Montana Conservation Easement

Description

How to fill out Conservation Easement?

You may commit hrs on-line trying to find the legitimate document design which fits the state and federal demands you want. US Legal Forms supplies a huge number of legitimate types that happen to be examined by professionals. You can actually download or printing the Montana Conservation Easement from my services.

If you have a US Legal Forms profile, you may log in and click the Obtain button. After that, you may comprehensive, edit, printing, or indicator the Montana Conservation Easement. Every single legitimate document design you acquire is the one you have forever. To obtain another copy for any purchased type, visit the My Forms tab and click the related button.

If you are using the US Legal Forms website the very first time, stick to the simple guidelines beneath:

- Very first, ensure that you have selected the correct document design to the state/town of your liking. See the type information to make sure you have selected the correct type. If offered, make use of the Review button to appear from the document design also.

- If you wish to discover another variation from the type, make use of the Look for industry to find the design that fits your needs and demands.

- Upon having located the design you desire, click Buy now to continue.

- Pick the pricing program you desire, enter your references, and sign up for your account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal profile to purchase the legitimate type.

- Pick the format from the document and download it to the gadget.

- Make adjustments to the document if necessary. You may comprehensive, edit and indicator and printing Montana Conservation Easement.

Obtain and printing a huge number of document layouts utilizing the US Legal Forms site, which provides the biggest selection of legitimate types. Use professional and status-specific layouts to deal with your business or person demands.

Form popularity

FAQ

Montana law requires a conservation easement to be granted for a term of at least 15 years, but many are granted in perpetuity. A conservation easement runs with the land and remains in place even if the land is sold. Forever. A landowner may want the land to always be protected. Conservation Easements: Things Everyone Should Know Montana Legislature (.gov) ? 2010easementsbrochure Montana Legislature (.gov) ? 2010easementsbrochure PDF

What is a Conservation Easement? A conservation easement is a voluntary legal agreement between a landowner and a land trust like MLR that permanently limits the uses of the land in order to protect its conservation values.

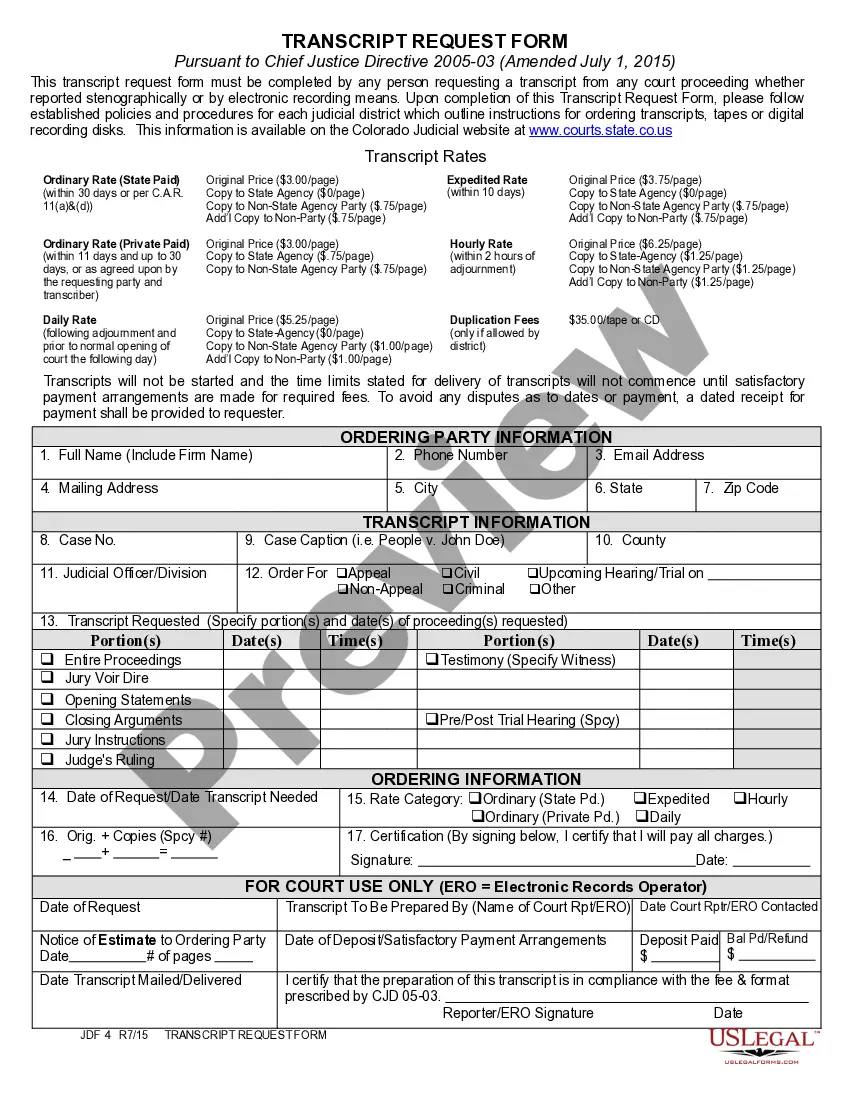

Form 8283, Noncash Charitable Contributions, which must be filed by individual taxpayers who claim itemized deductions for donations of easements. Charitable Contributions of Conservation Easements - IRS irs.gov ? pub ? irs-soi irs.gov ? pub ? irs-soi

There are significant financial benefits available to landowners who agree to protect their land with a conservation easement including a deduction for federal income taxes and a credit for state income taxes. In addition, there is property tax credit and possible federal estate tax exemptions.

As discussed, prescriptive easement actions require proof of open, notorious, exclusive, adverse, and continuous possession or use for the statutory period of 5 years. The burden is on the party seeking to establish the prescriptive easement, and all elements must be proved. Tanner v. Dream Island, Inc., 275 Mont. Prescriptive Easements and Ways of Necessity emwh.org ? issues ? prescriptive easements a... emwh.org ? issues ? prescriptive easements a...

To download IRS Form 8283, go to the IRS website. Generally, you can either print out Form 8283 and mail a paper copy to the IRS or file it electronically.

In Florida, Section 704.06, Florida Statutes, defines a ?Conservation Easement? as ?. . . a right or interest in real property which is appropriate to retaining land or water areas predominantly in their natural, scenic, open, agricultural, or wooded condition; retaining such areas as suitable habitat for fish, plants, ...

Yellowstone: What Is A Conservation Easement Under this agreement, no one - not even the Duttons - can develop, sell, subdivide, or do whatever else they want with the land, the sole purpose of which would be to remain in its natural state. Is John Dutton Really Giving Up The Yellowstone Ranch? - Screen Rant screenrant.com ? john-dutton-yellowstone-ranch-c... screenrant.com ? john-dutton-yellowstone-ranch-c...