Montana Percentage Exchange Agreement

Description

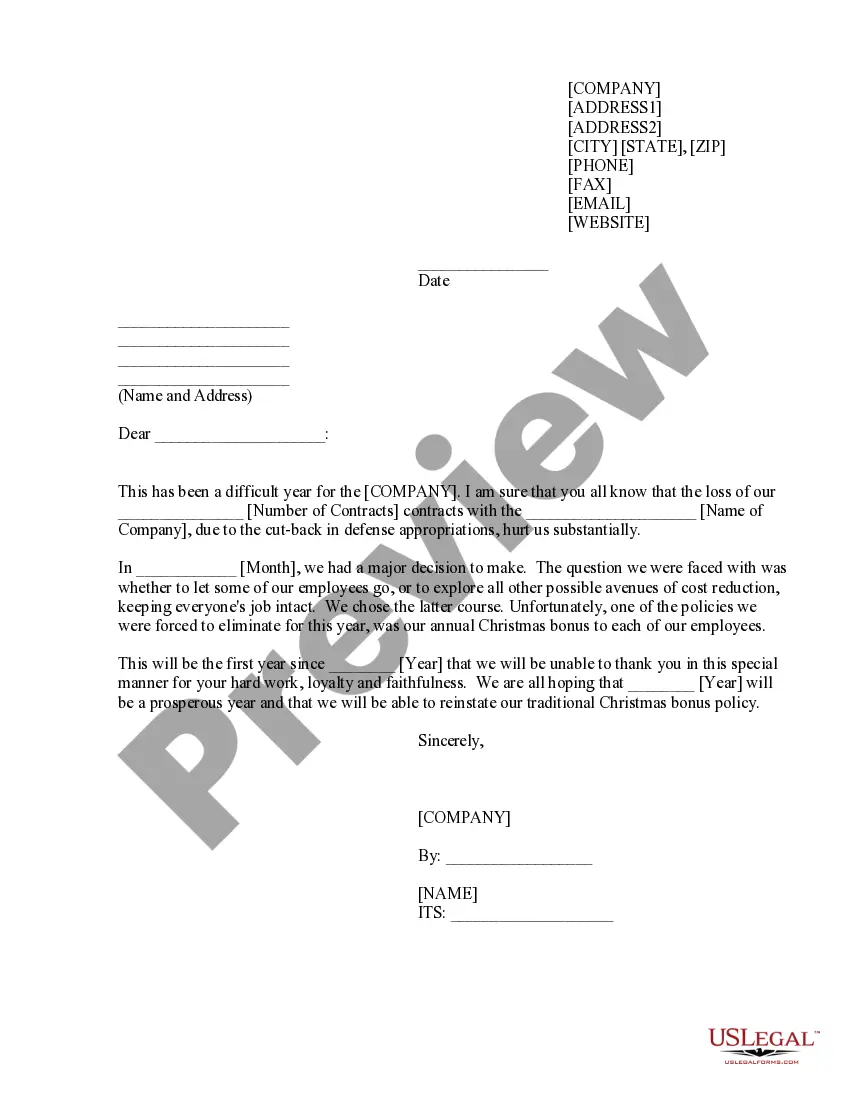

How to fill out Percentage Exchange Agreement?

US Legal Forms - one of the most extensive collections of valid forms in the United States - offers a broad selection of authentic document templates that you can obtain or print.

By using the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Montana Percentage Exchange Agreement in just a few minutes.

If you hold a subscription, Log In and download the Montana Percentage Exchange Agreement from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the saved Montana Percentage Exchange Agreement.

Each template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Montana Percentage Exchange Agreement with US Legal Forms, the most extensive collection of legitimate document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are some easy steps to get you started.

- Ensure you have selected the correct form for your area/region. Click the Review button to examine the form's content.

- Check the form information to confirm that you have chosen the right form.

- If the form doesn't meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the pricing plan you want and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

In Montana, whether a resale certificate is needed depends on the nature of your business transactions. If you are purchasing goods for resale, you will likely need to provide a resale certificate to your suppliers. This ensures that you are not charged sales tax on items you plan to sell. Utilizing a Montana Percentage Exchange Agreement can help streamline your transactions and clarify your tax obligations.

You can typically receive WUE benefits for up to four years, provided you maintain satisfactory academic progress. The Montana Percentage Exchange Agreement allows you to enjoy lower tuition rates throughout your undergraduate studies. It is essential to adhere to the university's requirements to keep your WUE status active. Always consult your institution's guidelines for specific policies regarding the duration of these benefits.

Montana participates in the Western Undergraduate Exchange program, which includes several states with tuition reciprocity. These states include Alaska, Arizona, California, Colorado, Hawaii, Idaho, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming. The Montana Percentage Exchange Agreement facilitates reduced tuition fees for students from these states, enhancing educational opportunities across the region. Always verify the latest updates on participating states for the most accurate information.

Documenting a 1031 exchange requires careful attention to detail to ensure compliance with IRS regulations. The process typically starts by identifying the replacement property within 45 days of selling your original property. You must also complete IRS Form 8824, which outlines the exchange specifics, including the properties involved. Using resources like the US Legal Forms platform can simplify this process and help you properly document your Montana Percentage Exchange Agreement.

The 75% rule in a 1031 exchange allows for tax deferral when the value of a new property is at least 75% of the value of the sold property. This rule is designed to provide flexibility and encourage reinvestment in real estate. If you're exploring a Montana Percentage Exchange Agreement, understanding this rule can help you make strategic investment choices.

In Montana, the rules for 1031 exchanges align with federal regulations, allowing property owners to defer capital gains taxes when selling and buying like-kind properties. Investors must adhere to specific timelines and identification rules to ensure compliance. Utilizing a Montana Percentage Exchange Agreement can simplify this process, making it easier to navigate local regulations.

The 200% rule allows investors to identify multiple replacement properties in a 1031 exchange, provided their total value does not exceed 200% of the value of the sold property. This rule offers flexibility in choosing properties while still complying with IRS regulations. When structuring a Montana Percentage Exchange Agreement, this rule can be beneficial for diversifying your investments.

Certain properties do not qualify for a 1031 exchange, including primary residences, properties held primarily for personal use, and inventory or stocks. Additionally, properties that are not like-kind to the one being sold can be disqualified. Understanding these exclusions is vital when navigating a Montana Percentage Exchange Agreement, as it helps you make informed investment decisions.

Currently, there are discussions in Congress about the potential elimination of 1031 exchanges by 2025. However, no definitive legislation has passed that would affect these exchanges at this time. It is essential to stay informed about potential changes, especially if you are considering a Montana Percentage Exchange Agreement in your investment strategy.

The 75% rule refers to a guideline in 1031 exchanges that allows investors to defer taxes on the sale of a property. Specifically, it states that if you replace your sold property with a new property worth at least 75% of the sold property's value, you can still qualify for tax deferral. This rule is crucial for those engaging in a Montana Percentage Exchange Agreement, ensuring you maximize your investment potential.