Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

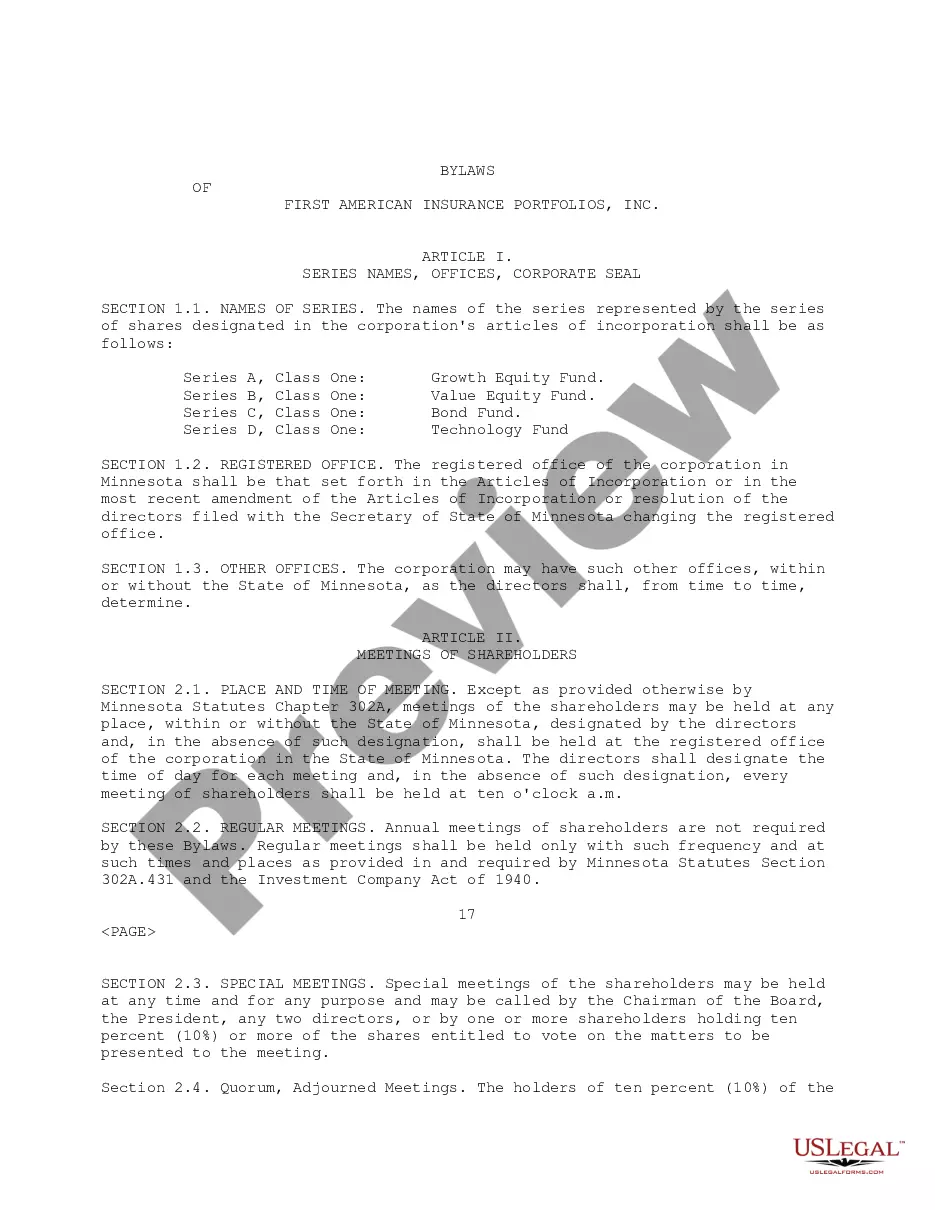

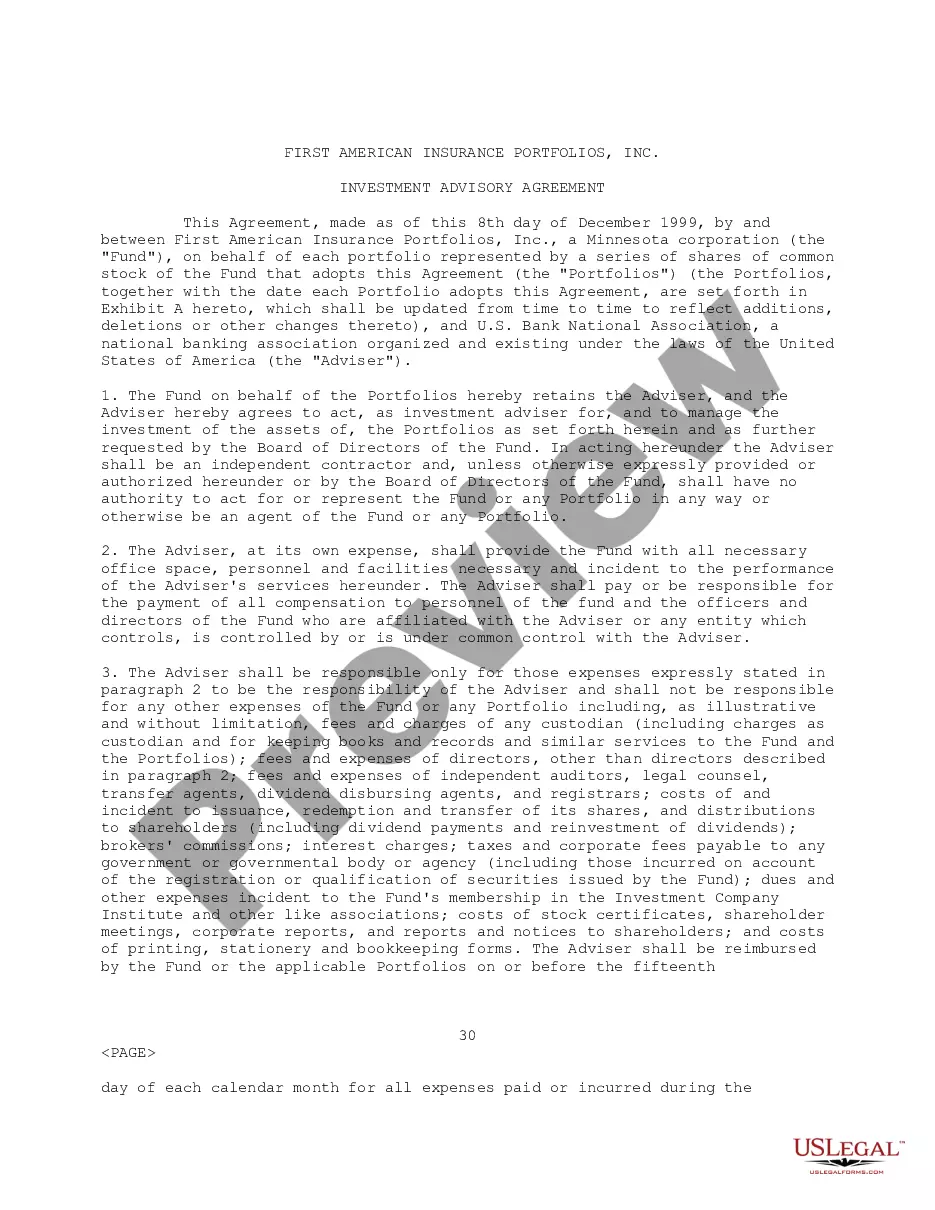

If you want to gather, obtain, or generate sanctioned document templates, make use of US Legal Forms, the largest assortment of legal forms that are accessible online.

Utilize the site’s straightforward and convenient search to find the documents you require. An assortment of templates for business and personal purposes is organized by categories and states, or keywords.

Use US Legal Forms to procure the Montana Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP with just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every form you purchased within your account. Visit the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Montana Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP using US Legal Forms. There are numerous professional and state-specific forms you can apply to your business or personal needs.

- Step 1.

- Ensure you have selected the form for the correct city/state.

- Step 2.

- Utilize the Preview option to review the form’s contents. Be sure to check the description.

- Step 3.

- If you are dissatisfied with the form, use the Search field at the top of the screen to locate other versions of the legal form format.

- Step 4.

- Once you have discovered the form you desire, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5.

- Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6.

- Select the format of the legal form and download it onto your system.

- Step 7.

- Complete, modify, and print or sign the Montana Request for Loan Modification RMA Under the Home Affordable Modification Program HAMP.

Form popularity

FAQ

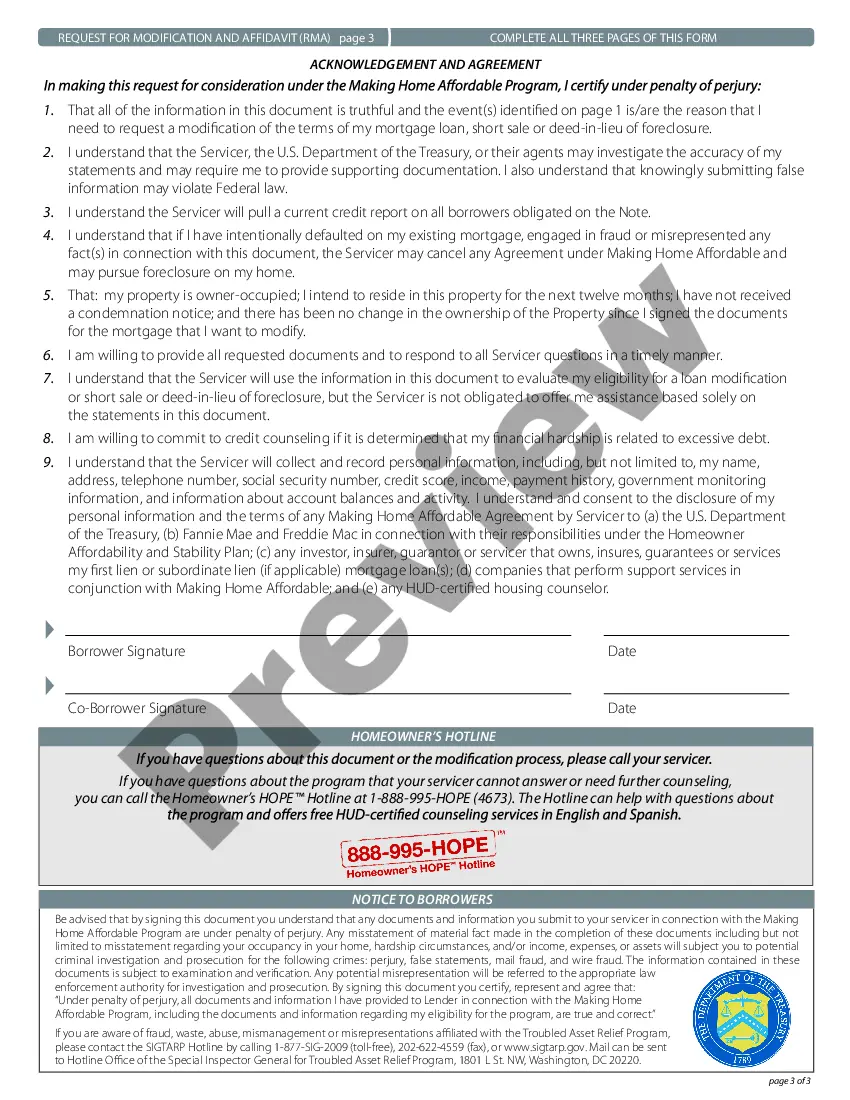

To qualify for a loan modification, you must demonstrate financial hardship, such as a decrease in income or unexpected expenses. Each lender has different criteria, but generally, you must be able to show your current financial situation clearly under the Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Providing complete and accurate documentation is vital when applying. Platforms like US Legal Forms can help you understand the qualifications and collect the necessary documents for your application.

The HAMP loan modification program aims to provide relief to struggling homeowners by making mortgage payments more affordable. Under the Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, eligible homeowners can qualify for reduced monthly payments and loan modifications. This program is designed to prevent foreclosure, allowing homeowners to retain their homes while managing their financial difficulties. Learning more about HAMP can guide you toward making informed decisions about your mortgage.

To request a mature modification on your loan, start by gathering all necessary documents, such as your income statements and mortgage information. You will need to submit a formal request, emphasizing your specific situation, especially under the Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Utilizing US Legal Forms can streamline this process, offering templates and instructions to ensure you present your request accurately and effectively.

Getting approved for a loan modification can be challenging, but it is achievable if you meet specific criteria. Many homeowners wonder about the process, particularly under the Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. Understanding the requirements and preparing your documentation can significantly improve your chances of approval. Resources like US Legal Forms provide guidance and tools to help you through the application process.

To apply for a loan modification, begin by gathering your financial documents, including income statements and expenses. Next, reach out to your loan servicer to express your need for a modification. Utilizing the Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can streamline your application process, making it easier for you to manage your mortgage.

The Home Owners' Loan Corporation (HOLC) was established during the Great Depression but is no longer in operation. However, its legacy lives on through various mortgage relief programs like HAMP. Understanding historical programs helps you appreciate the importance of the Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP in today's context.

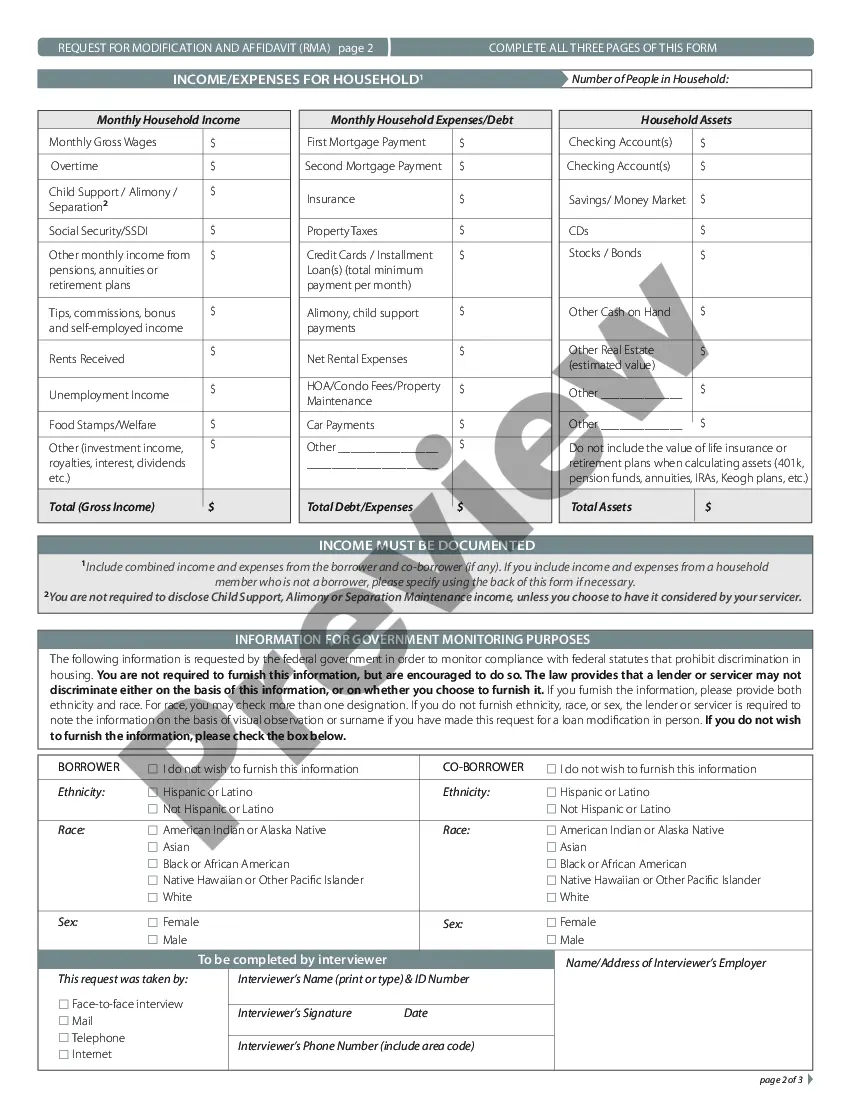

The Request for Mortgage Assistance (RMA) form is a key document used when applying for a loan modification under HAMP. It allows you to provide your financial information to your lender to assess your eligibility for a modification. Correctly completing the Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is essential for a successful application.

While the HAMP program ended in 2016, some loan servicers still offer modifications based on its guidelines. If you are experiencing financial difficulties, you might still benefit from similar programs. The Montana Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can guide you in seeking these alternatives.