This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

Montana Form of Accounting Index

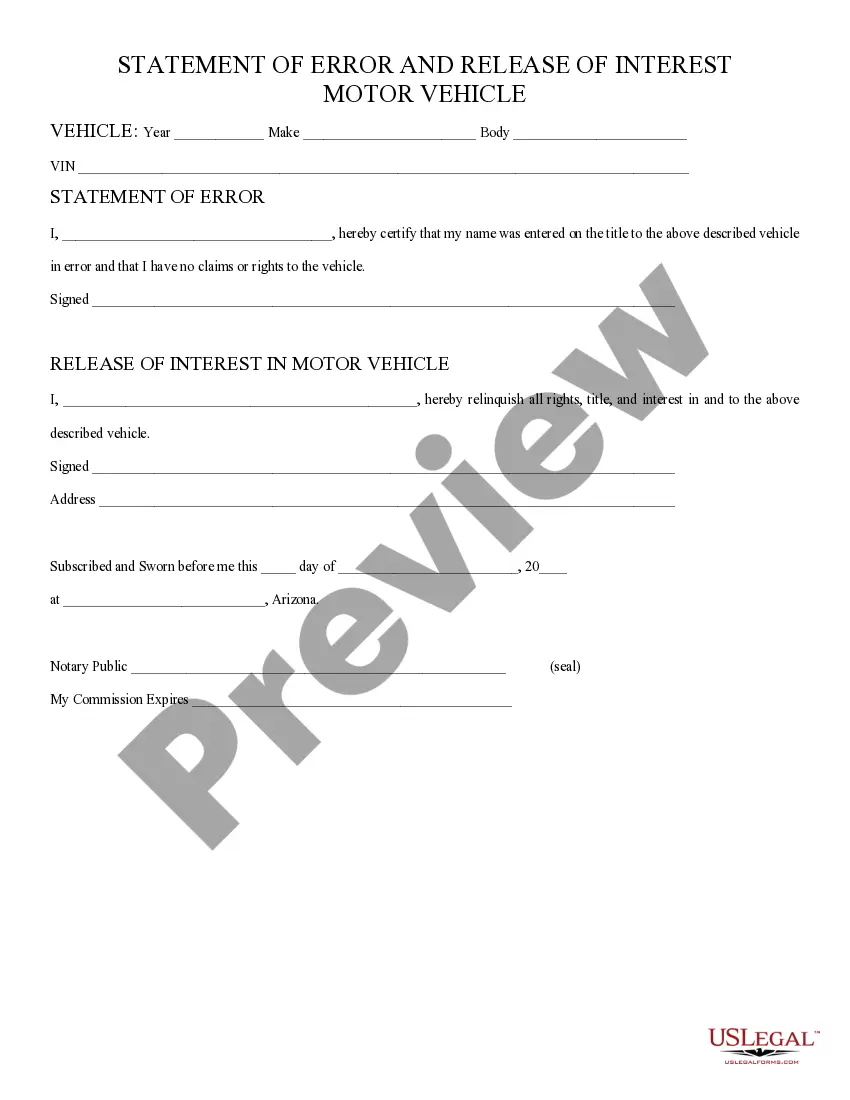

Description

How to fill out Form Of Accounting Index?

Selecting the finest legal document template can be challenging.

Of course, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Montana Form of Accounting Index, suitable for both business and personal needs.

You can examine the form using the Review button and view the form description to confirm it is suitable for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Montana Form of Accounting Index.

- Use your account to browse the legal forms you have previously ordered.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines you should follow.

- First, ensure you have selected the correct form for your city or county.

Form popularity

FAQ

In Montana, state income tax rates vary based on your income level, ranging from 1% to 6.9%. Understanding these rates is important for effective tax planning and aligns with the guidelines of the Montana Form of Accounting Index. You can use uslegalforms to access reliable tax resources, helping you navigate your tax obligations and make informed decisions about your finances.

An annual report for an LLC in Montana is a requirement that reports crucial business information to the state, such as ownership and financial details. This keeps your business in good standing and up to date, as outlined by the Montana Form of Accounting Index. By using resources like uslegalforms, you can prepare and file your report easily and maintain your legal obligations.

An LLC annual report serves as a formal document that provides the state with updated information about your business. This includes address changes, management structure, and financial details, aligning with the requirements set forth in the Montana Form of Accounting Index. Filing this report ensures that your LLC stays compliant and avoids penalties. Tools on the uslegalforms platform can simplify this process for you.

Your Montana withholding account number is essential for managing state income tax withholdings. You can find it on your Montana Form of Accounting Index provided by the state. If you need assistance, consider using the uslegalforms platform to ensure you complete your form accurately and efficiently. It streamlines the process and helps you keep track of important numbers.

To obtain a tax ID number in Montana, you will need to apply through the Internal Revenue Service (IRS) as well as the Montana Department of Revenue. Start by completing the IRS Form SS-4, which is the application for an Employer Identification Number (EIN). Once you have your EIN, ensure that you comply with any state-specific requirements, which can be conveniently found in the Montana Form of Accounting Index. By following these steps, you can establish your business on solid ground and access additional resources available on platforms like US Legal Forms.

To register for Montana state income tax, start by visiting the Montana Department of Revenue's website. Complete the necessary registration forms, providing information about your business structure and income. Maintaining organized records through the Montana Form of Accounting Index will simplify this registration process. It ensures you have all required documents and information readily available.

You should renew your LLC in Montana by the due date stated in your annual report. Typically, this occurs on the anniversary of your LLC's formation. Set reminders to manage this crucial task on time, ensuring your business remains in good standing. Utilizing the Montana Form of Accounting Index can help you keep track of upcoming renewal deadlines.

To apply for a Montana withholding account, visit the Montana Department of Revenue's website and complete the online application form. You will need to provide information about your business and its employees. Having a Montana Form of Accounting Index can help you track employee information efficiently. This will streamline your application process and ensure accuracy.

The bars chart of accounts in Montana is a state-specific framework designed to help businesses categorize and manage their financial information effectively. It provides a comprehensive overview of financial accounts tailored to meet the state's accounting standards. By adhering to the bars chart, businesses can ensure compliance with the Montana Form of Accounting Index, thereby minimizing risks.

The four types of chart of accounts include the standard chart, consolidated chart, detailed chart, and budget chart. Each type serves a different purpose in financial reporting and management. Utilizing the right chart can help businesses align their practices with the Montana Form of Accounting Index, ultimately leading to improved financial oversight.