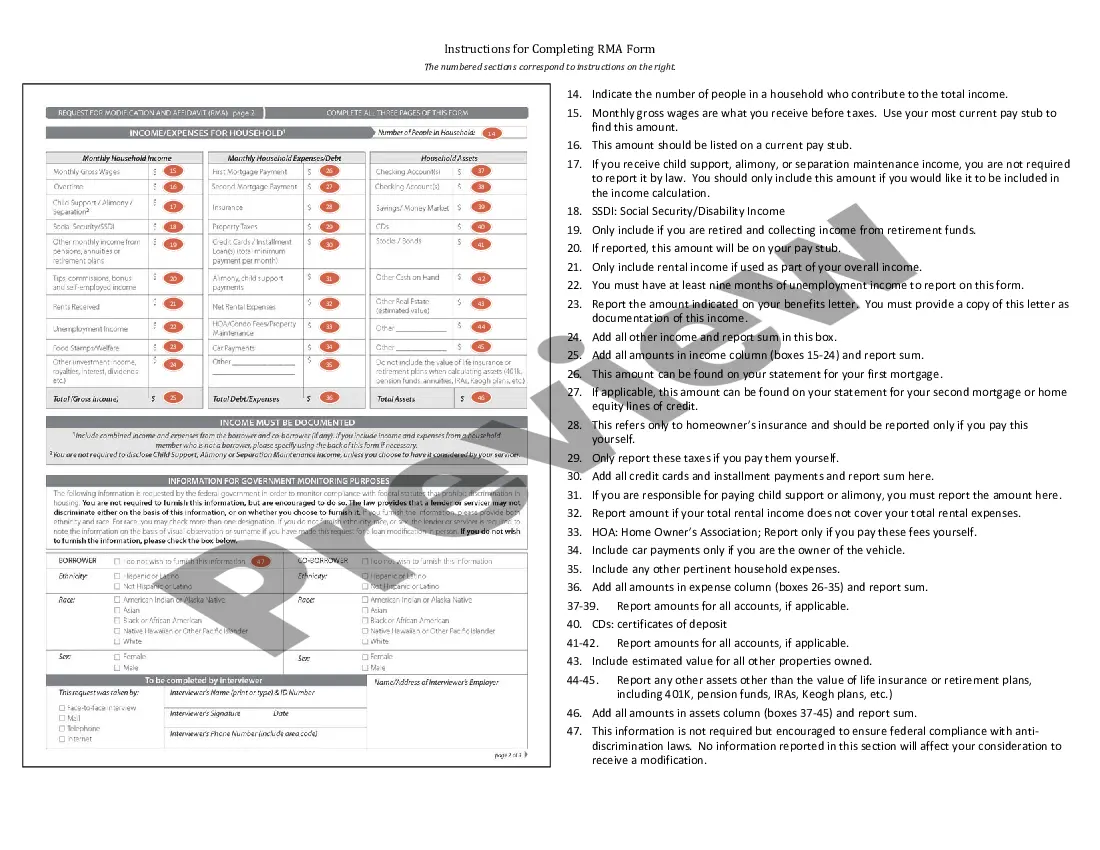

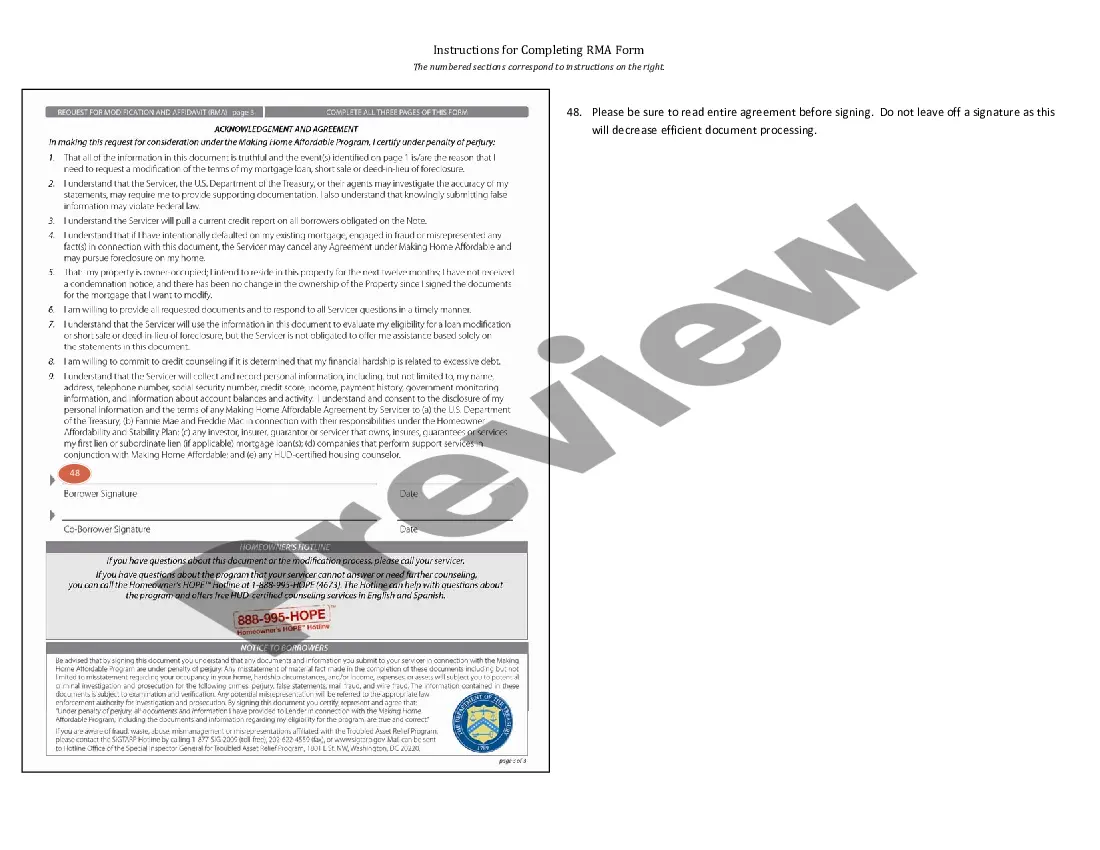

Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Locating the appropriate legal document format can be a challenge.

Clearly, there are numerous web templates available online, but how do you obtain the legal form you desire.

Utilize the US Legal Forms website.

If you are a new client of US Legal Forms, here are simple instructions you should follow: First, ensure you have selected the right form for your city/county. You can preview the form using the Preview button and review the form summary to confirm this is suitable for you. If the form does not meet your needs, use the Search field to find the correct form. Once you are confident that the form is acceptable, click the Buy now button to obtain the form. Choose the pricing plan you want and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document format to your device. Finally, complete, revise, print, and sign the obtained Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Take advantage of the service to download properly designed documents that adhere to state requirements.

- The service offers thousands of templates, including the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form, that you can use for business and personal needs.

- All forms are verified by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to acquire the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- Use your account to view the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and download another copy of the document you need.

Form popularity

FAQ

In mortgage terms, RMA stands for Request for Loan Modification and Affidavit. This form is essential for homeowners seeking a loan modification to make their mortgage payments more manageable. Completing the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form accurately can facilitate the review process by your lender. Familiarity with this terminology is key to effectively navigating the modification process.

A hardship letter for a mortgage is a personal statement outlining your financial struggles. For instance, you might describe how job loss or unexpected medical expenses have affected your ability to make mortgage payments. When submitting your hardship letter together with the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you give your lender a clear view of your situation. Be honest and specific to help strengthen your request.

The full form of RMA is Request for Loan Modification and Affidavit. This crucial form allows borrowers to formally request changes to their mortgage agreement based on their current financial situation. By accurately filling out the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can effectively communicate your need for modification to your lender. Knowledge of this terminology can empower you in your mortgage discussions.

Several factors may disqualify you from receiving a loan modification. These include being in foreclosure or having late payments, not demonstrating financial hardship, or failing to provide required documents for the Request for Loan Modification and Affidavit RMA Form. Moreover, if you have previously been denied a modification, it may complicate your request. Understanding these disqualifiers can help you prepare better.

RMA in mortgage refers to the Request for Loan Modification and Affidavit. This form is submitted to lenders when homeowners seek adjustments to their mortgage terms. Completing the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form can help you present your case for a more manageable mortgage payment. Accurate submission of this form is vital for a successful modification process.

In the context of real estate, RMA stands for Request for Loan Modification and Affidavit. This document plays a crucial role in the mortgage modification process. When you submit the Request for Loan Modification and Affidavit RMA Form, you provide your lender with necessary information to review your financial situation. Understanding RMA is essential for navigating potential modifications to your mortgage.

The timeline for loan modification approval varies, but it often takes several weeks after you submit your application. Factors that influence this timeline include the lender's workload and the completeness of your Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Staying in touch with your lender can help keep the process moving smoothly.

Getting approved for a loan modification can be challenging, but it is not impossible. The key lies in providing thorough documentation and following the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form carefully. By presenting a clear picture of your financial situation, you can improve your chances of a favorable outcome.

Underwriters assess several factors when reviewing a loan modification request. They examine your income, expenses, and overall financial health, often referencing the Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form. Additionally, they look for evidence of hardship and your ability to maintain future payments.

To qualify for a loan modification, you typically need to demonstrate financial hardship and provide relevant documentation. Key requirements often include proof of income, a completed Montana Instructions for Completing Request for Loan Modification and Affidavit RMA Form, and a statement outlining your current financial circumstances. Meeting these criteria increases your chances of approval.