Montana MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

Are you presently in the situation where you require documents for both business or personal reasons almost every single day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, like the Montana MHA Request for Short Sale, designed to meet state and federal requirements.

Once you find the correct form, click on Purchase now.

Choose the subscription plan you prefer, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Montana MHA Request for Short Sale template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/region.

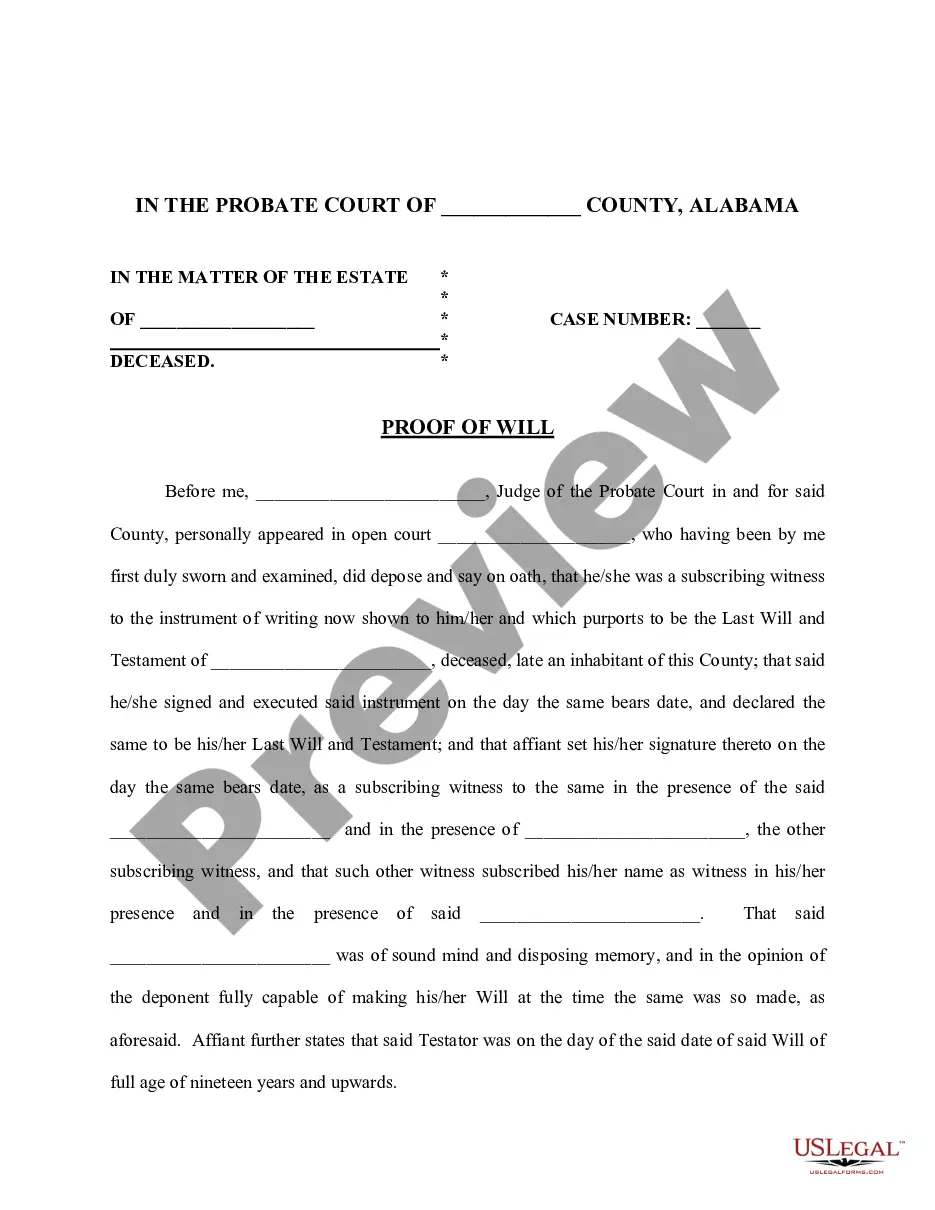

- Utilize the Review option to inspect the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

In a short sale, the seller typically requests the lender to accept less than the total amount owed on the mortgage. This request is part of the Montana MHA Request for Short Sale process, where you present a case for why the lender should agree to the reduced payout. The seller’s ultimate goal is to avoid foreclosure and find a mutually beneficial outcome for both parties involved.

Writing a hardship letter for a Montana MHA Request for Short Sale involves clearly explaining your financial situation and the reasons for your hardship. Begin with an introduction of who you are and your mortgage details, followed by a detailed account of your circumstances. Remember to express your intent to resolve the matter amicably and explain why a short sale is the best solution for both you and the lender.

To get approved for a Montana MHA Request for Short Sale, you must demonstrate financial hardship that makes it impossible for you to continue your mortgage payments. Typically, you'll need to submit a short sale package, which includes financial documents, bank statements, and a hardship letter. Working with your lender and possibly an experienced real estate agent can streamline this process, ensuring you meet all requirements effectively.

The foreclosure process in Montana can take anywhere from a few months to a year, depending on various factors. These factors include the type of foreclosure and whether the borrower contests the sale. Understanding this timeline is crucial if you are considering a Montana MHA Request for Short Sale, as it may influence your decisions moving forward.

The Small Tract Financing Act in Montana provides an alternative way to finance smaller parcels of real estate. This act allows for easier lending terms and can benefit borrowers looking to secure land without debt complications. If you are exploring a Montana MHA Request for Short Sale, understanding this act could open up additional financing options for your property.

Yes, Montana does allow transfer on death deeds. This type of deed enables property owners to pass on their real estate to beneficiaries without going through probate. If you're thinking about a Montana MHA Request for Short Sale, it’s essential to know how these deeds can affect property transfer during financial distress.

In Montana, foreclosures typically follow a non-judicial process, meaning the lender can sell the property without going to court. This process begins when a borrower fails to make mortgage payments and can take a few months to complete. If you're navigating a Montana MHA Request for Short Sale, understanding this process can help you find solutions that might prevent foreclosure.

Using a deed of trust provides more flexibility compared to a traditional mortgage. In Montana, it simplifies the process of securing property loans, allowing for a quicker resolution in case of default. This can be particularly beneficial when you are looking into a Montana MHA Request for Short Sale, as it can speed up the transaction.

A short sale approval letter is a formal document from the lender indicating agreement to sell the property for less than the owed mortgage amount. This letter is vital when completing the Montana MHA Request for Short Sale process. It outlines the conditions under which the sale will occur, allowing both buyers and sellers to proceed with confidence. Having this letter is crucial for closing the deal.

To avoid capital gains tax on real estate in Montana, consider utilizing exemptions such as the primary residence exclusion. If you qualify and the property involved in the Montana MHA Request for Short Sale meets specific criteria, you can potentially exclude gains from taxation. Consulting with a tax professional is essential to navigate the details effectively.