Montana Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

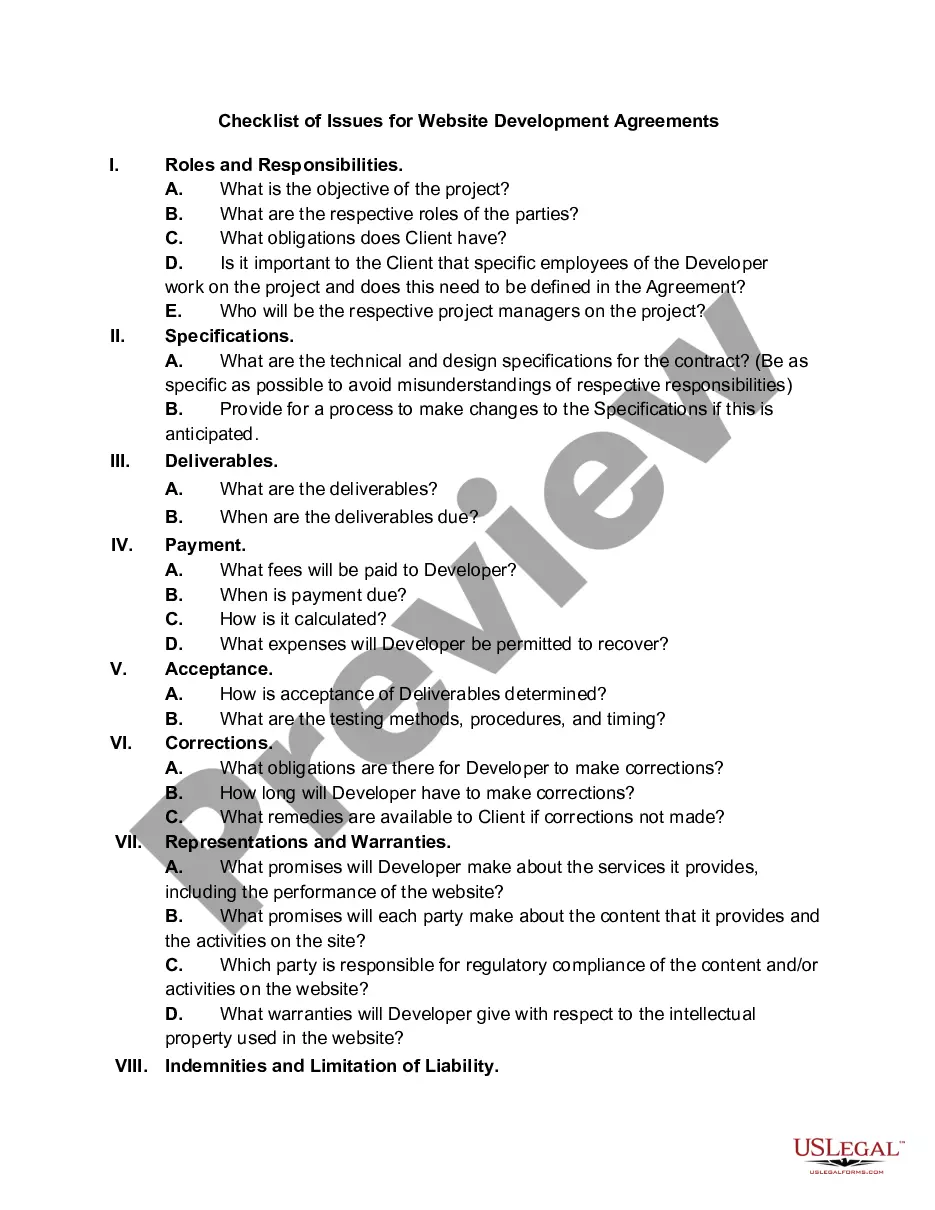

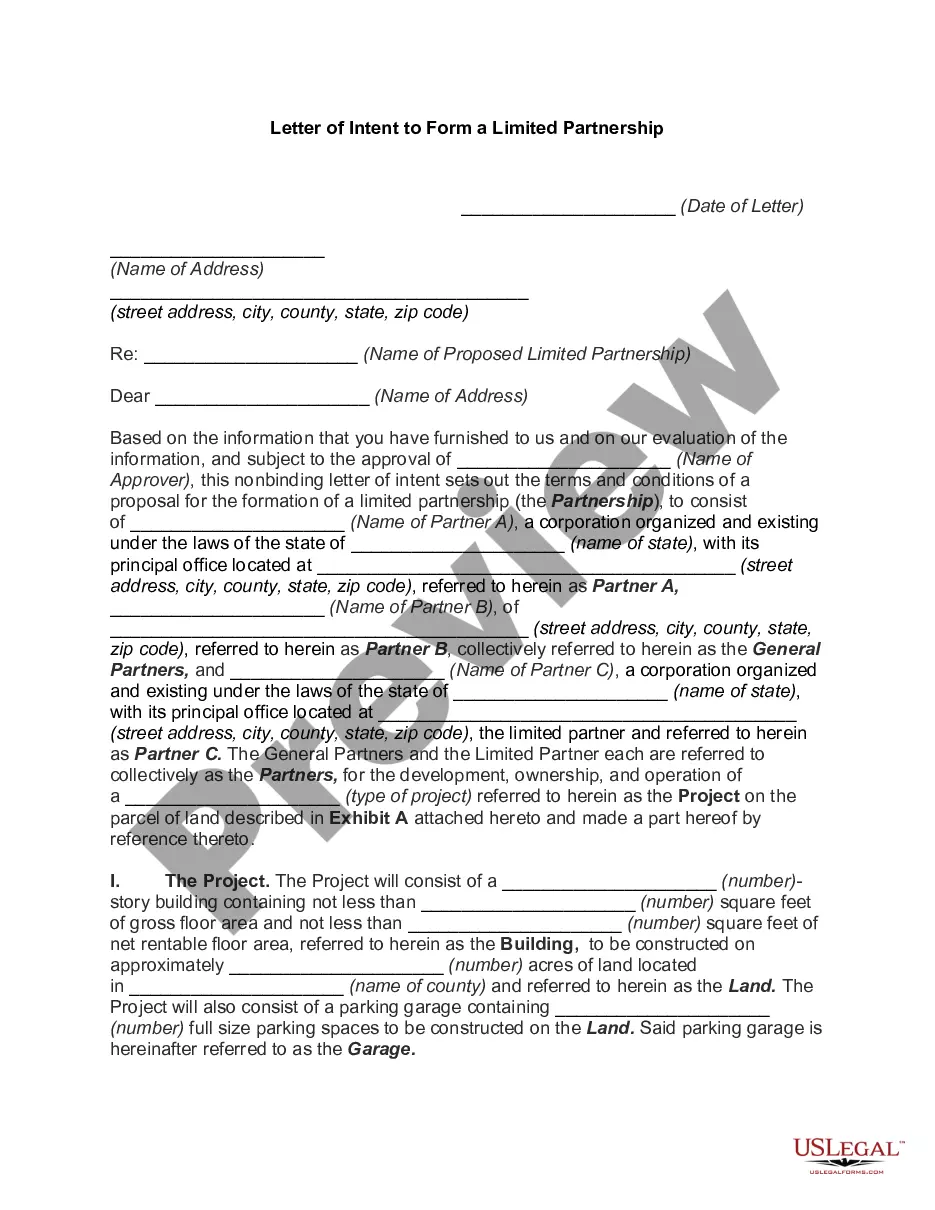

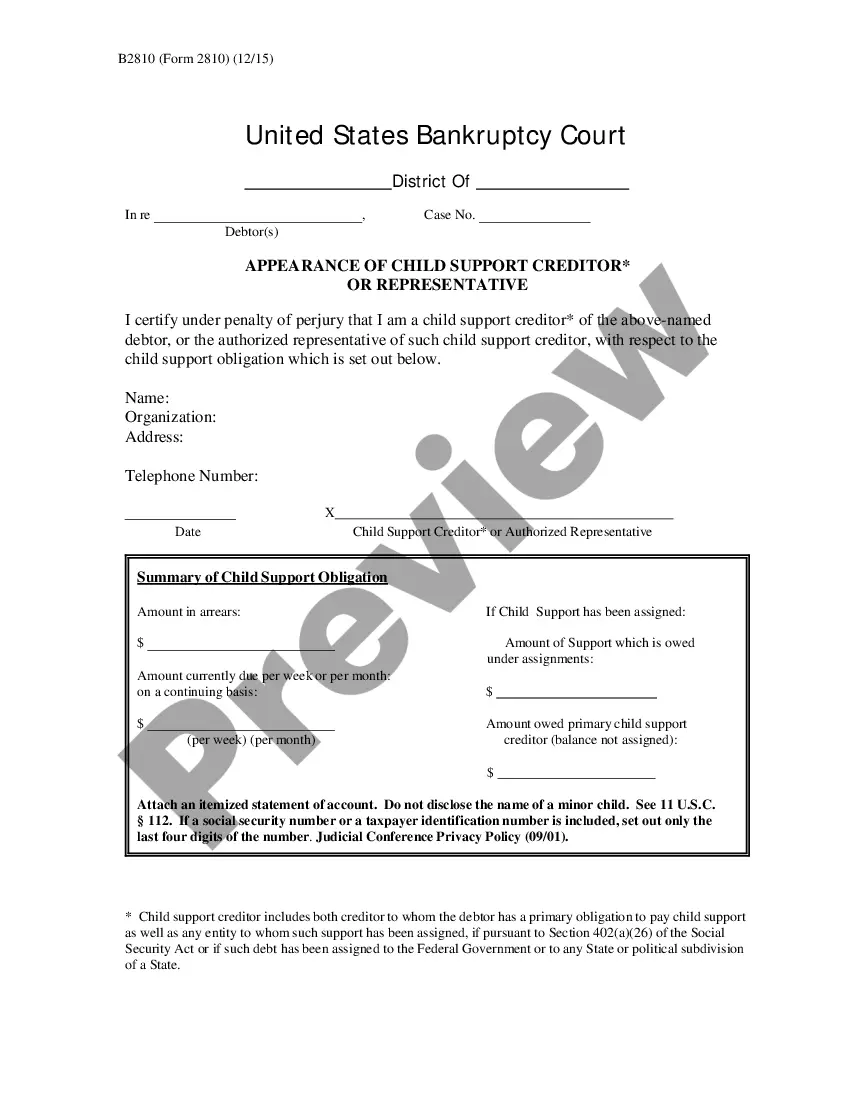

Discovering the right authorized document design could be a have a problem. Naturally, there are a lot of layouts available on the Internet, but how will you find the authorized type you need? Take advantage of the US Legal Forms internet site. The services offers a large number of layouts, including the Montana Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, that can be used for enterprise and private demands. Every one of the varieties are inspected by specialists and satisfy federal and state specifications.

In case you are already authorized, log in to the accounts and click the Obtain key to obtain the Montana Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest. Make use of accounts to appear throughout the authorized varieties you might have ordered previously. Go to the My Forms tab of the accounts and have another backup of the document you need.

In case you are a new consumer of US Legal Forms, here are straightforward instructions that you can comply with:

- Very first, ensure you have selected the correct type for your personal town/state. You can check out the shape utilizing the Review key and browse the shape explanation to make certain this is the best for you.

- In the event the type does not satisfy your needs, make use of the Seach field to obtain the correct type.

- When you are certain the shape would work, click on the Acquire now key to obtain the type.

- Select the prices plan you would like and enter the required details. Create your accounts and buy an order making use of your PayPal accounts or charge card.

- Select the submit formatting and download the authorized document design to the system.

- Comprehensive, revise and produce and indication the attained Montana Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

US Legal Forms will be the most significant library of authorized varieties where you will find a variety of document layouts. Take advantage of the service to download professionally-made papers that comply with state specifications.

Form popularity

FAQ

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease. Royalty Interest ? occurs when mineral rights are leased. Should the property owner enter into a lease agreement with another party, the owner of the mineral rights retains royalty interest.

Mineral Interest (MI) When the mineral rights are conveyed to another person or entity, they are ?severed? from the land, and a separate chain of title begins. When a person owns less than 100% of the minerals, they are said to own a fractional or undivided mineral interest.

Hear this out loud PauseThe formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Hear this out loud PauseA mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

Hear this out loud PauseAn Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

Hear this out loud PauseThe term ?undivided interest? refers to a type of ownership in which multiple parties share ownership of a single asset without the property being physically divided among them. This is commonly seen in real estate, natural resource holdings, and certain types of financial investments.