Montana Reservation of Production Payment

Description

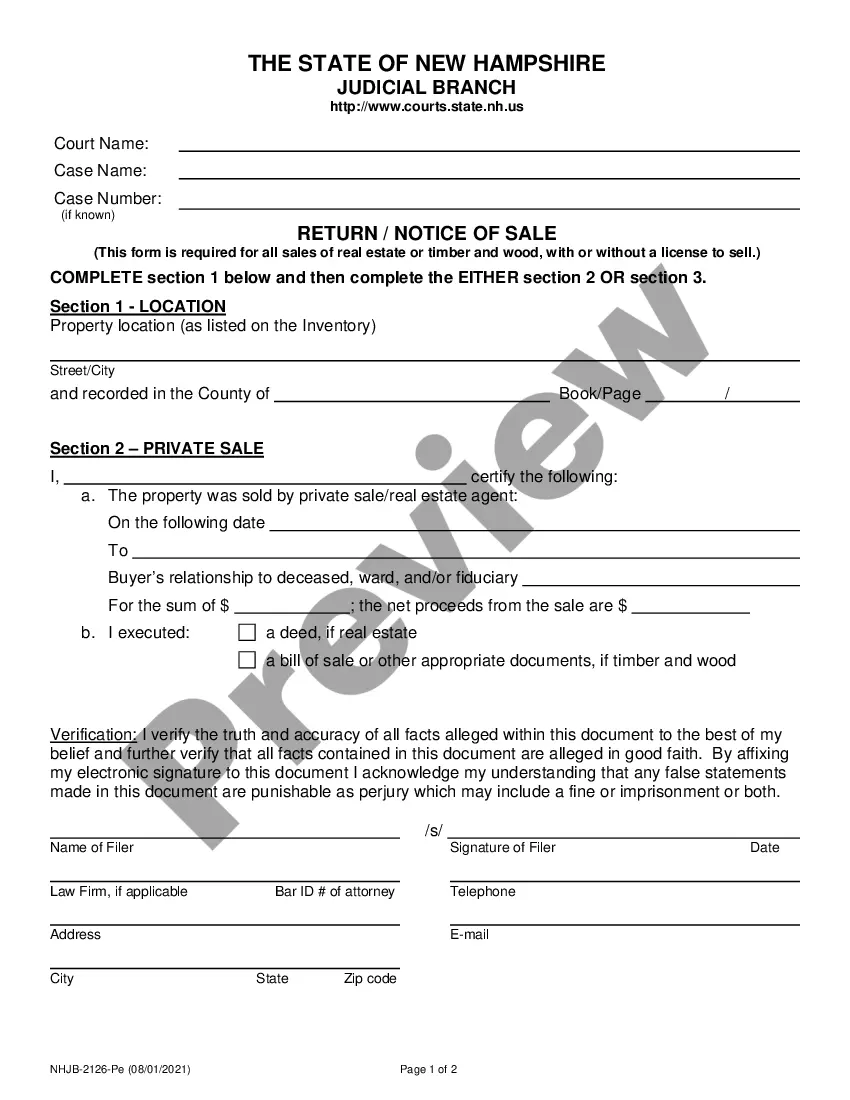

How to fill out Reservation Of Production Payment?

If you need to comprehensive, download, or produce lawful papers themes, use US Legal Forms, the biggest selection of lawful types, which can be found on the web. Utilize the site`s easy and hassle-free lookup to get the papers you need. Various themes for organization and personal purposes are sorted by groups and says, or keywords and phrases. Use US Legal Forms to get the Montana Reservation of Production Payment in just a handful of clicks.

In case you are previously a US Legal Forms consumer, log in for your accounts and click on the Acquire switch to obtain the Montana Reservation of Production Payment. You may also access types you earlier acquired in the My Forms tab of your accounts.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the form for that right town/region.

- Step 2. Utilize the Preview method to check out the form`s content. Do not forget to read the explanation.

- Step 3. In case you are not happy with all the type, use the Lookup area on top of the screen to get other variations of the lawful type format.

- Step 4. Once you have located the form you need, select the Acquire now switch. Pick the prices program you like and add your credentials to register on an accounts.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal accounts to complete the deal.

- Step 6. Pick the formatting of the lawful type and download it on the system.

- Step 7. Comprehensive, revise and produce or sign the Montana Reservation of Production Payment.

Each and every lawful papers format you get is yours eternally. You have acces to each and every type you acquired inside your acccount. Go through the My Forms segment and pick a type to produce or download once again.

Be competitive and download, and produce the Montana Reservation of Production Payment with US Legal Forms. There are millions of skilled and condition-specific types you can use for the organization or personal needs.

Form popularity

FAQ

Federal tax must be withheld at the rate of 30% of gross royalties unless an IRS tax treaty is applicable. Royalties ? Definition, Payment Processing and Tax Reporting wisc.edu ? accounting ? royalties-... wisc.edu ? accounting ? royalties-...

6 percent The amount to withhold is determined by multiplying the net amount of the Montana mineral royalty by 6 percent. This withholding tax rate applies to all types of royalty owners, regardless of whether the royalty owner is an individual, estate, trust, partnership, or other type of business entity. Mineral Royalty Withholding Tax Guide Montana Department of Revenue (.gov) ? uploads ? 2019/08 ? Min... Montana Department of Revenue (.gov) ? uploads ? 2019/08 ? Min... PDF

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone.

The deed to the property is a good place to start researching mineral rights for property in Montana. For surface owners, if the deed says ownership of the property is fee simple or fee simple absolute, that means the surface and mineral rights are intact unless otherwise indicated in the chain of title.

Mineral records are complicated and it may take intensive research to establish title, but minerals are real property and therefore similar to real estate. Unlike metals or coal, in some formations oil and natural gas can migrate under the surface. Understanding Mineral Rights - MSU Extension msuextension.org ? montguide ? guide msuextension.org ? montguide ? guide

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

Montana has a graduated individual income tax, with rates ranging from 1.00 percent to 6.75 percent. Montana has a 6.75 percent corporate income tax rate. Montana does not have a state sales tax and does not levy local sales taxes. Montana's tax system ranks 5th overall on our 2023 State Business Tax Climate Index. Montana Tax Rates & Rankings taxfoundation.org ? location ? montana taxfoundation.org ? location ? montana