Montana Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

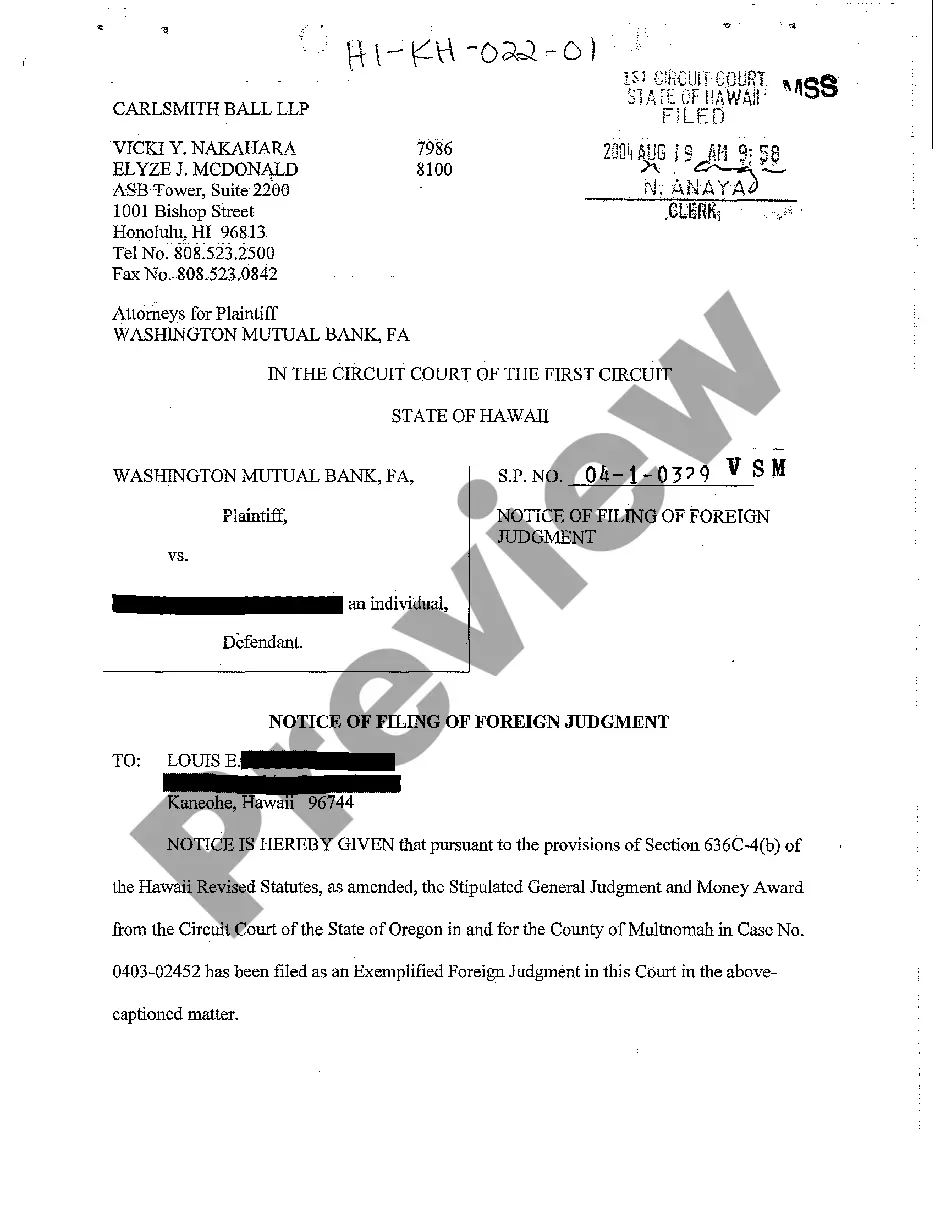

Finding the correct authentic document template can be a challenge. Of course, there are numerous templates available online, but how do you locate the authentic type you need? Utilize the US Legal Forms website. The service provides thousands of templates, such as the Montana Statement to Add to Credit Report, that can be utilized for business and personal purposes. All the documents are verified by professionals and meet federal and state standards.

If you are already a member, Log In to your account and click the Download button to access the Montana Statement to Add to Credit Report. Use your account to browse through the authentic documents you have previously purchased. Visit the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct document for your city/state. You can preview the form using the Review button and read the form description to confirm it is the right one for you. If the document does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the document is suitable, click the Get now button to retrieve the form. Choose the pricing option you need and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the authentic document template to your device. Complete, modify, print, and sign the obtained Montana Statement to Add to Credit Report.

Take advantage of this service to secure the rightful legal documents you require.

- US Legal Forms is the largest collection of authentic documents.

- You can find a variety of document templates.

- Utilize the service to obtain professionally crafted files.

- All documents comply with state regulations.

- Access thousands of templates for various needs.

- Expertly verified documents are available.

Form popularity

FAQ

Raising your credit score by 200 points in just 30 days requires a focused approach. Start by reviewing your credit report for errors and disputing any inaccuracies. Additionally, consider adding a Montana Statement to Add to Credit Report, which can provide context for your credit history. Paying down existing debts and ensuring all bills are current will also positively impact your score.

Yes, you can add a statement to your credit report to explain any negative information. This statement allows you to share your perspective with potential creditors. Using a Montana Statement to Add to Credit Report can be an excellent way to communicate your financial history clearly. Consider using uslegalforms to help you draft a professional and effective statement.

To add something to your credit report, you typically need to contact the credit bureau directly. They will provide guidelines on how to submit your information or dispute inaccuracies. Additionally, including a Montana Statement to Add to Credit Report can be beneficial, as it allows you to provide context for any changes you want lenders to consider. Platforms like uslegalforms can assist you in drafting this statement effectively.

Yes, putting a freeze on your credit can be a prudent decision, especially if you suspect fraud. A credit freeze restricts access to your credit report, making it harder for identity thieves to open accounts in your name. However, remember that it won’t directly improve your credit score. If you're managing your credit well and want to add a Montana Statement to Add to Credit Report, a freeze may not be necessary.

To add a statement to your credit report, contact the credit bureau that maintains your report. You will need to provide a written statement explaining your circumstances. The Montana Statement to Add to Credit Report can be a useful tool in this process, helping you communicate effectively with the bureaus. Consider using platforms like uslegalforms to streamline the creation of your statement.

Yes, you can include a statement on your credit report, but it's typically limited to a certain number of characters. While the length may vary, a concise explanation of your financial situation can provide context to lenders. Using a Montana Statement to Add to Credit Report allows you to clarify any negative information, ensuring that potential creditors see the full picture.

Achieving an 800 credit score in 45 days requires focused efforts. Begin by paying down existing debts, especially on credit cards, as low credit utilization positively impacts your score. Additionally, review your credit report for errors and dispute any inaccuracies. Finally, consider adding a Montana Statement to Add to Credit Report to explain any past financial difficulties, which can help lenders understand your situation better.

To add an account to your credit report, first, contact the credit bureau directly. You will need to provide relevant documentation that verifies your account information. For those in Montana, using the Montana Statement to Add to Credit Report can simplify this process. Additionally, consider using US Legal Forms for templates and guidance to ensure you submit everything correctly.