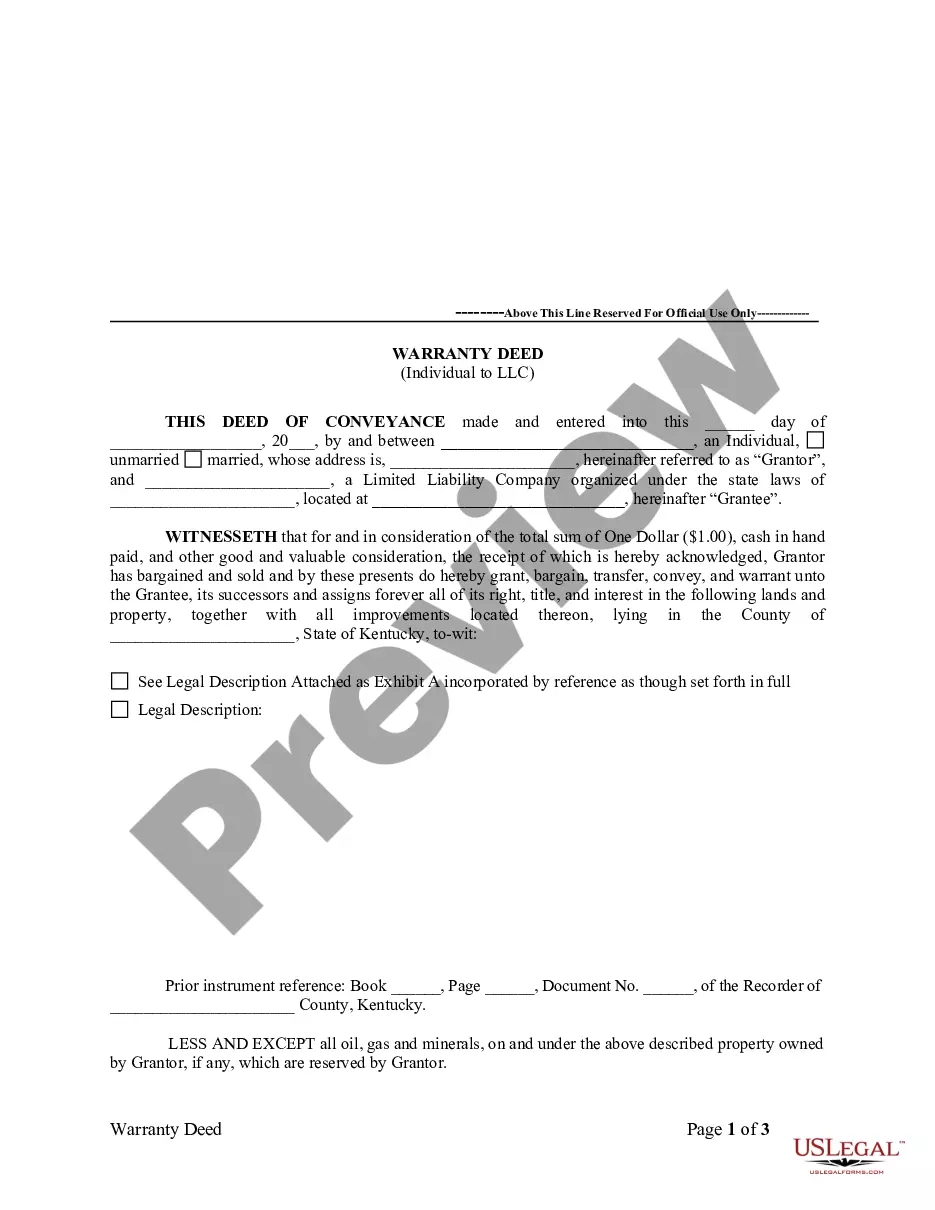

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

North Carolina Personal Representative's Deed to a Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Personal Representative's Deed To A Trust?

Steer clear of expensive attorneys and locate the North Carolina Personal Representative's Deed to a Trust you require at an affordable rate on the US Legal Forms website.

Utilize our straightforward categories feature to search for and acquire legal and tax documents. Review their descriptions and preview them before downloading.

Choose to download the form in PDF or DOCX format. Click Download and locate your template in the My documents section. You are welcome to save the template to your device or print it. After downloading, you can fill out the North Carolina Personal Representative's Deed to a Trust by hand or using editing software. Print it out and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Furthermore, US Legal Forms offers clients with step-by-step guidance on how to download and complete each template.

- US Legal Forms users simply need to Log In and retrieve the specific document they need from their My documents section.

- Those who have not yet obtained a subscription should follow the steps below.

- Verify that the North Carolina Personal Representative's Deed to a Trust is suitable for use in your state.

- If applicable, examine the description and utilize the Preview option prior to downloading the sample.

- If you are sure the document is appropriate for you, click Buy Now.

- If the form is incorrect, employ the search box to find the correct one.

- Next, set up your account and select a subscription plan.

- Pay via credit card or PayPal.

Form popularity

FAQ

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

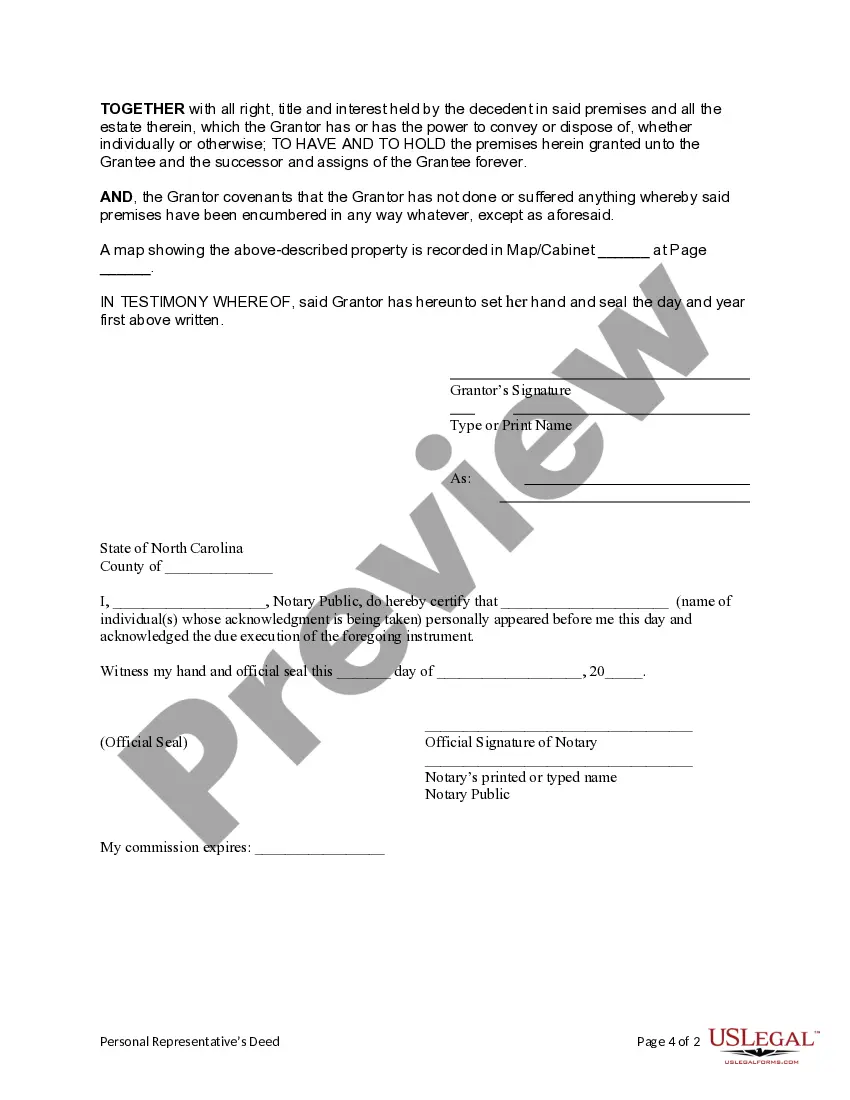

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

A personal representative is appointed by a judge to oversee the administration of a probate estate. It can be a person, an institution such as a bank or trust company, or a combination of both. If the decedent left a last will and testament, it most likely names the individual he wanted to handle this responsibility.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

You can do this by simply signing your name and putting your title of executor of the estate afterward. One example of an acceptable signature would be Signed by Jane Doe, Executor of the Estate of John Doe, Deceased. Of course, many institutions may not simply take your word that you are the executor of the estate.

A personal representative is appointed by a judge to oversee the administration of a probate estate.In most cases, the judge will honor the decedent's wishes and appoint this person. When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

When signing on behalf of the estate the proper signature is Name, Title with regard to the estate. Depending on the language you want to use or the language the the document appointing you use it could be John Smith, Personal Representative; John Smith, Executor; Jane Smith Executrix; John Smith, Administrator; or