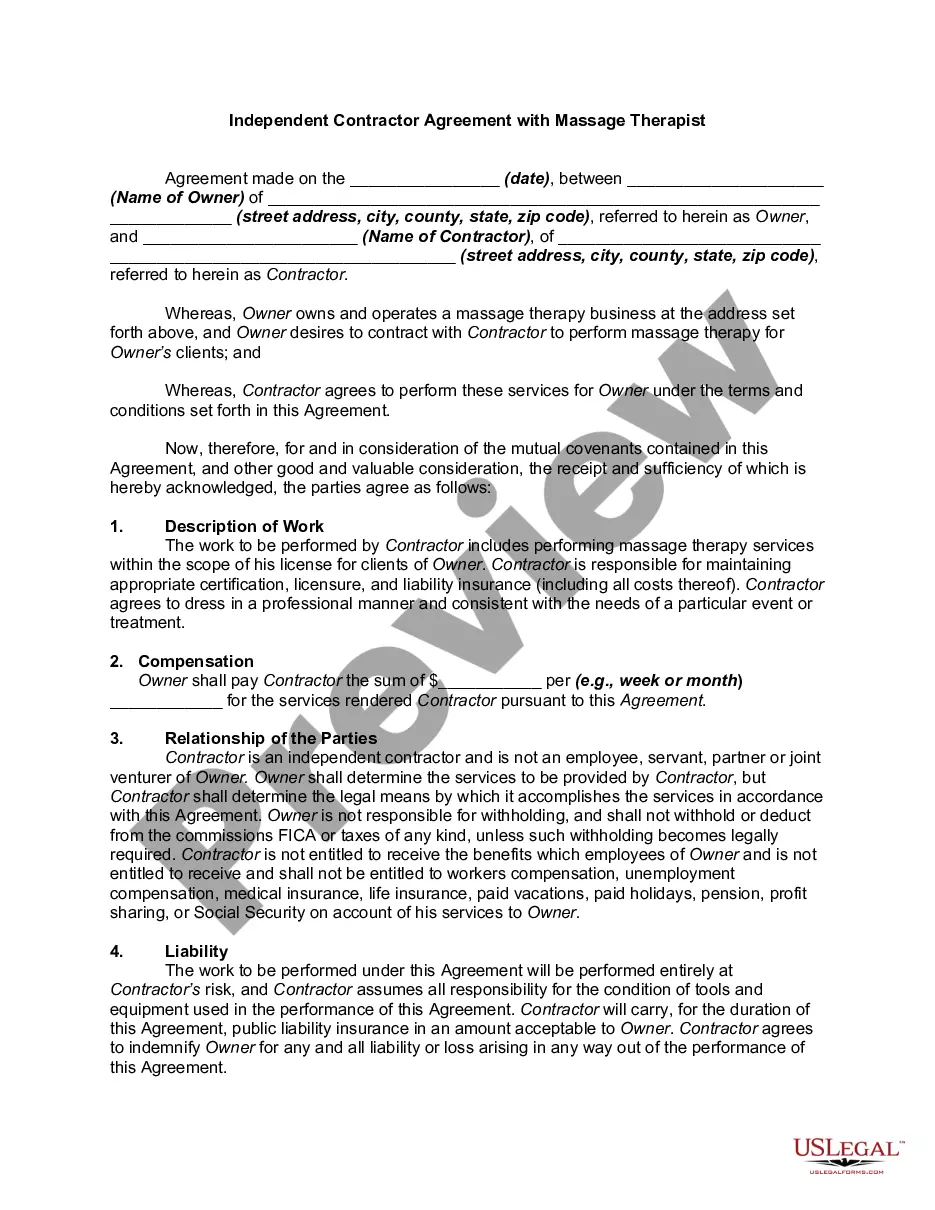

Montana Self-Employed Masseuse Services Contract

Description

How to fill out Self-Employed Masseuse Services Contract?

Selecting the appropriate valid document format can present challenges.

Certainly, there are numerous templates accessible online, but how can you find the specific valid form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Montana Self-Employed Masseuse Services Agreement, that can be utilized for both business and personal purposes.

- All documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Montana Self-Employed Masseuse Services Agreement.

- Utilize your account to search for the legal forms you have previously obtained.

- Navigate to the My documents section of your account and retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

- First, ensure you have chosen the correct form for your jurisdiction/county. You can review the form using the Preview button and read the form details to confirm it is suitable for you.

Form popularity

FAQ

Prop 22 was a ballot measure that passed on November 3, 2020. It declares that app-based transportation companies, such as rideshare (i.e. Uber and Lyft) and food delivery companies (i.e. Grubhub), are exempt from AB5 and its drivers are classified as independent contractors.

Self Employed, Contractors, and other individuals may qualify for Pandemic Unemployment Assistance (PUA). The user-friendly application can be accessed by going to mtpua.mt.gov and clicking on Apply for Pandemic Unemployment Assistance or by clicking on the blue button below.

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

Montana is ending its expansion of unemployment benefits including a $300 weekly increase in aid more than two months early. Some fear that other states will take similar measures before the labor market recovers. Montana is opting to end its participation in federal unemployment programs on June 27, Gov.

To be eligible for this benefit program, you must a resident of Montana and meet all of the following: Unemployed, and. Worked in Montana during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by Montana guidelines, and.

Many massage therapists work as independent contractors, and in light of this ruling and subsequent bill, many will continue to do so; status changes may soon be required if you work for a company that classifies and treats you as an independent contractor rather than an employee and your situation does not pass the

Amount and Duration of Unemployment Benefits in MontanaThe maximum weekly benefit amount is currently $552; the minimum amount is currently $163. You may receive benefits for a maximum of 28 weeks. (In times of very high unemployment, additional weeks of benefits may be available.)

What It Is: PUA presently provides benefits to the self-employed, the underemployed, independent contractors, and individuals who have been unable to work due to health or COVID-19 affected reasons. How It's Changing: Beginning June 27, 2021, the Montana will no longer participate in the federal PUA program.

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.

How AB 5 might affect licensed massage therapists isn't determined yet, as massage therapy is not specifically mentioned as an exempt profession in the bill. However, many professions will be exempt, including some health care occupations.