Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor

Description

How to fill out Athletic Person Training Or Trainer Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online trying to locate the authentic document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can easily download or print the Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor via my service.

First, ensure you have selected the correct document template for the state/region of your choice. Review the form description to confirm you have chosen the right form. If available, utilize the Review button to view the document template at the same time. If you wish to obtain another version of the form, use the Search field to find the template that meets your desires and needs. Once you find the template you want, click on Acquire now to proceed. Select the pricing plan you want, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit and sign and print the Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor. Download and print a vast number of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

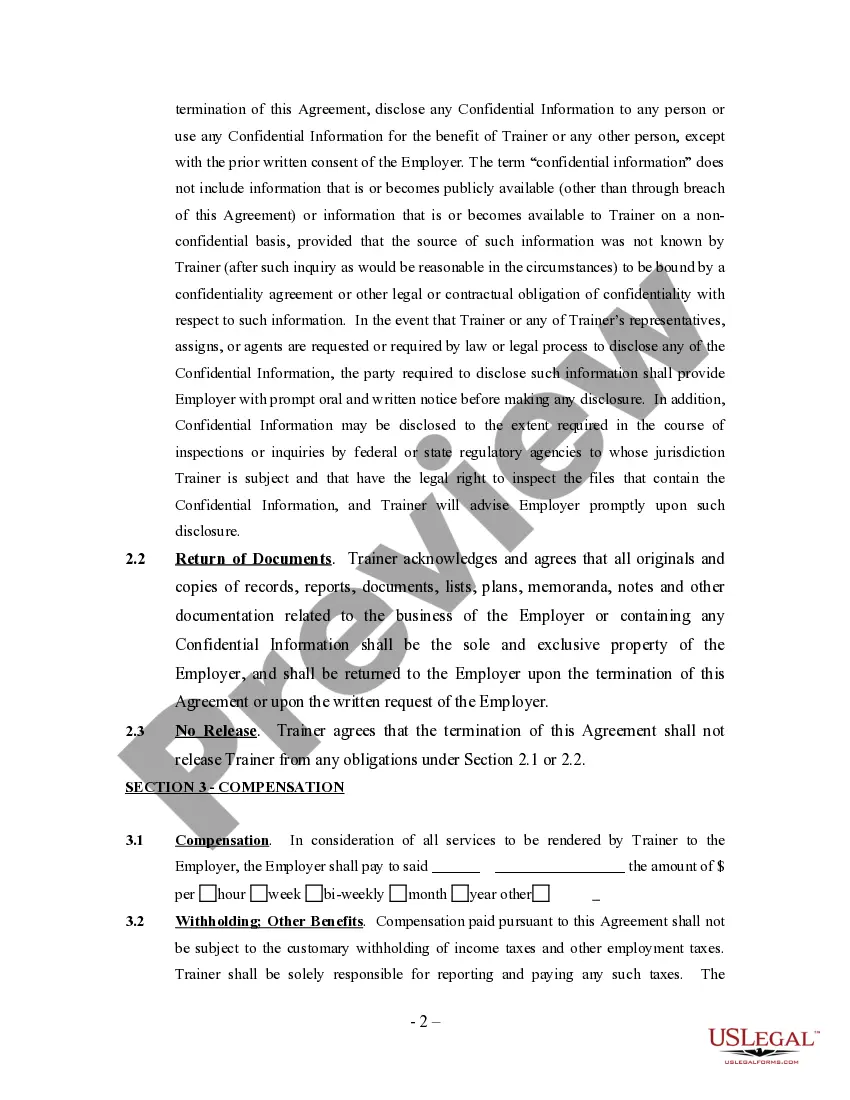

A basic independent contractor agreement typically includes essential components such as the identification of the parties, scope of work, payment terms, and duration of the agreement, similar to a Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor. It may also cover intellectual property rights and confidentiality clauses. This type of agreement sets expectations and protects both the contractor and the client, fostering a successful working relationship.

To write a contract as an independent contractor, start by identifying the parties and the nature of the services provided under a Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor. Outline the specific terms of engagement, payment schedules, and confidentiality clauses. Additionally, include termination conditions and dispute resolution methods. A thoughtful approach ensures both parties fully understand their obligations.

Yes, having a contract is essential for an independent contractor working on a Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor basis. A contract protects your rights and clarifies expectations between you and your clients. It helps prevent misunderstandings and outlines the terms of service. Therefore, a well-drafted contract serves as a foundation for your professional interactions.

Writing an independent contractor agreement, such as a Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor, involves several key steps. Start with a clear introduction that outlines the parties involved. Next, include the scope of work, payment terms, and any relevant deadlines. Ensure you review the terms for clarity and completeness to foster a positive working relationship.

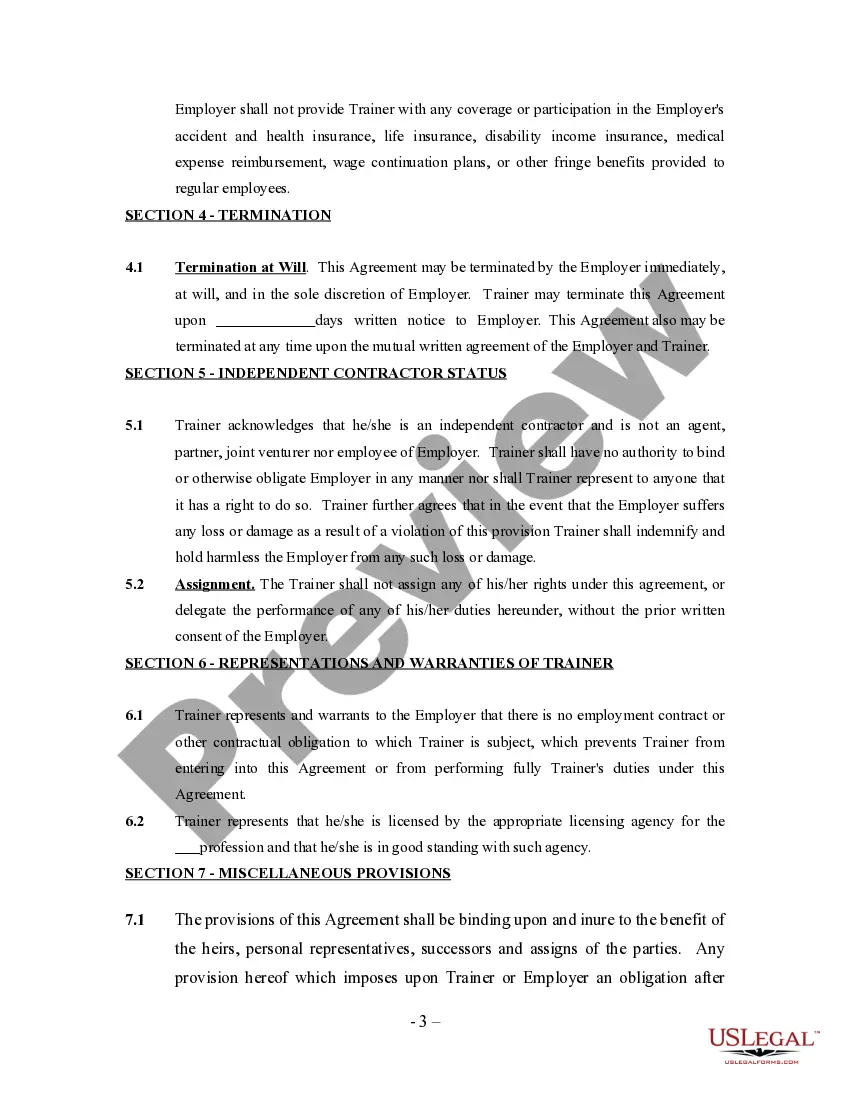

Certainly, a personal trainer can be self-employed, providing them the freedom to work on their own terms. By entering into a Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor, trainers can set their own hours and choose their clients. This path often leads to greater job satisfaction, as well as the ability to tailor services to meet individual client needs. Utilizing resources like U.S. Legal Forms can simplify the process of drafting agreements that establish clear expectations for both trainers and clients.

Yes, fitness instructors can be classified as 1099 independent contractors. This classification allows them to operate as self-employed individuals while offering services under Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor terms. Being a 1099 worker means instructors manage their own taxes and have the flexibility to determine their own schedules, which many find appealing. It's important for fitness instructors to understand the implications of this arrangement, especially regarding tax obligations and legal responsibilities.

Yes, businesses can require training for independent contractors, especially in specialized fields like fitness training. Training helps ensure consistency in service and compliance with safety standards. However, it’s important to outline training requirements clearly in your contract. Utilizing the Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor can help you set these expectations effectively.

Whether personal trainers are classified as employees or independent contractors depends on various factors. These include the level of control over their work and the nature of their agreement with clients. Many personal trainers choose the independent contractor route for flexibility and autonomy. However, reviewing the Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor can provide clarity on this classification.

Fitness trainers can often operate as independent contractors, depending on their employment arrangement. This status allows them more flexibility in their work schedule and client interactions. However, it's essential to confirm their classification aligns with Montana's legal standards. Referencing the Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor will help clarify their status.

Filling out an independent contractor agreement requires attention to detail. First, include the parties' names, the scope of services, payment terms, and the duration of the contract. Make sure to outline responsibilities and any other expectations clearly. Utilizing platforms like USLegalForms can simplify this process, ensuring your Montana Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor is completed correctly.