Montana Investment Transfer Affidavit and Agreement

Description

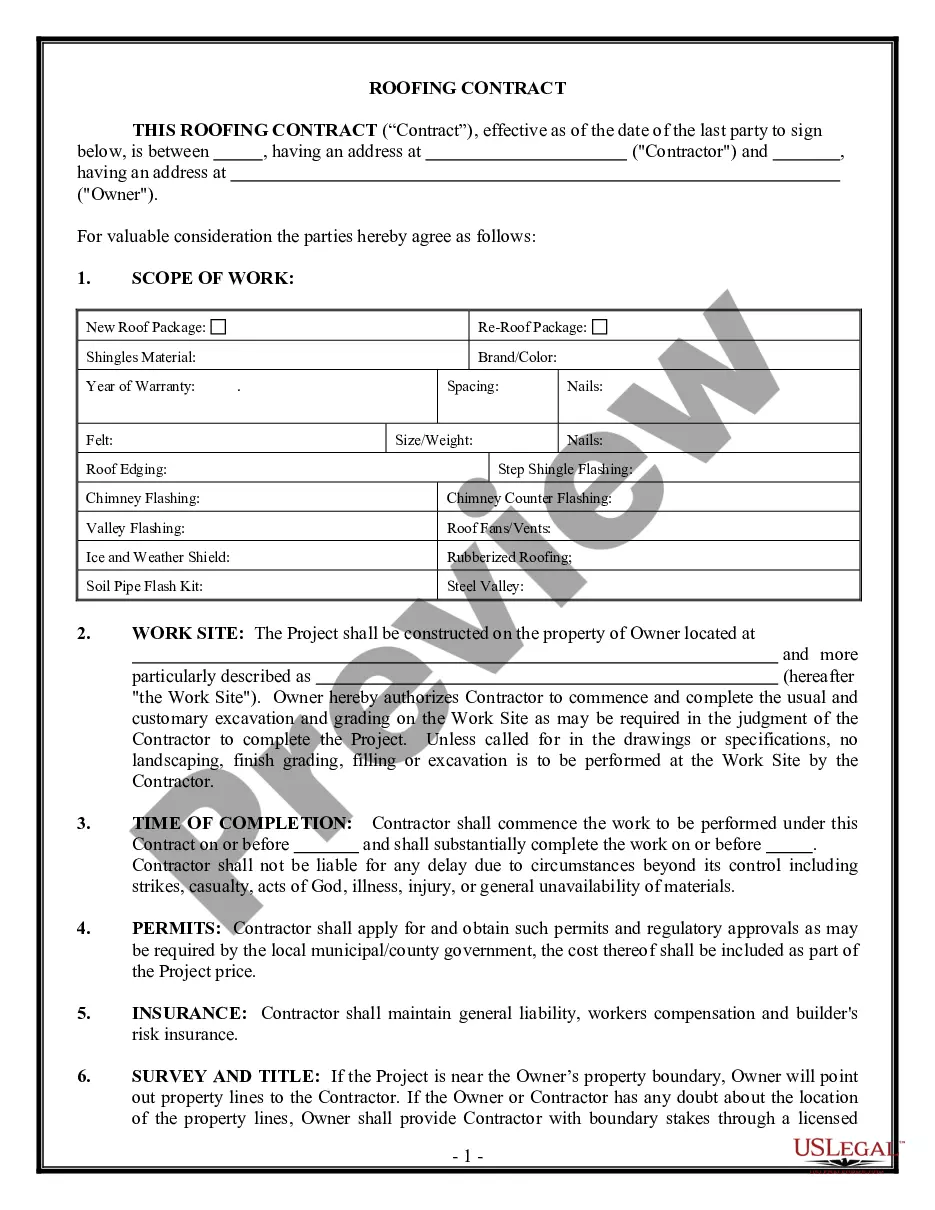

How to fill out Investment Transfer Affidavit And Agreement?

Are you currently in the situation the place you will need papers for both business or individual purposes nearly every day time? There are plenty of authorized file themes accessible on the Internet, but getting types you can depend on is not straightforward. US Legal Forms delivers thousands of develop themes, like the Montana Investment Transfer Affidavit and Agreement, which are composed to satisfy federal and state demands.

If you are previously acquainted with US Legal Forms site and possess an account, simply log in. After that, you are able to download the Montana Investment Transfer Affidavit and Agreement template.

Unless you provide an account and would like to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for that appropriate metropolis/county.

- Make use of the Review option to examine the form.

- Read the outline to ensure that you have chosen the correct develop.

- When the develop is not what you`re seeking, take advantage of the Search area to find the develop that meets your requirements and demands.

- Once you discover the appropriate develop, simply click Buy now.

- Opt for the prices plan you desire, complete the required info to make your account, and pay for your order with your PayPal or bank card.

- Select a practical file formatting and download your version.

Find all the file themes you might have bought in the My Forms menu. You can aquire a further version of Montana Investment Transfer Affidavit and Agreement whenever, if possible. Just select the required develop to download or print the file template.

Use US Legal Forms, one of the most considerable variety of authorized varieties, to conserve time and steer clear of faults. The assistance delivers skillfully manufactured authorized file themes which can be used for a variety of purposes. Produce an account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

Living trusts A living trust is often the best choice for a large estate or if there are many beneficiaries. To avoid probate, most people create a living trust commonly called a revocable living trust.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent. Montana Requirements: Montana requirements are set forth in the statutes below. Montana Small Estate Law uslegal.com ? montana-small-estate-law uslegal.com ? montana-small-estate-law

The form must include: The witnesses' names and addresses. Relationships to the decedent. Decedent's date of death. Decedent's marital history. Decedent's family history (children, grandchildren, parents, siblings, nieces/nephews) How to file a small estate affidavit in Texas | .com ? articles ? how-to-file-a-sm... .com ? articles ? how-to-file-a-sm...

Collection of Personal Property by Affidavit ? This procedure may be initiated 30 days after a person dies, if the value of the entire estate (less liens and encumbrances) does not exceed $50,000.

Trusts: If the deceased had a trust, you will not need to go through probate. Trusts are created to allow the deceased's family and friends to inherit without having to go through the long and expensive probate process.

Under Montana's probate laws, you can distribute certain types of property and assets without a probate court's approval. They include: Accounts with a named beneficiary, such as life insurance policies and retirement funds. Assets and property that is held in a living trust. When Is Probate Not Necessary? - Silverman Law Office mttaxlaw.com ? faqs ? when-is-probate-not-necess... mttaxlaw.com ? faqs ? when-is-probate-not-necess...

How to Write (1) Name Of Minnesota Deceased. ... (2) County Of Minnesota Deceased. ... (3) Name of Minnesota Petitioner. ... (4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death. ... (6) Basis For Minnesota Petitioner Claim. ... (7) Minnesota Decedent Estate Assets. ... (8) Signature Date Of Minnesota Petitioner. Free Minnesota Small Estate Affidavit | Form PRO202 - PDF - eForms eforms.com ? small-estate ? minnesota-small-estat... eforms.com ? small-estate ? minnesota-small-estat...

Establish a living trust: This is a common way for people with high-value estates to avoid probate. With a living trust, the person writing the trust decides which assets to put into the trust and who will act as trustee. When the trust owner dies, the trustee will divide the assets outside of probate.